Volvo 1998 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

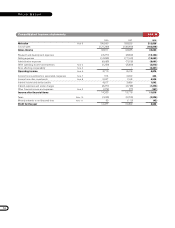

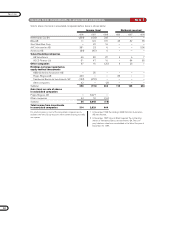

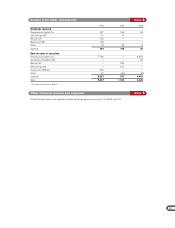

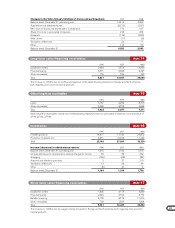

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the two preceding years; the

first figure is for 1997 and the second for 1996.

This change in accounting results in a deferred tax

receivable of SEK 1.3 billion, based on 1998 accounts,

that is attributable largely to so-called temporary dif-

ferences. The deferred tax receivable as of January 1,

1999 will be shown as a corresponding increase in

shareholders’ equity.

Principles of consolidation

The consolidated accounts comprise the Parent Company,

all subsidiaries and associated companies. Subsidiaries

are defined as companies in which Volvo holds more

than 50% of the voting rights or in which Volvo otherwise

has a controlling influence. Subsidiaries in which Volvo’s

holding is temporary are not consolidated, however.

Associated companies are companies in which Volvo has

long-term holdings equal to at least 20% but not more

than 50% of the voting rights.

The consolidated accounts are prepared in accordance

with the principles set forth in the Recommendation of

the Swedish Financial Accounting Standards Council.

All acquisitions of companies are accounted for in

accordance with the purchase method.

Companies that have been divested are included in

the consolidated accounts up to and including the date

of divestment. Companies acquired during the year are

consolidated as of the date of acquisition.

Holdings in associated companies are reported in

accordance with the equity method. The Group’s share

of reported income before taxes in such companies,

adjusted for minority interests, is included in the consoli-

dated income statement, reduced in appropriate cases

by amortization of excess values. The Group’s share of

reported taxes in associated companies, as well as esti-

mated taxes in allocations, are included in Group tax

expense.

For practical reasons, most of the associated com-

panies are included in the consolidated accounts with

a certain time lag, normally one quarter. Dividends from

associated companies are not included in consolidated

income. In the consolidated balance sheet, the book

value of shareholdings in associated companies is affect-

ed by Volvo’s share of company’s income after tax, re-

duced by amortization of excess values and by the

amount of dividends received.

Accounting for hedges

Loans and other financial instruments used to hedge an

underlying position are reported as a hedge. In order to

apply hedge accounting, the following criteria must be

met: the position being hedged is identified and exposed

to exchange-rate and interest-rate movements, the aim

of the loan/instrument is to serve as a hedge and that

the hedging effectively protects the underlying position

against changes in the market rates. Financial instru-

ments used for the purpose of hedging future currency

flows are accounted for as hedges if the flows are con-

sidered most probably to occur.

Volvo’s operations

Volvo’s operations are concentrated in the automotive

and transport equipment industry. The focus in1998 was

on strengthening the Group’s position in the passenger

car field and developing its position as one of the world’s

leading manufacturers of trucks, buses, construction

equipment and drive systems for marine and industrial

applications. In the aircraft engine field Volvo has sub-

stantial resources for the maintenance of engines and

the development of engine components.

The consolidated accounts for AB Volvo and its sub-

sidiaries are prepared in accordance with Swedish

accounting principles. These principles differ in certain

significant aspects from general accepted accounting

principles in the US. (see Note 31).

Operating structure

The Volvo Group’s operations are organized in six product-

related business areas: Cars, Trucks, Buses, Construction

Equipment, Marine and Industrial Engines, and Aero. In

addition to the six business areas, there are certain

operations consisting mainly of service companies that

are designed to support the other businesses.

Each business area has total responsibility for its

operating income and operating capital. Business area

responsibilities include responsibility for sales-financing

activities, but certain restrictions and principles are estab-

lished centrally.

The supervision and coordination of tax and treasury

matters is organized centrally to obtain the benefits of

a Groupwide approach.

The legal structure of the Volvo Group is based on

optimal handling of treasury, tax and administrative mat-

ters and, accordingly, differs from the operating structure.

Changes in accounting principles

New Annual Accounts Act

The new Annual Accounts Act, which primarily involves

changes in the forms of presentation of the income sta-

tement and balance sheet, was applied effective in

1997. Income statements and balance sheets for prior

years have been adjusted to conform with the new rules.

The new Act has affected Volvo’s valuation principles

only to an insignificant degree.

Change in accounting for deferred taxes 1999

Until now, Volvo has reported deferred tax receivables

pertaining to so-called temporary differences and loss

carryforwards to the degree that these items could be

offset against deferred tax liabilities in the same tax area.

Effective in 1999, Volvo is adapting its accounting policies

to generally accepted international and Swedish accoun-

ting practice, and deferred tax receivables will thereby be

reported subject to that it is probable that the amounts

can be offset against future taxable income.

Accounting principles Note 1