Volvo 1998 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

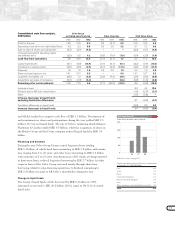

Impact of foreign exchange rates on operating income

The Swedish krona weakened during 1998 against several currencies, which

favorably affected inflow currencies, mainly the USD, GBP and the ITL, and

adversely affected outflow currencies, primarily the BEF, NLG and DEM. The

net effect of changes in spot rates was positive in a total amount of SEK 1.0

billion. Because Volvo hedges large portions of its payment flows in foreign

currencies through forward contracts, changes in spot exchange rates do not have

an immediate effect on operating income. In 1998, the effect on income of

forward and option contracts amounted to a loss of SEK 0.6 billion (1997: loss

of SEK 1.2 billion), which resulted in a positive impact of SEK 0.6 billion on

operating income for 1998, compared with 1997.

Changes in spot rates in connection with the translation of income in foreign

subsidiaries and the revaluation of balance sheet items in foreign currencies had

a positive impact of SEK 0.4 billion.

Consequently, the total effect of changes in foreign exchange rates on Group

operating income for 1998 compared with 1997 was SEK 2.0 billion.

Financial items

Income from investments in associated companies amounted to SEK 0.4 billion

(2.9) and consisted primarily of income from investments in NedCar, Bilia AB

and AB Volvofinans. The difference relative to the preceding year was attribut-

able to a gain of SEK 3.0 billion on the sale of the shareholding in Pripps

Ringnes AB, in 1997.

Income from other shares and participations included the profit of SEK 4.5

billion that arose in connection with the sale of Volvo’s entire shareholding in

Pharmacia & Upjohn, Inc. Net interest income of SEK 0.1 billion (0.7) was

generated through a return of 5.6% on interest-bearing assets and average

borrowing costs of 8.8%. The lower net interest income compared with the

preceding year was due primarily to lower average net financial assets and lower

interest rates in Europe. The Group’s expansion in certain growth markets such

as South Korea, Eastern Europe and South America also involved local financing

at high rates of interest in these markets.

Taxes

Tax expense rose to SEK 2.9 billion (2.7) and was equal to an average rate of

25% (21). Tax expenses consist largely of current tax.

Minority interest in income

The minority interest in the Volvo Group consists mainly of the Henlys Group’s

holding (49%) in Prévost Inc and Nova BUS, as well as Hitachi Construction

Machinery’s stake (40%) regarding Euclid Hitachi Heavy Equipment Inc up to

and including September, and the minority’s holding (43%) in The AGES Group

ALP.

Profit for the year

Profit for the year amounted to SEK 8.6 billion (10.4) and the return on equity,

excluding items affecting comparability and gain on sale of shares, was 10.3%

(10.4).

BOARD OF DIRECTORS’ REPORT

excluding items affecting

comparability 1996 1997 1998

Cars 1.8 4.7 3.7

Commercial Products 3.4 4.9 5.1

Trucks 2.0 3.6 4.8

Buses 3.9 5.2 2.7

Construction Equipment 9.1 8.6 8.0

Marine and

Industrial Engines neg. 4.1 1.9

Aero 3.7 6.3 6.1

Total 2.4 4.6 4.2

Com-

Impact of foreign exchange mercial

rates on operating income Cars Products Total

Net sales 2.0 2.1 4.1

Cost of sales (1.4) (0.7) (2.1)

Research and develop-

ment expenses 0.0 (0.1) (0.1)

Selling expenses (0.2) (0.1) (0.3)

Administrative expenses 0.0 (0.2) (0.2)

Other operating income

and expenses 0.9 (0.3) 0.6

Total effect of changes

in exchange rate on

operating income 1.3 0.7 2.0

Group sales are reported at average spot prices and the

effects of currency hedges are reported among “Other

operating income and expenses”.

Operating margin %

Condensed income

statements 1996 1997 1998

Net sales 5,101 5,956 10,268

Operating income 146 202 470

Income from investments

in associated companies 6 (146) 109

Financial income

and expenses (16) 1 1

Income after

financial items 136 57 580

Taxes (137) (167) (295)

Minority interests (4) (6) 4

Profit for the year (5) (116) 289

Sales financing SEK M

Impact of exchange rates SEK billion