Volvo 1998 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

NOTE S

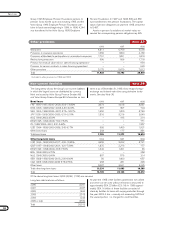

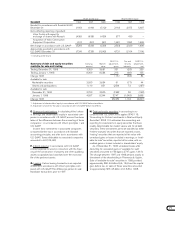

January 1, 1998 December 31, 1998

Carrying amount Market value Carrying amount Market value

Available for sale

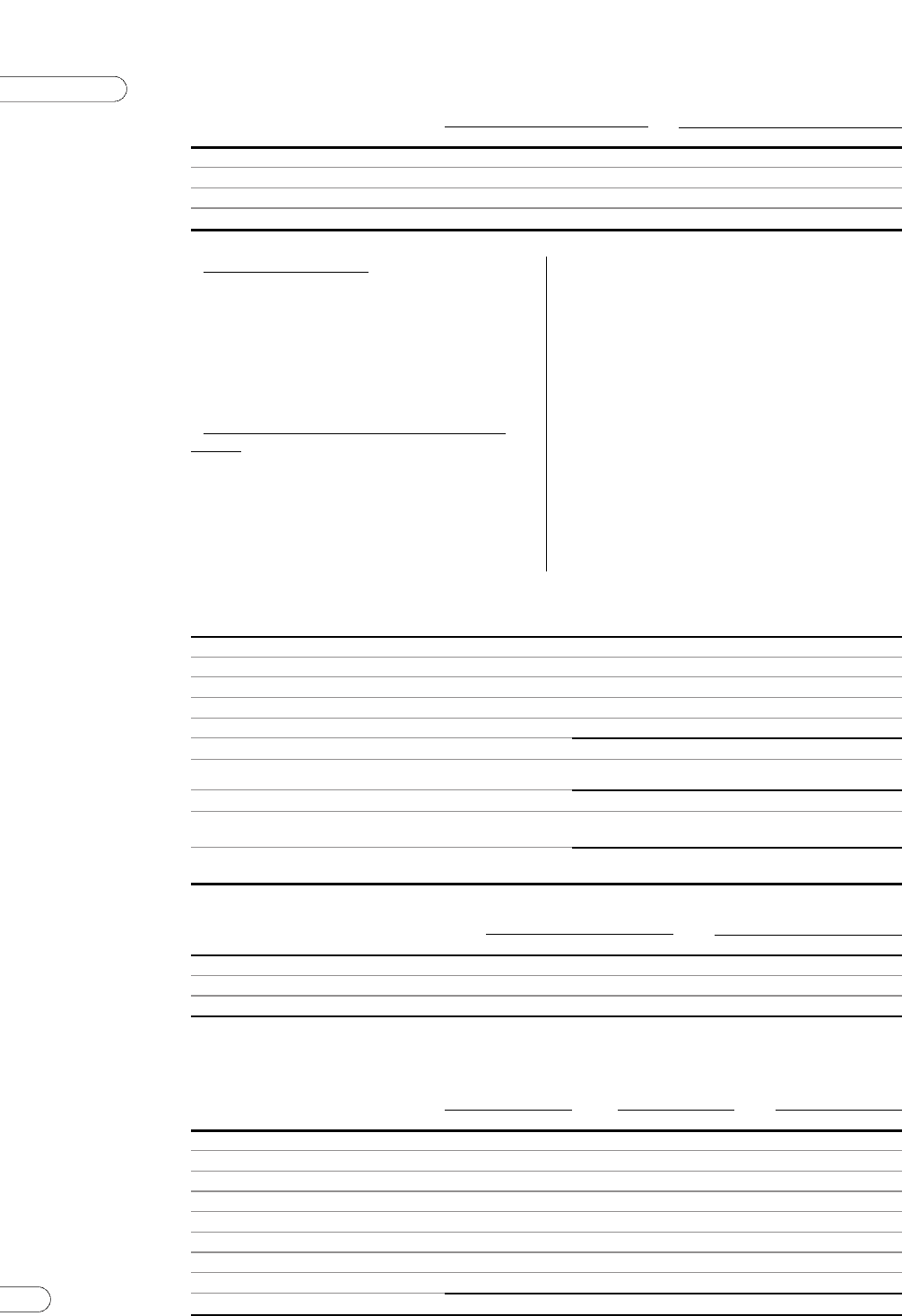

Marketable securities 2,508 2,565 2,593 2,654

Shares and participations 2,089 5,779 1,110 851

Trading 8,369 8,584 3,350 3,681

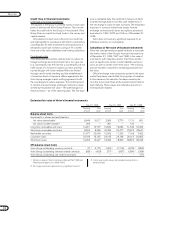

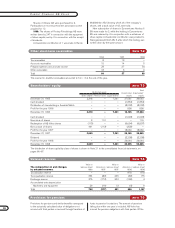

I. Items affecting comparability. In the Volvo Group, costs

for restructuring measures are reported during the year in

which the implementation of these measures was decided

in the Board of the respective company. In accordance

with U.S. GAAP, costs for restructuring measures are

reported only under the condition that a sufficiently de-

tailed plan for implementation of the measures is available

at the close of the reporting period.

J. Provision for pensions and other post-employment

benefits. The greater part of the Volvo Group’s pension

commitments are defined contribution plans; that is, they

are met through regular payments to independent author-

ities or organs that administer pension plans. There is no

difference between US and Swedish accounting prin-

ciples in accounting for these pension plans.

Other pension commitments are defined benefit

plans; that is, the employee is entitled to receive a cer-

tain level of pension, usually related to the employee’s

final salary. In these cases the annual pension cost is

calculated based on the current value of future pension

payments. In Volvo’s consolidated accounts, provisions

for pensions and pension costs for the year in the

individual companies are calculated based on local rules

and directives. In accordance with U.S. GAAP, provisions

for pensions and pension costs for the year should

always be calculated as specified in SFAS 87, “Employers

Accounting for Pensions”. The difference lies primarily in

the choice of discount rates and the circumstance that

US calculations of capital-valuation, in contrast to the

Swedish, are based on salaries calculated at time of

retirement. In addition under US GAAP, the surplus in

pension foundations is accounted for.

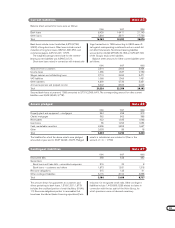

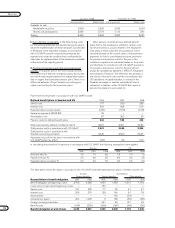

Post-retirement expenses in accordance with U.S. GAAP include:

Defined benefit plans in Sweden and US 1996 1997 1998

Service cost 177 260 289

Interest cost 354 408 415

Expected return on plan assets (186) (376) (513)

Severance payments (SFAS 88) 32 — —

Amortization, net 67 252 33

Pension costs for defined benefit plans 444 544 224

Other plans (mainly defined contribution plans) 3,097 3,051 3,030

Total pension costs in accordance with U.S. GAAP 3,541 3,595 3,254

Total pension costs in accordance with

Swedish accounting principles 3,446 3,660 3,567

Adjustment of profit for the year in accordance with

U.S. GAAP before tax effect (95) 65 313

In calculating the provisions for pensions in accordance with U.S. GAAP, the following assumptions were applied:

Sweden U.S.

1996 1997 1998 1996 1997 1998

Discount rate, % 7.5 7.0 6.5 7.5 7.0 7.0

Payroll increase, % 4.5 4.0 3.5 6.0 4.0 4.5

Expected return on assets, % 9.0 9.0 7.0 9.0 9.0 9.0

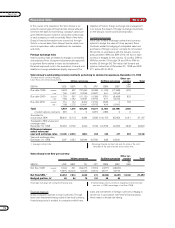

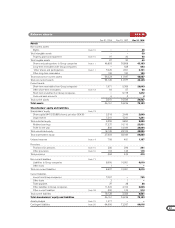

The table below shows the status in accordance with U.S. GAAP of benefit-based pension plans in Sweden and the US.

Sweden United States

Pension benefits Pension benefits Other benefits

Reconciliation of benefit obligation 1997 1998 1997 1998 1997 1998

Benefit obligation at beginning of year 3,798 4,268 1,660 1,985 1,015 1,154

Lump sums not yet paid at beginning of year — — 132 — — —

Service cost 191 200 77 90 41 47

Interest cost 259 270 138 146 81 78

Amendments — — — 140 (32) —

Actuarial loss (gain) 204 1.028 3 138 (50) (35)

Foreign exchange translation — — 241 49 147 29

Benefits paid (184) (209) (266) (168) (48) (35)

Benefit obligation at end of year 4,268 5,557 1,985 2,380 1,154 1,238