Volvo 1998 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

NOTE S

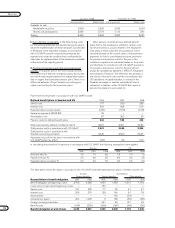

Significant differences between Swedish and U.S.

accounting principles

A. Foreign currency translation. Volvo uses forward

exchange contracts and currency options to hedge the

value of future flows of payments in foreign currency.

Outstanding contracts that are highly certain to be cover-

ed by currency transactions are not assigned a value in

the consolidated accounts.

In accordance with U.S. GAAP, outstanding futures

contracts and currency options are valued at market

through so-called fictive closing. The profits and losses

that thereby arise are included when calculating income.

Unrealized net losses for 1998 pertaining to forwards

and options contracts are estimated at 628 (losses

1,163; profit 3,660).

B. Income taxes. Volvo applies the so-called liability

method for accounting income tax, in accordance with

SFAS 109: “Accounting for income taxes.” In accordance

with this method, deferred tax is calculated on so-called

temporary differences, i. e., the difference between the

accounting value and tax value at enacted future tax

rates.

The greatest difference, relative to U.S. GAAP, is the

principle for determining the valuation allowance. In

accordance with SFAS 109, deferred tax receivables are

reported when it is “more likely than not” that the receiv-

able will be realized. Deferred tax receivables are report-

ed in Volvo’s consolidated accounts only to the degree

that they are balanced by deferred tax liabilities in the

same tax area. The valuation allowance at December 31,

1998, based on U.S. GAAP, was 1,300 (1,500; 1,400)

lower. See also Note 1, “Future changes in accounting

principles in 1999.”

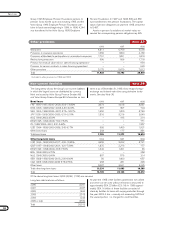

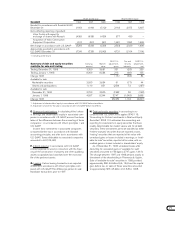

Specification of deferred tax receivables and liabilities

(in accordance with Swedish GAAP) 1996 1997 1998

Deferred tax receivables:

Tax-loss carryforwards 1,640 1,582 1,085

Other tax deductions 106 103 60

Shares and participations 626 236 109

Other deductible temporary differences 2,905 3,838 5,475

5,277 5,759 6,729

Valuation allowance (2,209) (2,578) (2,403)

Deferred tax receivables after deductions for valuation allowance 3,068 3,181 4,326

Deferred tax liabilities:

Taxable temporary differences 4,935 5,324 5,776

4,935 5,324 5,776

Deferred tax liabilities, net 1,867 2,143 1,450

After taking into account offsetting possibilities the items

above are shown in Volvo’s balance sheet as follows:

Other long-term receivables 265 255 368

Other short-term receivables 923 1,514 2,499

Deferred taxes 3,055 3,912 4,317

Deferred tax liabilities, net 1,867 2,143 1,450

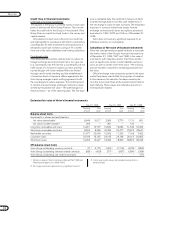

C. Tooling costs. Adjustments under this point pertain

to depreciation of capitalized tooling costs in accordance

with U.S. GAAP prior to 1993.

D. Business combinations. There are differences be-

tween Swedish reporting and U.S. GAAP in the method

of accounting for certain acquisitions, particularly in the

recognition and amortization of excess values and

accounting for the tax benefits related to utilization of

loss carryforwards of acquired subsidiaries.

Volvo’s earnings in 1993 include a provision for an

excess value related to Volvo Trucks which resulted from

the exchange of shares with Renault. In accordance with

U.S. GAAP, the corresponding excess value should have

been reported as a non-current asset (goodwill) which is

being amortized over a period of five years.

In 1995 AB Volvo acquired the outstanding 50% of

the shares of Volvo Construction Equipment Corporation

(formerly VME) from Clark Equipment Company in the

U.S. In connection with the acquisition, an excess value

(goodwill) of SEK 2.8 billion was reported. The share-

holding was written down by SEK 1.8 billion, the portion

of the excess value estimated to be attributable to the

Volvo brand name at the date of acquisition. In accord-

ance with U.S. GAAP, the excess value of SEK 2.8 billion

should be amortized over the economic life (20 years).