Volvo 1998 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

sales. It is possible that Volvo Cars will not be in a position to match its com-

petitors in terms of total expenditure on general R&D. This could result in an

increasing gap in key areas of technology, such as drivelines or electronics.

As a stand-alone car company, the level of investment required of an aggres-

sive growth plan for Volvo Cars would thus involve a significant level of

financial risk for the Volvo Group.

Having analysed and considered the complexities involved in operating a part-

nership, the benefits to be gained from full ownership clarity, and the benefits to

the Volvo Group of being able to devote its full economic and management

resources to its growth strategy in commercial products, the Board of AB Volvo

concluded that a sale of 100% of Volvo Cars to a major automotive manufac-

turer was in the best interests of Volvo shareholders and employees, Volvo

Group as well as of Volvo Cars.

Ford is the right home for Volvo Cars

Volvo considered various potential new owners of Volvo Cars and, on the basis

of discussions with a number of parties, concluded that Ford is the most appro-

priate new owner.

The value placed by Ford on Volvo Cars’ Swedish heritage, and on the

company’s strong management and employee team is a vital component in the

Volvo Board’s decision to recommend that its shareholders approve the sale of

Volvo Cars to Ford.

With worldwide sales of approximately 6.8 million units and a distribution

network which includes 15,800 dealers in over 200 countries around the world,

Ford is a leading vehicle manufacturer. Volvo Cars will be part of an organization

where the competitive advantages that come with volume can be fully realized.

Importantly, Ford has strong financial resources and is among the world’s most

profitable automotive manufacturers. The application of its financial capacity

and expertise to the Volvo Cars business is likely to strengthen an organization

which already exhibits profitability above the industry average.

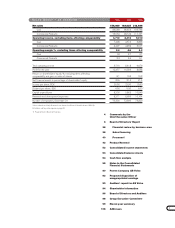

1998

1998

1994

1998

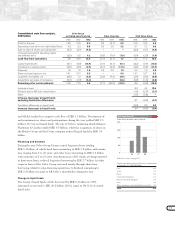

GM Ford

Toyota Daimler

Chrysler VW

Nissan Honda Chrysler Fiat Peugeot Renault

ASIA

5-8

Unit production 1998

in millions

4-5

2-3

1-2

< 1

< 0.5

U.S EUROPE

Hyundai Suzuki Mitsubishi Mercedez

Benz BMW

Daewoo Fuji

Heavy Daihatsu Mazda Rover

Samsung Kia Isuzu Saab Volvo

1998

1998

Source: Volvo

The pace of consolidation in the automotive

industry accelerated during 1998: Daimler

and Chrysler merged; Daewoo acquired

Samsung and Ssyangyong; Hyundai

purchased Kia; GM increased its interest in

Suzuki to 10% and Toyota raised its interest

in Daihatsu to 51%.

Consolidation of automotive industry