Volvo 1998 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

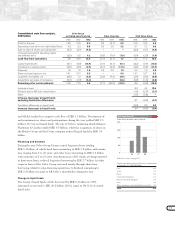

REDOVISNING PER AFFÄRSOMRÅDE

Cars

The passenger car industry in 1998 was characterized by continued severe

competition and there were strong demands on development in marketing as

well as in distribution, product- and process-development.

The total world market of new-car registrations, including mini-cars (<660cc),

decreased to 36.5 million vehicles in 1998. Demand in the European car market

has increased continuously since 1993 and there was a sharp rise, 7%, in the

number of new cars registered in Europe in 1998, compared with 1997. The

North American market declined by approximately 1%. The Japanese market

which is important to Volvo, declined in total by 9%, while the market for

imported makes was down 18%.

Competitors

Volvo Cars is a specialist manufacturer in the car industry with products in the

upper segment of the market where a strong brand name is required in order to

achieve a competitive position. Mercedes-Benz, BMW and Audi are important

competitors. In the large-car segment, which in 1998 included the Volvo S/V70,

Volvo S/V90, Volvo 940, Volvo C70 and Volvo S80, the share of the market in

Europe was 7.0% (8.2), with a 11.5% (10.9) share in North America. In the

medium-car segment in which the Volvo S/V40 competes, the share in Europe

was 4.3% (3.6). Volvo’s share of the passenger car market as a whole was

unchanged at 1%.

Consolidation in the car industry meant alliances across national borders and

cultures. The consolidation process also continued in the supplier and after-sales

industries, with major mergers. Another trend that was accentuated is that

responsibility for a greater portion of the car’s content is being outsourced

to suppliers resulting in shared research and development costs.

Objectives in 1999

Volvo Cars’ product line will be broadened in 1999 through introductions of

Volvo S/V40 models in new markets, as well as new versions of the Volvo S80,

whose engine program is being expanded to include 5-cylinder gasoline and

diesel engines.

Engine development is being focused on engines with lower fuel consumption.

In addition, development work on a Volvo diesel engine is being intensified to

meet the increasing demand for diesel-powered cars.

Introduction of Volvo S80, based on a new industrial platform

The Volvo S80, introduced in May 1998, is broadening Cars’ customer base by

attracting new categories of customers and also confirms Volvo’s position in

terms of safety, quality and concern for the environment. The Volvo S80 is the

first model developed on Cars’ new, large platform. By basing an increasing

number of models on the same platform, the company is achieving shorter lead

times, more efficient production and increased cost-effectiveness. The method

makes a broader range of products possible.

Increased supplier responsibility for development and production of complete

systems in cars is an important part of Volvo’s concept. Nearly 60% of the value

98

97969594

Total market development cars

Number of new cars, registered, million

5

10

15

20

25

40

35

30

Western Europe

NAFTA

Japan

Other

37.5 36.5

13.3

9.3

9.4

4.1

4.5

6.7

7.2

2.1

3.1

Asia

14.3

Total

FINANCIAL REVIEW BY BUSINESS AREA