Volvo 1998 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 1998 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

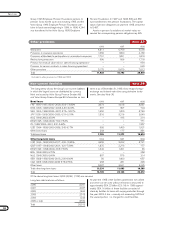

Profit for the year Shareholders’ equity

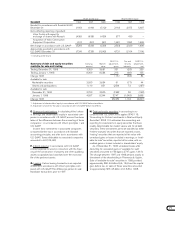

Goodwill 1996 1997 1998 1996 1997 1998

Goodwill in accordance with Swedish GAAP,

December 31 (195) (196) (512) 12,163 3,075 5,607

Items affecting reporting of goodwill:

Volvo Trucks with regard to

exchange of shares with Renault (438) (438) (439) 877 439 –

Acquisition of Volvo Construction

Equipment Corporation (91) (91) (91) 1,681 1,590 1,499

Net change in accordance with U.S. GAAP (529) (529) (530) 2,558 2,029 1,499

Approximate goodwill in accordance with

U.S. GAAP, December 31 (724) (725) (1,042) 4,721 5,104 7,106

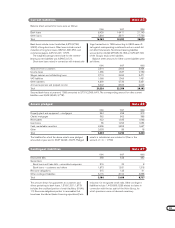

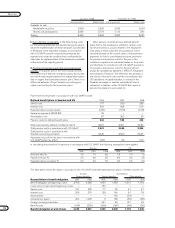

FAS 115- Tax and FAS 115-

Summary of debt and equity securities Carrying Market adjustment, minority adjustment,

available for sale and trading amount value gross interests net

Trading, December 31, 1998 3,350 3,681 331 (92) 239

Trading, January 1, 1998 8,369 8,584 215 (60) 155

Change 1998 116 2(32) 84

Available for sale

Marketable securities 2,593 2,654 61 (17) 44

Shares and participations 1,110 851 (259) 72 (187)

Available for sale

December 31, 1998 3,703 3,505 (198) 155 (143)

January 1, 1998 4,597 8,344 3,747 (1,049) 2,698

Change 1998 (3,945) 1,104 (2,841)

1 Adjustment of shareholders’ equity in accordance with U.S. GAAP before tax effects.

2 Adjustment of profit for the year in accordance with U.S. GAAP before tax effects.

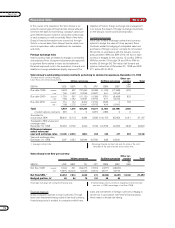

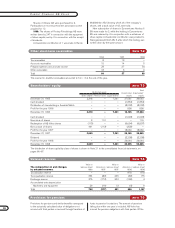

E. Shares and participations. In calculating Volvo’s share

of earnings and shareholders’ equity in associated com-

panies in accordance with U.S. GAAP, account has been

taken of the differences between the accounting of these

companies – in accordance with Volvo’s principles – and

U.S. GAAP.

Income from investments in associated companies

is reported before tax in accordance with Swedish

accounting principles, and after tax in accordance with

U.S. GAAP. Taxes attributable to associated companies

amounted to 60 (103; 68).

F. Interest expense. In accordance with U.S. GAAP,

interest expense incurred in connection with the finan-

cing of the construction of property and other qualifying

assets is capitalized and amortized over the economic

life of the pertinent assets.

G. Leasing. Certain leasing transactions are reported

differently in accordance with Volvo’s principles, com-

pared with U.S. GAAP. The differences pertain to sale-

leaseback transactions prior to 1997.

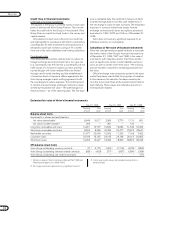

H. Debt and equity securities. In accounting in ac-

cordance with U.S. GAAP, Volvo applies SFAS 115:

“Accounting for Certain Investments in Debt and Equity

Securities.” SFAS 115 addresses the accounting and

reporting for investments in equity securities that have

readily determinable fair market values, and for all debt

securities. These investments are to be classified as either

“held-to-maturity” securities that are reported at cost,

“trading” securities that are reported at fair value with

unrealized gains or losses included in earnings, or “avail-

able-for-sale” securities, reported at fair value, with un-

realized gains or losses included in shareholders’ equity.

As of December 31, 1998, unrealized losses after

deducting for unrealized gains in “available-for-sale”

securities amounted to 198 (gains 3,747; gains 1,661).

The change between 1997 and 1998 pertains mainly to

divestment of the shareholding in Pharmacia & Upjohn.

Sale of “available-for-sale” securities in 1998 provided

approximately SEK 6.6 billion (6,4; 13,6) and the capital

gain, before tax, on sales of these securities amounted

to approximately SEK 4.5 billion (1,0; 8.3) in 1998.

1 Including write-downs