US Airways 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

restricted cash, offset in part by net sales of investments in marketable securities of $206 million. The change in the restricted cash

balance for the 2008 period was due to changes in the amount of holdback held by certain credit card processors for advance ticket sales

for which we had not yet provided air transportation. Principal investing activities in 2007 included net sales of investments in marketable

securities of $612 million, a decrease in restricted cash of $200 million and $56 million in proceeds from the sale of investments in

ARINC and Sabre, offset in part by expenditures for property and equipment totaling $523 million, including the purchase of nine

Embraer 190 aircraft, and an increase in equipment purchase deposits of $80 million. The net sales of investments in marketable

securities in the 2007 period were primarily certain auction rate securities sold at par value in the third quarter of 2007. The change in the

restricted cash balances for the 2007 period was due to changes in the amounts of holdback held by certain credit card processors.

Net cash provided by financing activities was $981 million and $112 million in 2008 and 2007, respectively. Principal financing

activities in 2008 included proceeds from the issuance of debt of $1.59 billion, of which $800 million was from the series of financing

transactions completed in October 2008. See further discussion of these transactions under "Commitments." Proceeds also included

$521 million to finance the acquisition of 14 Embraer 190 aircraft and five Airbus A321 aircraft and $145 million in proceeds from the

refinancing of certain aircraft equipment notes. Debt repayments were $734 million, including a $400 million paydown at par of our

Citicorp credit facility, a $100 million prepayment of certain indebtedness incurred as part of our financing transactions completed in

October 2008 and $97 million related to the $145 million aircraft equipment note refinancing discussed above. Proceeds from the

issuance of common stock, net were $179 million as we completed an underwritten public stock offering of 21.85 million common shares

issued at an offering price of $8.50 per share during the third quarter of 2008. Principal financing activities in 2007 included proceeds

from the issuance of debt of $1.8 billion, including $1.6 billion generated from the Citicorp credit facility and proceeds from property and

equipment financings. Debt repayments were $1.68 billion and, using the proceeds from the Citicorp credit facility, included the

repayment in full of the balances outstanding on the $1.25 billion GE loan, the Barclays Bank Delaware prepaid miles loan of

$325 million and a GECC credit facility of $19 million.

2007 Compared to 2006

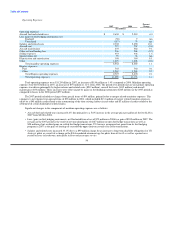

Net cash provided by operating activities was $451 million and $643 million in 2007 and 2006, respectively, a decrease of

$192 million. The period over period decrease was due principally to higher expenses in 2007 compared to 2006 related to an increase in

salaries and benefits of $212 million, aircraft maintenance of $53 million and mainline and Express fuel costs, net of realized fuel

hedging gains and losses, of $46 million, offset by an increase in revenue of $143 million.

Net cash provided by investing activities in 2007 was $269 million as compared to net cash used in investing activities of

$903 million in 2006. Principal investing activities in 2007 included net sales of investments in marketable securities of $612 million, a

decrease in restricted cash of $200 million and $56 million in proceeds from the sale of investments in ARINC and Sabre, offset in part

by expenditures for property and equipment totaling $523 million, including the purchase of nine Embraer 190 aircraft, and an increase in

equipment purchase deposits of $80 million. The net sales of investments in marketable securities in the 2007 period were primarily

certain auction rate securities sold at par value in the third quarter of 2007. Principal investing activities in 2006 included net purchases of

investments in marketable securities of $798 million, expenditures for property and equipment totaling $232 million, including the

purchase of three Boeing 757-200 and two Embraer 190 aircraft, and a decrease in restricted cash of $128 million. Changes in the

restricted cash balances for the 2007 and 2006 periods are due to changes in the amounts of holdback held by certain credit card

processors.

Net cash provided by financing activities was $112 million and $251 million in 2007 and 2006, respectively. Principal financing

activities in 2007 included proceeds from the issuance of debt of $1.8 billion, including $1.6 billion generated from the Citicorp credit

facility and proceeds from property and equipment financings. Debt repayments were $1.68 billion and, using the proceeds from the

Citicorp credit facility, included the repayment in full of the balances outstanding on the $1.25 billion GE loan, the Barclays Bank

Delaware prepaid miles loan of $325 million and a GECC credit facility of $19 million. Principal financing activities in 2006 included

proceeds from the issuance of debt of $1.42 billion, which included borrowings of $1.25 billion under the GE loan, a $64 million draw on

an Airbus loan and $92 million of equipment notes issued to finance the acquisition of property

60