Time Magazine 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounting for Uncertainty in Income Taxes

The Company recognizes income tax benefits for tax positions determined more likely than not to be sustained

upon examination, based on the technical merits of the positions. The reserve for uncertain income tax positions is

included in other liabilities in the consolidated balance sheet.

The Company does not currently anticipate that its existing reserves related to uncertain tax positions as of

December 31, 2010 will significantly increase or decrease during the twelve-month period ending December 31,

2011; however, various events could cause the Company’s current expectations to change in the future. Should the

Company’s position with respect to the majority of these uncertain tax positions be upheld, the effect would be

recorded in the consolidated statement of operations as part of the income tax provision.

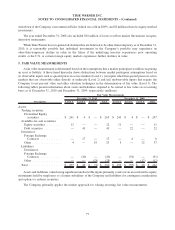

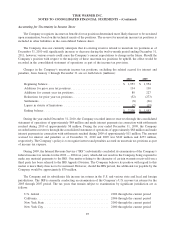

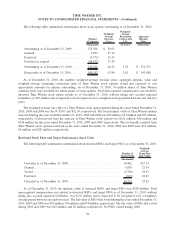

Changes in the Company’s uncertain income tax positions, excluding the related accrual for interest and

penalties, from January 1 through December 31 are set forth below (millions):

2010 2009

Beginning balance ............................................ $ 1,953 $ 1,954

Additions for prior year tax positions . . . ........................... 134 130

Additions for current year tax positions . ........................... 80 227

Reductions for prior year tax positions . . ........................... (52) (273)

Settlements ................................................. (8) (66)

Lapses in statute of limitations .................................. (7) (19)

Ending balance .............................................. $ 2,100 $ 1,953

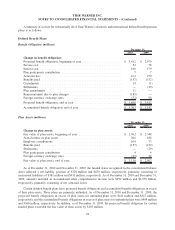

During the year ended December 31, 2010, the Company recorded interest reserves through the consolidated

statement of operations of approximately $84 million and made interest payments in connection with settlements

reached during 2010 of approximately $8 million. During the year ended December 31, 2009, the Company

recorded interest reserves through the consolidated statement of operations of approximately $88 million and made

interest payments in connection with settlements reached during 2009 of approximately $11 million. The amount

accrued for interest and penalties as of December 31, 2010 and 2009 was $349 million and $273 million,

respectively. The Company’s policy is to recognize interest and penalties accrued on uncertain tax positions as part

of income tax expense.

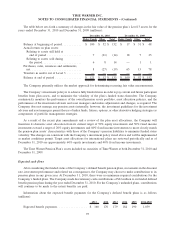

During 2009, the Internal Revenue Service (“IRS”) substantially concluded its examination of the Company’s

federal income tax returns for the 2002 — 2004 tax years, which did not result in the Company being required to

make any material payments to the IRS. One matter relating to the character of certain warrants received from a

third party has been referred to the IRS Appeals Division. The Company believes its position with regard to this

matter is more likely than not to be sustained. However, should the IRS prevail, the additional tax payable by the

Company would be approximately $70 million.

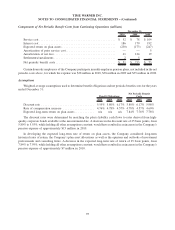

The Company and its subsidiaries file income tax returns in the U.S. and various state and local and foreign

jurisdictions. The IRS is currently conducting an examination of the Company’s U.S. income tax returns for the

2005 through 2007 period. The tax years that remain subject to examination by significant jurisdiction are as

follows:

U.S. federal ......................................... 2002 through the current period

California ........................................... 2006 through the current period

New York State ...................................... 2000 through the current period

New York City ....................................... 2000 through the current period

87

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)