Time Magazine 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

that dismissal. On November 8, 2010, Anderson News filed a notice of appeal with the U.S. Court of Appeals for the

Second Circuit.

The Company intends to defend against or prosecute, as applicable, the lawsuits and proceedings described

above vigorously, but is unable to predict the outcome of these matters or to reasonably estimate the possible loss or

range of loss arising from the claims against the Company.

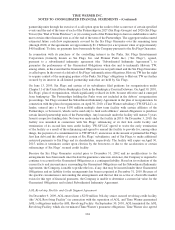

From time to time, the Company receives notices from third parties claiming that it infringes their intellectual

property rights. Claims of intellectual property infringement could require Time Warner to enter into royalty or

licensing agreements on unfavorable terms, incur substantial monetary liability or be enjoined preliminarily or

permanently from further use of the intellectual property in question. In addition, certain agreements entered into by

the Company may require the Company to indemnify the other party for certain third-party intellectual property

infringement claims, which could increase the Company’s damages and its costs of defending against such claims.

Even if the claims are without merit, defending against the claims can be time-consuming and costly.

The costs and other effects of pending or future litigation, governmental investigations, legal and administrative

cases and proceedings (whether civil or criminal), settlements, judgments and investigations, claims and changes in

those matters (including those matters described above), and developments or assertions by or against the Company

relating to intellectual property rights and intellectual property licenses, could have a material adverse effect on the

Company’s business, financial condition and operating results.

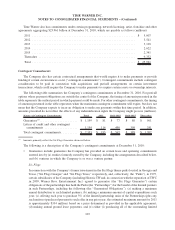

17. RELATED PARTY TRANSACTIONS

The Company has entered into certain transactions in the ordinary course of business with unconsolidated

investees accounted for under the equity method of accounting. These transactions have been executed on terms

comparable to the terms of transactions with unrelated third parties and primarily include the licensing of broadcast

rights to The CW broadcast network for film and television product, by the Filmed Entertainment segment and the

licensing of rights to carry cable television programming provided by the Networks segment.

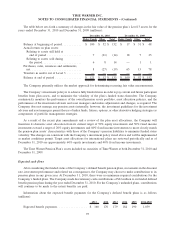

Revenues from transactions with related parties were $360 million, $316 million and $404 million for the years

ended December 31, 2010, 2009 and 2008, respectively. Expenses from transactions with related parties were

$62 million, $54 million and $41 million for the years ended December 31, 2010, 2009 and 2008, respectively.

18. ADDITIONAL FINANCIAL INFORMATION

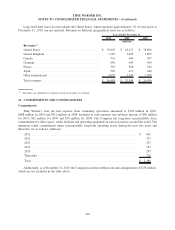

Cash Flows

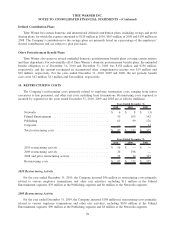

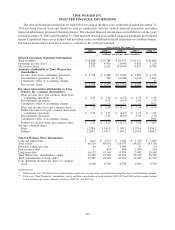

Additional financial information with respect to cash (payments) and receipts is as follows (millions):

2010 2009 2008

Years Ended December 31,

Cash payments made for interest ....................... $ (1,086) $ (1,125) $ (1,406)

Interest income received ............................. 26 43 65

Cash interest payments, net ........................... $ (1,060) $ (1,082) $ (1,341)

Cash payments made for income taxes .................. $ (961) $ (1,150) $ (691)

Income tax refunds received .......................... 90 99 137

TWC and AOL tax sharing (payments) receipts, net

(a)

....... (87) 241 342

Cash tax (payments) receipts, net ...................... $ (958) $ (810) $ (212)

(a)

Represents net amounts (paid) received from TWC and AOL in accordance with tax sharing agreements with TWC and AOL.

107

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)