Time Magazine 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

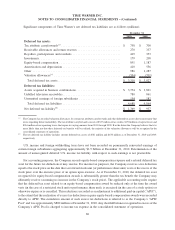

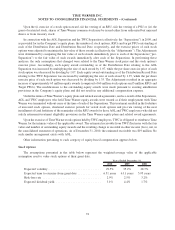

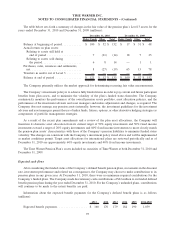

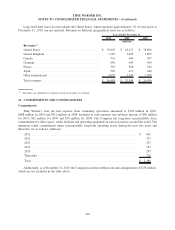

A summary of activity for substantially all of Time Warner’s domestic and international defined benefit pension

plans is as follows:

Defined Benefit Plans

Benefit Obligation (millions)

2010 2009

December 31,

Change in benefit obligation:

Projected benefit obligation, beginning of year . ....................... $ 3,412 $ 2,970

Service cost.................................................. 52 78

Interest cost.................................................. 186 179

Plan participants contribution ..................................... 7 7

Actuarial loss ................................................ 162 270

Benefits paid ................................................. (157) (152)

Curtailments ................................................. 14 (1)

Settlements .................................................. — (29)

Plan amendments ............................................. 11 —

Remeasurement due to plan changes ............................... (185) —

Foreign currency exchange rates .................................. (52) 90

Projected benefit obligation, end of year ............................ $ 3,450 $ 3,412

Accumulated benefit obligation, end of year . . . ....................... $ 3,303 $ 3,142

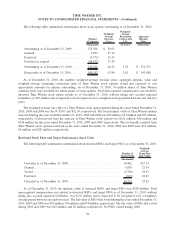

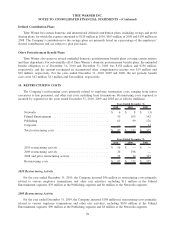

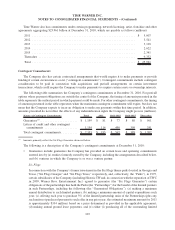

Plan Assets (millions)

2010 2009

December 31,

Change in plan assets:

Fair value of plan assets, beginning of year . . . ....................... $ 2,962 $ 2,348

Actual return on plan assets ...................................... 266 636

Employer contributions ......................................... 104 73

Benefits paid ................................................. (157) (152)

Settlements .................................................. — (29)

Plan participants contribution ..................................... 4 4

Foreign currency exchange rates .................................. (49) 82

Fair value of plan assets, end of year ............................... $ 3,130 $ 2,962

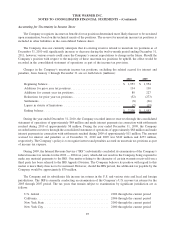

As of December 31, 2010 and December 31, 2009, the funded status recognized in the consolidated balance

sheet reflected a net liability position of $320 million and $450 million, respectively, primarily consisting of

noncurrent liabilities of $381 million and $431 million, respectively. As of December 31, 2010 and December 31,

2009, amounts included in Accumulated other comprehensive income were $992 million and $1.078 billion,

respectively, primarily consisting of net actuarial losses.

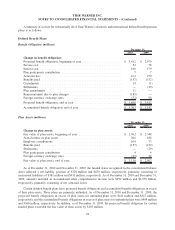

Certain defined benefit plans have projected benefit obligations and accumulated benefit obligations in excess

of their plan assets. These plans are primarily unfunded. As of December 31, 2010 and December 31, 2009, the

projected benefit obligations in excess of plan assets for unfunded plans were $411 million and $347 million,

respectively, and the accumulated benefit obligations in excess of plan assets for unfunded plans were $404 million

and $360 million, respectively. In addition, as of December 31, 2009, the projected benefit obligation for certain

funded plans exceeded the fair value of their assets by $103 million.

94

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)