Time Magazine 2010 Annual Report Download - page 75

Download and view the complete annual report

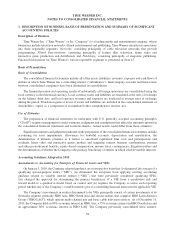

Please find page 75 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investments for impairment, including when the carrying value of an investment exceeds its related market value. If

it has been determined that an investment has sustained an other-than-temporary decline in its value, the investment

is written down to its fair value by a charge to earnings. Factors that are considered by the Company in determining

whether an other-than-temporary decline in value has occurred include the (i) market value of the security in

relation to its cost basis, (ii) financial condition of the investee and (iii) the Company’s intent and ability to retain the

investment for a sufficient period of time to allow for recovery in the market value of the investment.

In evaluating the factors described above for available-for-sale securities, the Company presumes a decline in

value to be other-than-temporary if the quoted market price of the security is 20% or more below the investment’s

cost basis for a period of six months or more (the “20% criterion”) or the quoted market price of the security is 50%

or more below the security’s cost basis at any quarter end (the “50% criterion”). However, the presumption of an

other-than-temporary decline in these instances may be overcome if there is persuasive evidence indicating that the

decline is temporary in nature (e.g., the investee’s operating performance is strong, the market price of the investee’s

security is historically volatile, etc.). Additionally, there may be instances in which impairment losses are

recognized even if the 20% and 50% criteria are not satisfied (e.g., there is a plan to sell the security in the

near term and the fair value is below the Company’s cost basis).

For investments accounted for using the cost or equity method of accounting, the Company evaluates

information (e.g., budgets, business plans, financial statements, etc.) in addition to quoted market prices, if

any, in determining whether an other-than-temporary decline in value exists. Factors indicative of an

other-than-temporary decline include recurring operating losses, credit defaults and subsequent rounds of

financing at an amount below the cost basis of the Company’s investment. For more information, see Note 4.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and indefinite-lived intangible assets, primarily tradenames, are tested annually for impairment

during the fourth quarter or earlier upon the occurrence of certain events or substantive changes in circumstances.

Goodwill is tested for impairment at a level referred to as a reporting unit. A reporting unit is either the “operating

segment level,” such as Warner Bros. Entertainment Group (“Warner Bros.”), Home Box Office, Inc. (“Home Box

Office”), Turner Broadcasting System, Inc. (“Turner”) and Time Inc., or one level below, which is referred to as a

“component” (e.g., Sports Illustrated,People). The level at which the impairment test is performed requires

judgment as to whether the operations below the operating segment constitute a self-sustaining business. If the

operations below the operating segment level are determined to be a self-sustaining business, testing is generally

required to be performed at this level; however, if multiple self-sustaining business units exist within an operating

segment, an evaluation would be performed to determine if the multiple business units share resources that support

the overall goodwill balance. For purposes of the goodwill impairment test, Time Warner has identified Warner

Bros., Home Box Office, Turner and Time Inc. as its reporting units.

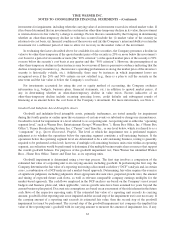

Goodwill impairment is determined using a two-step process. The first step involves a comparison of the

estimated fair value of a reporting unit to its carrying amount, including goodwill. In performing the first step, the

Company determines the fair value of a reporting unit using a discounted cash flow (“DCF”) analysis and, in certain

cases, a combination of a DCF analysis and a market-based approach. Determining fair value requires the exercise

of significant judgment, including judgments about appropriate discount rates, perpetual growth rates, the amount

and timing of expected future cash flows, as well as relevant comparable company earnings multiples for the

market-based approach. The cash flows employed in the DCF analyses are based on the Company’s most recent

budgets and business plans and, when applicable, various growth rates have been assumed for years beyond the

current business plan period. Discount rate assumptions are based on an assessment of the risk inherent in the future

cash flows of the respective reporting units. If the estimated fair value of a reporting unit exceeds its carrying

amount, goodwill of the reporting unit is not impaired and the second step of the impairment test is not necessary. If

the carrying amount of a reporting unit exceeds its estimated fair value, then the second step of the goodwill

impairment test must be performed. The second step of the goodwill impairment test compares the implied fair

value of the reporting unit’s goodwill with its carrying amount to measure the amount of impairment loss, if any.

63

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)