Time Magazine 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

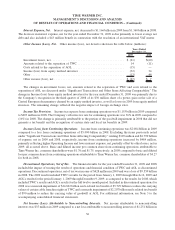

2008, of which $39 million of income and a $1.251 billion loss, respectively, were attributable to discontinued

operations.

Net Income (Loss) Attributable to Time Warner Inc. shareholders. Net income attributable to Time Warner

Inc. common shareholders was $2.477 billion in 2009 compared to a loss of $13.398 billion in 2008. Basic and

diluted net income per common share attributable to Time Warner Inc. common shareholders were $2.08 and $2.07,

respectively, in 2009 compared to basic and diluted net loss per common share attributable to Time Warner Inc.

common shareholders of $11.22 for both in 2008.

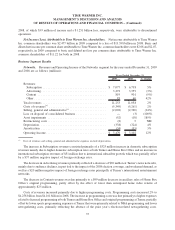

Business Segment Results

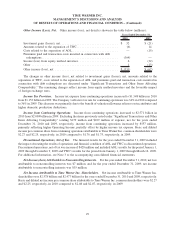

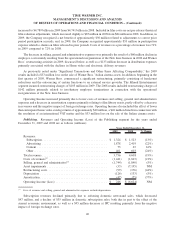

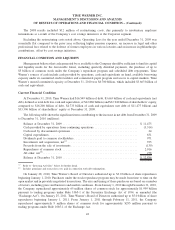

Networks. Revenues and Operating Income of the Networks segment for the years ended December 31, 2009

and 2008 are as follows (millions):

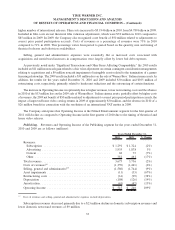

2009 2008 % Change

Years Ended December 31,

Revenues:

Subscription ...................................... $ 7,077 $ 6,738 5%

Advertising ....................................... 3,272 3,359 (3%)

Content ......................................... 819 901 (9%)

Other ........................................... 85 60 42%

Total revenues ...................................... 11,253 11,058 2%

Costs of revenues

(a)

.................................. (5,349) (5,261) 2%

Selling, general and administrative

(a)

...................... (2,002) (2,320) (14%)

Loss on disposal of consolidated business .................. — (3) (100%)

Asset impairments ................................... (52) (18) 189%

Restructuring costs ................................... (8) 3 NM

Depreciation ........................................ (338) (324) 4%

Amortization ....................................... (34) (33) 3%

Operating Income .................................... $ 3,470 $ 3,102 12%

(a)

Costs of revenues and selling, general and administrative expenses exclude depreciation.

The increase in Subscription revenues consisted primarily of a $325 million increase in domestic subscription

revenues mainly due to higher domestic subscription rates at both Turner and Home Box Office and an increase in

international subscription revenues of $51 million due to international subscriber growth, which was partially offset

by a $37 million negative impact of foreign exchange rates.

The decrease in Advertising revenues primarily reflected a decrease of $69 million at Turner’s news networks,

mainly due to audience declines, in part tied to the impact of the 2008 election coverage, and weakened demand, as

well as a $20 million negative impact of foreign exchange rates principally at Turner’s international entertainment

networks.

The decrease in Content revenues was due primarily to a $99 million decrease in ancillary sales of Home Box

Office’s original programming, partly offset by the effect of lower than anticipated home video returns of

approximately $25 million.

Costs of revenues increased primarily due to higher programming costs. Programming costs increased 2% to

$4.258 billion from $4.161 billion in 2008. The increase in programming costs was due primarily to higher expenses

related to licensed programming at both Turner and Home Box Office and original programming at Turner, partially

offset by lower sports programming expenses at Turner that were primarily related to NBA programming and lower

newsgathering costs, primarily reflecting the absence of the prior year’s election-related newsgathering costs.

37

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)