Time Magazine 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amortized based on the ratio of current period advertising revenue to total estimated advertising revenue over the

term of the agreement. Any costs recognized and payable by Turner due to the Loss Cap Amounts will be expensed

by the Company as incurred.

RESULTS OF OPERATIONS

Recent Accounting Guidance

As discussed more fully in Note 1 to the accompanying consolidated financial statements, on January 1, 2010,

the Company adopted on a retrospective basis amendments to accounting guidance pertaining to the accounting for

transfers of financial assets and variable interest entities.

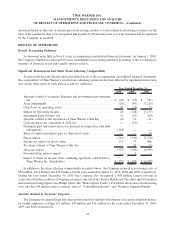

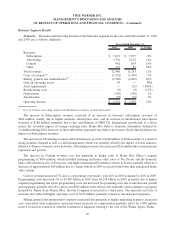

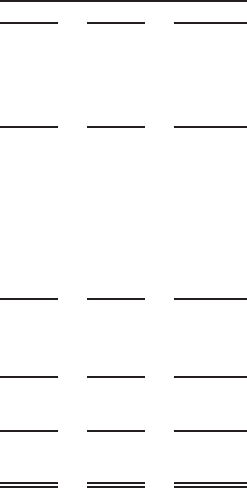

Significant Transactions and Other Items Affecting Comparability

As more fully described herein and in the related notes to the accompanying consolidated financial statements,

the comparability of Time Warner’s results from continuing operations has been affected by significant transactions

and certain other items in each period as follows (millions):

2010 2009 2008

Years Ended December 31,

Amounts related to securities litigation and government investigations,

net................................................. $ (22) $ (30) $ (21)

Asset impairments ....................................... (20) (85) (7,213)

Gain (loss) on operating assets .............................. 70 (33) (3)

Impact on Operating Income ............................... 28 (148) (7,237)

Investment gains (losses), net ............................... 32 (21) (60)

Amounts related to the separation of Time Warner Cable Inc. ...... (6) 14 (11)

Costs related to the separation of AOL Inc. .................... — (15) —

Premiums paid and transaction costs incurred in connection with debt

redemptions .......................................... (364) — —

Share of equity investment gain on disposal of assets ............. — — 30

Pretax impact .......................................... (310) (170) (7,278)

Income tax impact of above items ........................... 131 37 488

Tax items related to Time Warner Cable Inc. ................... — 24 (9)

After-tax impact ........................................ (179) (109) (6,799)

Noncontrolling interest impact .............................. — 5 —

Impact of items on income from continuing operations attributable to

Time Warner Inc. shareholders ............................ $ (179) $ (104) $ (6,799)

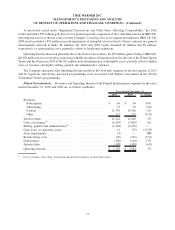

In addition to the items affecting comparability described above, the Company incurred restructuring costs of

$97 million, $212 million and $327 million for the years ended December 31, 2010, 2009 and 2008, respectively.

During the year ended December 31, 2010, the Company also recognized a $58 million reserve reversal in

connection with the resolution of litigation relating to the sale of the Atlanta Hawks and Thrashers sports franchises

and certain operating rights to the Philips Arena (the “Winter Sports Teams”). For further discussion of restructuring

costs and the $58 million reserve reversal, refer to “Consolidated Results” and “Business Segment Results.”

Amounts Related to Securities Litigation

The Company recognized legal and other professional fees related to the defense of securities litigation matters

by former employees totaling $22 million, $30 million and $21 million for the years ended December 31, 2010,

2009 and 2008, respectively.

25

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)