Time Magazine 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

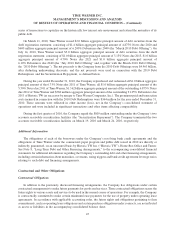

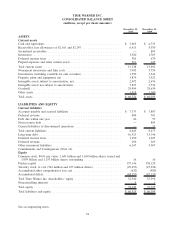

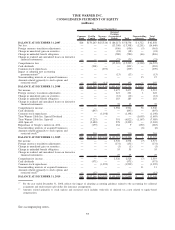

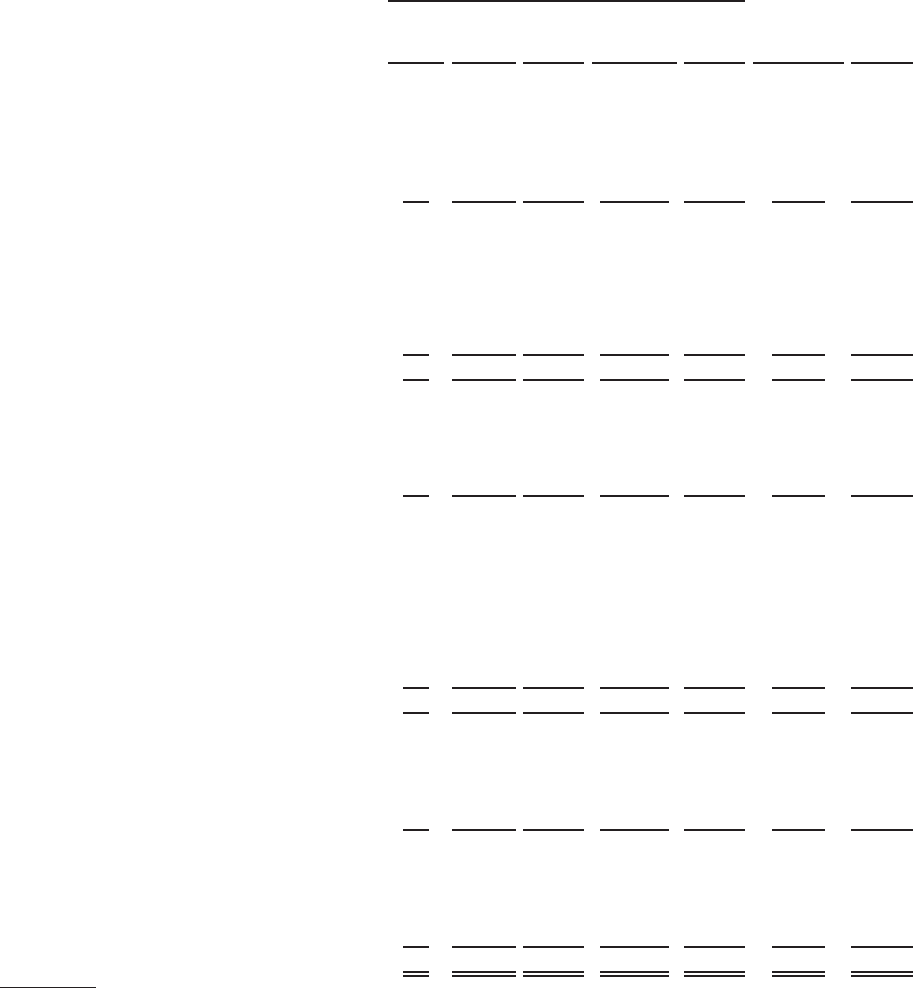

TIME WARNER INC.

CONSOLIDATED STATEMENT OF EQUITY

(millions)

Common

Stock

Paid-In

Capital

Treasury

Stock

Retained

Earnings

(Accumulated

Deficit) Total

Noncontrolling

Interests

Total

Equity

Time Warner Shareholders’

BALANCE AT DECEMBER 31, 2007 .......... $16 $170,263 $(25,526) $ (86,217) $ 58,536 $ 4,322 $ 62,858

Net loss ................................ — — — (13,398) (13,398) (1,251) (14,649)

Foreign currency translation adjustments .......... — — — (956) (956) (5) (961)

Change in unrealized gain on securities ........... — — — (18) (18) — (18)

Change in unfunded benefit obligation ........... — — — (780) (780) (46) (826)

Change in realized and unrealized losses on derivative

financial instruments ...................... — — — (71) (71) — (71)

Comprehensive loss ........................ — — — (15,223) (15,223) (1,302) (16,525)

Cash dividends . . ......................... — (901) — — (901) — (901)

Common stock repurchases ................... — — (299) — (299) — (299)

Impact of adopting new accounting

pronouncements

(a)

....................... — — — (13) (13) — (13)

Noncontrolling interests of acquired businesses ..... — — — — — 15 15

Amounts related primarily to stock options and

restricted stock

(b)

........................ — 202 (11) 1 192 — 192

BALANCE AT DECEMBER 31, 2008 .......... $16 $169,564 $(25,836) $(101,452) $ 42,292 $ 3,035 $ 45,327

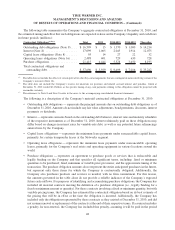

Net income ............................. — — — 2,477 2,477 35 2,512

Foreign currency translation adjustments .......... — — — 221 221 1 222

Change in unrealized gain on securities ........... — — — (12) (12) — (12)

Change in unfunded benefit obligation ........... — — — 183 183 — 183

Change in realized and unrealized losses on derivative

financial instruments ...................... — — — 35 35 — 35

Comprehensive income...................... — — — 2,904 2,904 36 2,940

Cash dividends . . ......................... — (897) — — (897) — (897)

Common stock repurchases ................... — — (1,198) — (1,198) — (1,198)

Time Warner Cable Inc. Special Dividend ......... — — — — — (1,603) (1,603)

Time Warner Cable Inc. Spin-off ............... — (7,213) — 391 (6,822) (1,167) (7,989)

AOL Spin-off . . . ......................... — (3,480) — 278 (3,202) — (3,202)

Repurchase of Google’s interest in AOL .......... — (155) — 164 9 (292) (283)

Noncontrolling interests of acquired businesses ..... — — — — — (8) (8)

Amounts related primarily to stock options and

restricted stock

(b)

........................ — 310 — — 310 — 310

BALANCE AT DECEMBER 31, 2009 .......... $16 $158,129 $(27,034) $ (97,715) $ 33,396 $ 1 $ 33,397

Net income ............................. — — — 2,578 2,578 (7) 2,571

Foreign currency translation adjustments .......... — — — (131) (131) — (131)

Change in unrealized gain on securities ........... — — — (1) (1) — (1)

Change in unfunded benefit obligation ........... — — — 55 55 — 55

Change in realized and unrealized losses on derivative

financial instruments ...................... — — — 25 25 — 25

Comprehensive income...................... — — — 2,526 2,526 (7) 2,519

Cash dividends . . ......................... — (971) — — (971) — (971)

Common stock repurchases ................... — — (1,999) — (1,999) — (1,999)

Noncontrolling interests of acquired businesses ..... — — — — — 11 11

Amounts related primarily to stock options and

restricted stock

(b)

........................ — (12) — — (12) — (12)

BALANCE AT DECEMBER 31, 2010 .......... $16 $157,146 $(29,033) $ (95,189) $ 32,940 $ 5 $ 32,945

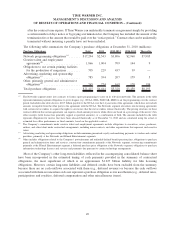

(a)

For the year ended December 31, 2008, reflects the impact of adopting accounting guidance related to the accounting for collateral

assignment and endorsement split-dollar life insurance arrangements.

(b)

Amounts related primarily to stock options and restricted stock includes write-offs of deferred tax assets related to equity-based

compensation.

See accompanying notes.

57