Time Magazine 2010 Annual Report Download - page 35

Download and view the complete annual report

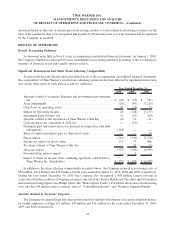

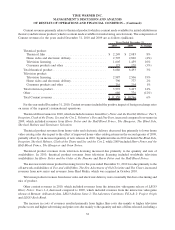

Please find page 35 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In its ongoing effort to improve efficiency and reduce its cost structure, the Publishing segment executed

restructuring initiatives, primarily relating to headcount reductions, in the fourth quarters of 2010 and 2009. For the

years ended December 31, 2010 and 2009, restructuring costs were $61 million and $99 million, respectively.

Recent Developments

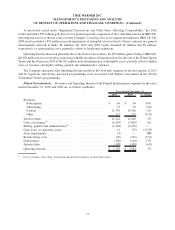

Revolving Bank Credit Facilities

On January 19, 2011, the Company entered into two new senior unsecured revolving bank credit facilities

totaling $5.0 billion, which replaced the Company’s senior unsecured revolving bank credit facility that would have

expired in February 2011. See “Financial Condition and Liquidity — Outstanding Debt and Other Financing

Arrangements” for more information.

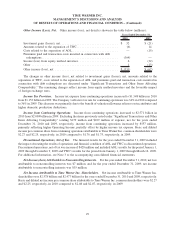

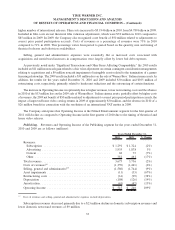

2010 Debt Transactions

As discussed more fully in “Financial Condition and Liquidity — Outstanding Debt and Other Financing

Arrangements,” in 2010, the Company entered into a series of transactions to capitalize on the historically low

interest rate environment and extend the average maturity of its public debt. Specifically, Time Warner issued

$5.0 billion aggregate principal amount of 5, 10, and 30-year debt securities in two public offerings and used the net

proceeds from the debt offerings to repurchase and redeem approximately $3.930 billion aggregate principal

amount of debt securities of Time Warner and Historic TW Inc. (“Historic TW”) that were scheduled to mature

within the next three years (collectively, the “2010 Debt Redemptions”) and to repay $805 million outstanding

under the Company’s two accounts receivable securitization facilities. For the year ended December 31, 2010, the

Company incurred $364 million of premiums paid and transaction costs incurred in connection with the 2010 Debt

Redemptions.

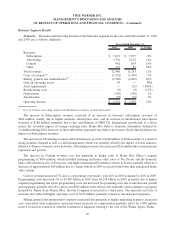

Shed Media

On October 13, 2010, Warner Bros. acquired an approximate 55% interest in Shed Media, a leading television

production company in the U.K., for $100 million in cash, net of cash acquired. Warner Bros. has a call right that

enables it to purchase a portion of the interests held by the other owners of Shed Media in 2014 and the remaining

interests held by the other owners in 2018. The other owners have a reciprocal put right that enables them to require

Warner Bros. to purchase a portion of their interests in Shed Media in 2014 and the remaining interests held by them

in 2018. See Note 3 to the accompanying consolidated financial statements.

Chilevisión

On October 6, 2010, Turner acquired Chilevisión, a television broadcaster in Chile, for $134 million in cash, net

of cash acquired. See Note 3 to the accompanying consolidated financial statements.

HBO LAG

On March 9, 2010, Home Box Office purchased additional interests in HBO LAG for $217 million in cash,

which resulted in Home Box Office owning 80% of the equity interests of HBO LAG. On November 18, 2010, one

of the remaining partners in HBO LAG exercised its put option to sell its remaining 8% equity interest in HBO LAG

for approximately $65 million in cash. The transaction is expected to close in the first quarter of 2011 and will result

in Home Box Office owning 88% of the equity interests of HBO LAG. Home Box Office accounts for this

investment under the equity method of accounting. See Notes 1 and 3 to the accompanying consolidated financial

statements.

23

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)