Time Magazine 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cash Flows

Cash and equivalents decreased by $1.070 billion, including $24 million of cash used by discontinued

operations, for the year ended December 31, 2010 and increased by $3.651 billion, including $617 million of cash

provided by discontinued operations, for the year ended December 31, 2009. Components of these changes are

discussed below in more detail.

Operating Activities from Continuing Operations

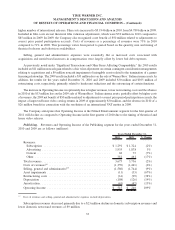

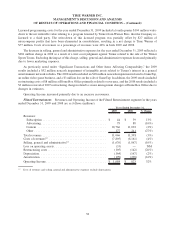

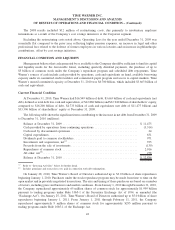

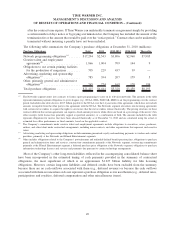

Details of cash provided by operations from continuing operations are as follows (millions):

2010 2009 2008

Years Ended December 31,

Operating Income (Loss) .............................. $ 5,428 $ 4,470 $ (3,044)

Depreciation and amortization .......................... 938 948 1,014

(Gain) loss on operating assets .......................... (70) 33 3

Noncash asset impairments ............................. 20 85 7,213

Net interest payments

(a)

............................... (1,060) (1,082) (1,341)

Net income taxes paid

(b)

............................... (958) (810) (212)

Noncash equity-based compensation ...................... 199 175 192

Domestic pension plan contributions ...................... (26) (43) (395)

Restructuring payments, net of accruals. . . ................. (62) (8) 181

Amounts paid to settle litigation ......................... (250) — —

All other, net, including working capital changes............. (845) (382) 681

Cash provided by operations from continuing operations ....... $ 3,314 $ 3,386 $ 4,292

(a)

Includes interest income received of $26 million, $43 million and $65 million in 2010, 2009 and 2008, respectively.

(b)

Includes income tax refunds received of $90 million, $99 million and $137 million in 2010, 2009 and 2008, respectively, and income tax

sharing payments to TWC of $87 million in 2010 and net income tax sharing receipts from TWC and AOL of $241 million and $342 million

in 2009 and 2008, respectively.

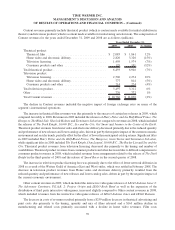

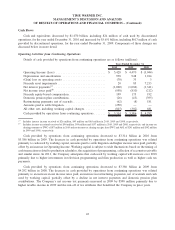

Cash provided by operations from continuing operations decreased to $3.314 billion in 2010 from

$3.386 billion in 2009. The decrease in cash provided by operations from continuing operations was related

primarily to cash used by working capital, amounts paid to settle litigation and higher income taxes paid, partially

offset by an increase in Operating Income. Working capital is subject to wide fluctuations based on the timing of

cash transactions related to production schedules, the acquisition of programming, collection of accounts receivable

and similar items. In 2011, the Company anticipates that cash used by working capital will increase over 2010

primarily due to higher investments in television programming and film production as well as higher cash tax

payments.

Cash provided by operations from continuing operations decreased to $3.386 billion in 2009 from

$4.292 billion in 2008. The decrease in cash provided by operations from continuing operations was related

primarily to an increase in net income taxes paid, an increase in restructuring payments, net of accruals and cash

used by working capital, partially offset by a decline in net interest payments and domestic pension plan

contributions. The Company’s net income tax payments increased in 2009 by $598 million primarily due to

higher taxable income in 2009 and the run-off of tax attributes that benefitted the Company in prior years.

43

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)