Time Magazine 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CME Investment

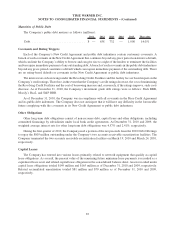

On May 18, 2009, the Company completed an equity investment in Central European Media Enterprises Ltd.

(“CME”) for $246 million in cash. As of December 31, 2010, the Company holds an approximate 29.5% economic

interest in CME. CME is a publicly-traded broadcasting company operating leading networks in seven Central and

Eastern European countries. In connection with its investment, Time Warner agreed to allow CME founder and

Non-Executive Chairman Ronald S. Lauder to vote Time Warner’s shares of CME for at least four years, subject to

certain exceptions. The Company’s investment in CME is being accounted for under the cost method of accounting.

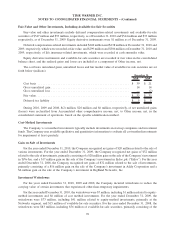

Summary of Discontinued Operations

AOL Separation from Time Warner

On July 8, 2009, the Company repurchased Google Inc.’s (“Google”) 5% interest in the AOL business for

$283 million in cash, which amount included a payment in respect of Google’s pro rata share of cash distributions to

Time Warner by AOL attributable to the period of Google’s investment in AOL. After repurchasing this stake, Time

Warner owned all of AOL.

On December 9, 2009 (the “Distribution Date”), the Company disposed of all of its shares of AOL Inc. (“AOL”)

common stock. The disposition was made pursuant to a separation and distribution agreement entered into on

November 16, 2009 by Time Warner and AOL for the purpose of legally and structurally separating AOL from Time

Warner (the “AOL Separation”). The AOL Separation was effected as a pro rata dividend of all shares of AOL

common stock held by Time Warner in a spin-off to Time Warner stockholders.

With the completion of the AOL Separation, the Company disposed of its AOL segment in its entirety.

Accordingly, the Company has presented the financial condition and results of operations of its former AOL

segment in the consolidated financial statements through December 9, 2009 as discontinued operations.

TWC Separation from Time Warner

On March 12, 2009 (the “Distribution Record Date”), the Company disposed of all of its shares of Time Warner

Cable Inc (“TWC”) common stock. The disposition was made pursuant to a separation agreement entered into on

May 20, 2008, among Time Warner, TWC and certain of their subsidiaries (the “Separation Agreement”) for the

purpose of legally and structurally separating TWC from Time Warner (the “TWC Separation”). The TWC

Separation was effected as a pro rata dividend of all shares of TWC common stock held by Time Warner in a spin-

off to Time Warner stockholders.

Prior to the Distribution Record Date, on March 12, 2009, TWC, in accordance with the terms of the Separation

Agreement, paid a special cash dividend of $10.27 per share to all holders of TWC Class A common stock and TWC

Class B common stock as of the close of business on March 11, 2009 (aggregating $10.856 billion) (the “Special

Dividend”), which resulted in the receipt by Time Warner of $9.253 billion.

With the completion of the TWC Separation, the Company disposed of its Cable segment in its entirety.

Accordingly, the Company has presented the financial condition and results of operations of its former Cable

segment in the consolidated financial statements through March 12, 2009 as discontinued operations.

74

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)