Time Magazine 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

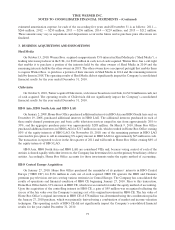

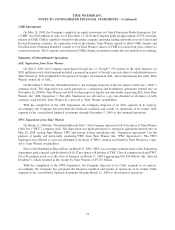

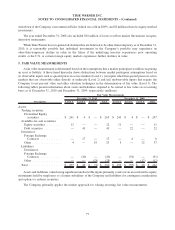

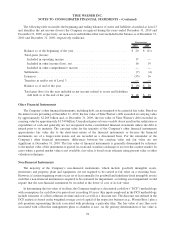

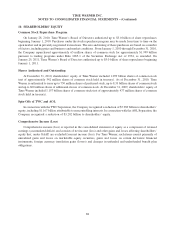

The following table reconciles the beginning and ending balances of assets and liabilities classified as Level 3

and identifies the net income (losses) the Company recognized during the years ended December 31, 2010 and

December 31, 2009, respectively, on such assets and liabilities that were included in the balance as of December 31,

2010 and December 31, 2009, respectively (millions):

2010 2009

Derivatives

Balance as of the beginning of the year ................................. $ 20 $ (11)

Total gains (losses):

Included in operating income ....................................... 17 —

Included in other income (loss), net .................................. 16 19

Included in other comprehensive income .............................. — —

Settlements ...................................................... (7) (4)

Issuances ....................................................... (55) 16

Transfers in and/or out of Level 3 ..................................... — —

Balance as of end of the year ........................................ $ (9) $ 20

Total gain (loss) for the year included in net income related to assets and liabilities

still held as of the end of the year ................................... $ 18 $ 19

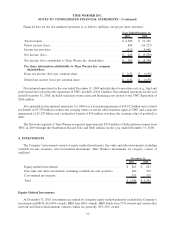

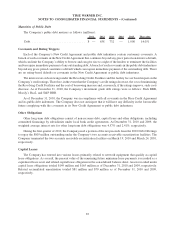

Other Financial Instruments

The Company’s other financial instruments, including debt, are not required to be carried at fair value. Based on

the interest rates prevailing at December 31, 2010, the fair value of Time Warner’s debt exceeded its carrying value

by approximately $2.269 billion and, at December 31, 2009, the fair value of Time Warner’s debt exceeded its

carrying value by approximately $1.749 billion. Unrealized gains or losses on debt do not result in the realization or

expenditure of cash and generally are not recognized in the consolidated financial statements unless the debt is

retired prior to its maturity. The carrying value for the majority of the Company’s other financial instruments

approximates fair value due to the short-term nature of the financial instruments or because the financial

instruments are of a longer-term nature and are recorded on a discounted basis. For the remainder of the

Company’s other financial instruments, differences between the carrying value and fair value are not

significant at December 31, 2010. The fair value of financial instruments is generally determined by reference

to the market value of the instrument as quoted on a national securities exchange or an over-the-counter market. In

cases where a quoted market value is not available, fair value is based on an estimate using present value or other

valuation techniques.

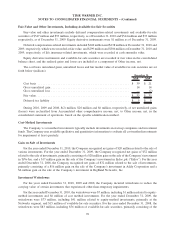

Non-Financial Instruments

The majority of the Company’s non-financial instruments, which include goodwill, intangible assets,

inventories and property, plant and equipment, are not required to be carried at fair value on a recurring basis.

However, if certain triggering events occur (or at least annually for goodwill and indefinite-lived intangible assets)

such that a non-financial instrument is required to be evaluated for impairment, a resulting asset impairment would

require that the non-financial instrument be recorded at the lower of cost or its fair value.

In determining the fair value of its films, the Company employs a discounted cash flow (“DCF”) methodology

with assumptions for cash flows for periods not exceeding 10 years. Key inputs employed in the DCF methodology

include estimates of a film’s ultimate revenue and costs as well as a discount rate. The discount rate utilized in the

DCF analysis is based on the weighted average cost of capital of the respective business (e.g., Warner Bros.) plus a

risk premium representing the risk associated with producing a particular film. The fair value of any film costs

associated with a film that management plans to abandon is zero. As the primary determination of fair value is

78

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)