Time Magazine 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

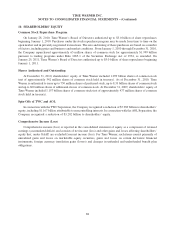

Upon the (i) exercise of a stock option award, (ii) the vesting of an RSU, (iii) the vesting of a PSU or (iv) the

grant of restricted stock, shares of Time Warner common stock may be issued either from authorized but unissued

shares or from treasury stock.

In connection with the AOL Separation and the TWC Separation (collectively, the “Separations”) in 2009, and

as provided for in the Company’s equity plans, the number of stock options, RSUs and target PSUs outstanding at

each of the Distribution Date and Distribution Record Date, respectively, and the exercise prices of such stock

options were adjusted to maintain the fair value of those awards (collectively, the “Adjustments”). The Adjustments

were determined by comparing the fair value of such awards immediately prior to each of the Separations (“pre-

Separation”) to the fair value of such awards immediately after each of the Separations. In performing these

analyses, the only assumptions that changed were related to the Time Warner stock price and the stock option’s

exercise price. Accordingly, each equity award outstanding as of the Distribution Date relating to the AOL

Separation was increased by multiplying the size of such award by 1.07, while the per share exercise price of each

stock option was decreased by dividing by 1.07. Each equity award outstanding as of the Distribution Record Date

relating to the TWC Separation was increased by multiplying the size of such award by 1.35, while the per share

exercise price of each stock option was decreased by dividing by 1.35. The Adjustments resulted in an aggregate

increase of approximately 65 million equity awards (comprised of 60 million stock options and 5 million RSUs and

Target PSUs). The modifications to the outstanding equity awards were made pursuant to existing antidilution

provisions in the Company’s equity plans and did not result in any additional compensation expense.

Under the terms of Time Warner’s equity plans and related award agreements, and as a result of the Separations,

AOL and TWC employees who held Time Warner equity awards were treated as if their employment with Time

Warner was terminated without cause at the time of each of the Separations. This treatment resulted in the forfeiture

of unvested stock options, shortened exercise periods for vested stock options and pro rata vesting of the next

installment of (and forfeiture of the remainder of) the RSU awards for those AOL and TWC employees who did not

satisfy retirement-treatment eligibility provisions in the Time Warner equity plans and related award agreements.

Upon the exercise of Time Warner stock options held by TWC employees, TWC is obligated to reimburse Time

Warner for the intrinsic value of the applicable award. The estimated receivable from TWC fluctuates with the fair

value and number of outstanding equity awards and the resulting change is recorded in other income (loss), net, in

the consolidated statement of operations. As of December 31, 2010, the estimated receivable was $19 million. No

such similar arrangement exists with AOL.

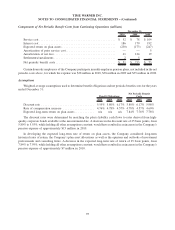

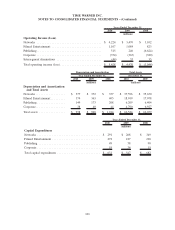

Other information pertaining to each category of equity-based compensation appears below.

Stock Options

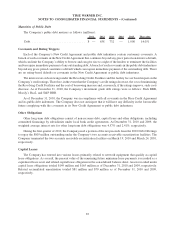

The assumptions presented in the table below represent the weighted-average value of the applicable

assumption used to value stock options at their grant date.

2010 2009 2008

Years Ended December 31,

Expected volatility................................ 29.5% 35.2% 28.7%

Expected term to exercise from grant date .............. 6.51 years 6.11 years 5.95 years

Risk-free rate ................................... 2.9% 2.5% 3.2%

Expected dividend yield............................ 3.1% 4.4% 1.7%

91

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)