Time Magazine 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

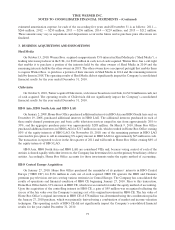

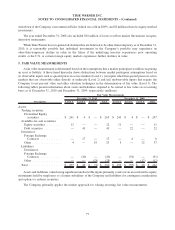

Financial data for the discontinued operations is as follows (millions, except per share amounts):

2009 2008

Years Ended December 31,

Total revenues .............................................. $ 6,500 $ 21,365

Pretax income (loss).......................................... 849 (14,227)

Income tax provision ......................................... (421) 4,668

Net income (loss)............................................ $ 428 $ (9,559)

Net income (loss) attributable to Time Warner Inc. shareholders ......... $ 389 $ (8,308)

Per share information attributable to Time Warner Inc. common

shareholders:

Basic net income (loss) per common share ......................... $ 0.32 $ (6.95)

Diluted net income (loss) per common share ........................ $ 0.32 $ (6.95)

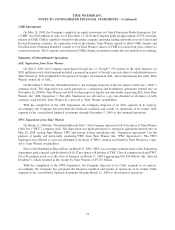

Discontinued operations for the year ended December 31, 2009 included direct transaction costs (e.g., legal and

professional fees) related to the separations of TWC and AOL of $112 million. Discontinued operations for the year

ended December 31, 2008, included such direct transaction and financing costs related to the TWC Separation of

$206 million.

Also included in discontinued operations for 2008 was a noncash impairment of $14.822 billion and a related

tax benefit of $5.729 billion to reduce the carrying values of certain cable franchise rights at TWC and a noncash

impairment of $2.207 billion and a related tax benefit of $90 million to reduce the carrying value of goodwill at

AOL.

The Networks segment of Time Warner recognized approximately $170 million of Subscription revenues from

TWC in 2009 through the Distribution Record Date and $840 million for the year ended December 31, 2008.

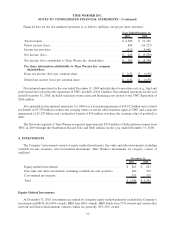

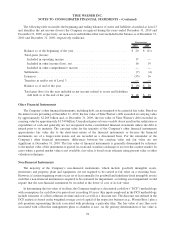

4. INVESTMENTS

The Company’s investments consist of equity-method investments, fair-value and other investments, including

available-for-sale securities, and cost-method investments. Time Warner’s investments, by category, consist of

(millions):

2010 2009

December 31,

Equity-method investments ....................................... $ 883 $ 641

Fair-value and other investments, including available-for-sale securities ...... 600 578

Cost-method investments......................................... 313 323

Total ....................................................... $ 1,796 $ 1,542

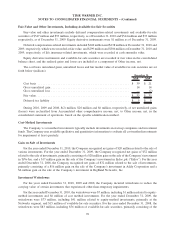

Equity-Method Investments

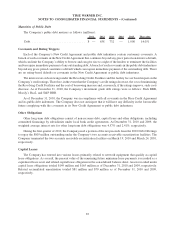

At December 31, 2010, investments accounted for using the equity method primarily included the Company’s

investments in HBO LAG (80% owned), HBO Asia (80% owned), HBO South Asia (75% owned) and certain other

network and filmed entertainment ventures which are generally 20%-50% owned.

75

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)