Time Magazine 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.under the Company’s New Credit Agreement are directly or indirectly guaranteed, on an unsecured basis by

Historic TW Inc. (“Historic TW”), Home Box Office and Turner. The obligations of TWIFL under the New Credit

Agreement are also guaranteed by Time Warner.

Commercial Paper Program

On February 16, 2011, the Company established a new commercial paper program on a private placement basis

under which Time Warner may issue unsecured commercial paper notes up to a maximum aggregate amount

outstanding at any time of $5.0 billion (the “CP Program”). Concurrently with the effectiveness of the CP Program,

the Company terminated its prior commercial paper program. Proceeds from the CP Program may be used for

general corporate purposes. Commercial paper issued by Time Warner is supported by, and the amount of

commercial paper issued may not exceed, the unused committed capacity under the Revolving Credit Facilities. The

obligations of the Company under the CP Program are directly or indirectly guaranteed, on an unsecured basis by

Historic TW, Home Box Office and Turner.

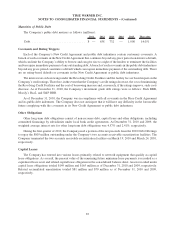

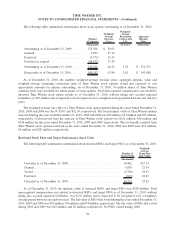

Public Debt

Time Warner and certain of its subsidiaries have various public debt issuances outstanding. At issuance, the

maturities of these outstanding series of debt ranged from five to 40 years and the interest rates on debt with fixed

interest rates ranged from 3.15% to 9.15%. At December 31, 2010 and 2009, the weighted average interest rate on

the Company’s outstanding fixed-rate public debt was 6.55% and 7.14%, respectively. At December 31, 2010, the

Company’s fixed-rate public debt had maturities ranging from 2012 to 2040.

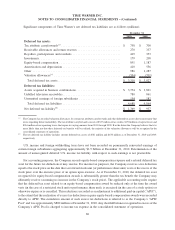

Debt Offerings, Tender Offers and Redemptions

On March 3, 2010, Time Warner filed a shelf registration statement with the SEC that allows it to offer and sell

from time to time debt securities, preferred stock, common stock and warrants to purchase debt and equity

securities.

On March 11, 2010, Time Warner issued $1.4 billion aggregate principal amount of 4.875% Notes due 2020

and $600 million aggregate principal amount of 6.200% Debentures due 2040 (the “March 2010 Debt Offering”),

and on July 14, 2010, it issued $1.0 billion aggregate principal amount of 3.15% Notes due 2015, $1.0 billion

aggregate principal amount of 4.70% Notes due 2021 and $1.0 billion aggregate principal amount of

6.10% Debentures due 2040 (the “July 2010 Debt Offering” and, together with the March 2010 Debt Offering,

the “2010 Debt Offerings”), in each case, under the shelf registration statement.

The net proceeds to the Company from the 2010 Debt Offerings were $4.963 billion, after deducting

underwriting discounts. The Company used a portion of the net proceeds from the 2010 Debt Offerings to

repurchase and redeem all $1.0 billion aggregate principal amount of the 6.75% Notes due 2011 of Time Warner, all

$1.0 billion aggregate principal amount of the 5.50% Notes due 2011 of Time Warner, $1.362 billion aggregate

principal amount of the outstanding 6.875% Notes due 2012 of Time Warner and $568 million aggregate principal

amount of the outstanding 9.125% Debentures due 2013 of Historic TW (as successor by merger to Time Warner

Companies, Inc.).

The securities issued pursuant to the 2010 Debt Offerings are directly or indirectly guaranteed, on an unsecured

basis by Historic TW, Home Box Office and Turner.

The premiums paid and transaction costs incurred of $364 million for the year ended December 31, 2010 in

connection with the repurchase and redemption of these securities were reflected in other income (loss), net in the

consolidated statement of operations.

82

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)