Time Magazine 2010 Annual Report Download - page 59

Download and view the complete annual report

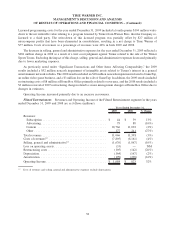

Please find page 59 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.series of transactions to capitalize on the historically low interest rate environment and extend the maturities of its

public debt.

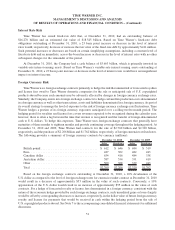

On March 11, 2010, Time Warner issued $2.0 billion aggregate principal amount of debt securities from the

shelf registration statement, consisting of $1.4 billion aggregate principal amount of 4.875% Notes due 2020 and

$600 million aggregate principal amount of 6.200% Debentures due 2040 (the “March 2010 Debt Offering”). On

July 14, 2010, Time Warner issued $3.0 billion aggregate principal amount of debt securities from the shelf

registration statement, consisting of $1.0 billion aggregate principal amount of 3.15% Notes due 2015, $1.0 billion

aggregate principal amount of 4.70% Notes due 2021 and $1.0 billion aggregate principal amount of

6.10% Debentures due 2040 (the “July 2010 Debt Offering” and, together with the March 2010 Debt Offering,

the “2010 Debt Offerings”). The net proceeds to the Company from the 2010 Debt Offerings were $4.963 billion,

after deducting underwriting discounts, and the net proceeds were used in connection with the 2010 Debt

Redemptions and the Securitization Repayment, as defined below.

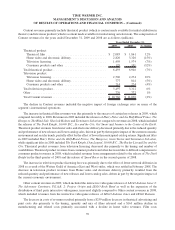

During the year ended December 31, 2010, the Company repurchased and redeemed all $1.0 billion aggregate

principal amount of the 6.75% Notes due 2011 of Time Warner, all $1.0 billion aggregate principal amount of the

5.50% Notes due 2011 of Time Warner, $1.362 billion aggregate principal amount of the outstanding 6.875% Notes

due 2012 of Time Warner and $568 million aggregate principal amount of the outstanding 9.125% Debentures due

2013 of Historic TW (as successor by merger to Time Warner Companies, Inc.). The premiums paid and transaction

costs incurred in connection with the 2010 Debt Redemptions were $364 million for the year ended December 31,

2010. These amounts were reflected in other income (loss), net in the Company’s consolidated statement of

operations and were included in significant transactions and other items affecting comparability.

During the first quarter of 2010, the Company repaid the $805 million outstanding under the Company’s two

accounts receivable securitization facilities (the “Securitization Repayment”). The Company terminated the two

accounts receivable securitization facilities on March 19, 2010 and March 24, 2010, respectively.

Additional Information

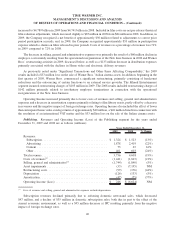

The obligations of each of the borrowers under the Company’s revolving bank credit agreements and the

obligations of Time Warner under the commercial paper program and public debt issued in 2010 are directly or

indirectly guaranteed, on an unsecured basis by Historic TW Inc. (“Historic TW”), Home Box Office and Turner.

See Note 8, “Long-Term Debt and Other Financing Arrangements,” to the accompanying consolidated financial

statements for additional information regarding the Company’s outstanding debt and other financing arrangements,

including certain information about maturities, covenants, rating triggers and bank credit agreement leverage ratios

relating to such debt and financing arrangements.

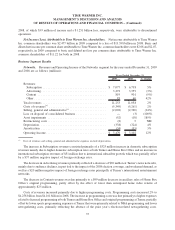

Contractual and Other Obligations

Contractual Obligations

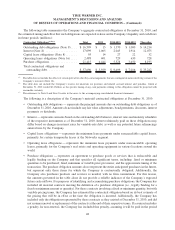

In addition to the previously discussed financing arrangements, the Company has obligations under certain

contractual arrangements to make future payments for goods and services. These contractual obligations secure the

future rights to various assets and services to be used in the normal course of operations. For example, the Company

is contractually committed to make certain minimum lease payments for the use of property under operating lease

agreements. In accordance with applicable accounting rules, the future rights and obligations pertaining to firm

commitments, such as operating lease obligations and certain purchase obligations under contracts, are not reflected

as assets or liabilities in the accompanying consolidated balance sheet.

47

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)