Time Magazine 2010 Annual Report Download - page 85

Download and view the complete annual report

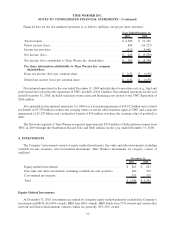

Please find page 85 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimated amortization expense for each of the succeeding five years ended December 31 is as follows: 2011 —

$266 million; 2012 — $250 million; 2013 — $236 million, 2014 — $229 million; and 2015 — $212 million.

These amounts may vary as acquisitions and dispositions occur in the future and as purchase price allocations are

finalized.

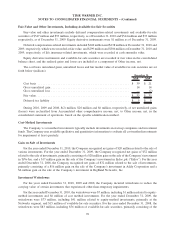

3. BUSINESS ACQUISITIONS AND DISPOSITIONS

Shed Media

On October 13, 2010, Warner Bros. acquired an approximate 55% interest in Shed Media plc (“Shed Media”), a

leading television producer in the U.K., for $100 million in cash, net of cash acquired. Warner Bros. has a call right

that enables it to purchase a portion of the interests held by the other owners of Shed Media in 2014 and the

remaining interests held by the other owners in 2018. The other owners have a reciprocal put right that enables them

to require Warner Bros. to purchase a portion of their interests in Shed Media in 2014 and the remaining interests

held by them in 2018. The operating results of Shed Media did not significantly impact the Company’s consolidated

financial results for the year ended December 31, 2010.

Chilevisión

On October 6, 2010, Turner acquired Chilevisión, a television broadcaster in Chile, for $134 million in cash, net

of cash acquired. The operating results of Chilevisión did not significantly impact the Company’s consolidated

financial results for the year ended December 31, 2010.

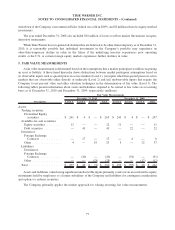

HBO Asia, HBO South Asia and HBO LAG

On January 2, 2008, Home Box Office purchased additional interests in HBO Asia and HBO South Asia and, on

December 19, 2008, purchased additional interests in HBO LAG. The additional interests purchased in each of

these multi-channel premium pay and basic cable television services ranged in size from approximately 20% to

30%, and the aggregate purchase price was approximately $288 million. On March 9, 2010, Home Box Office

purchased additional interests in HBO LAG for $217 million in cash, which resulted in Home Box Office owning

80% of the equity interests of HBO LAG. On November 18, 2010, one of the remaining partners in HBO LAG

exercised its put option to sell its remaining 8% equity interest in HBO LAG for approximately $65 million in cash.

The transaction is expected to close in the first quarter of 2011 and will result in Home Box Office owning 88% of

the equity interests of HBO LAG.

HBO Asia, HBO South Asia and HBO LAG are considered VIEs and, because voting control of each of the

entities is shared equally with other investors, the Company has determined it is not the primary beneficiary of these

entities. Accordingly, Home Box Office accounts for these investments under the equity method of accounting.

HBO Central Europe Acquisition

On January 27, 2010, Home Box Office purchased the remainder of its partners’ interests in HBO Central

Europe (“HBO CE”) for $136 million in cash, net of cash acquired. HBO CE operates the HBO and Cinemax

premium pay television services serving various territories in Central Europe. The Company has consolidated the

results of operations and financial condition of HBO CE beginning January 27, 2010. Prior to this transaction,

Home Box Office held a 33% interest in HBO CE, which was accounted for under the equity method of accounting.

Upon the acquisition of the controlling interest in HBO CE, a gain of $59 million was recognized reflecting the

excess of the fair value over the Company’s carrying cost of its original investment in HBO CE. The fair value of

Home Box Office’s original investment in HBO CE of $78 million was determined using the consideration paid in

the January 27, 2010 purchase, which was primarily derived using a combination of market and income valuation

techniques. The operating results of HBO CE did not significantly impact the Company’s consolidated financial

results for the year ended December 31, 2010.

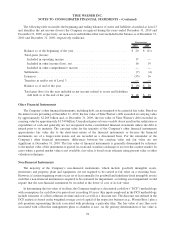

73

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)