Time Magazine 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

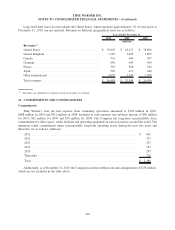

Time Warner also has commitments under certain programming, network licensing, artist, franchise and other

agreements aggregating $25.961 billion at December 31, 2010, which are payable as follows (millions):

2011 .............................................................. $ 5,007

2012 .............................................................. 3,541

2013 .............................................................. 3,118

2014 .............................................................. 2,622

2015 .............................................................. 2,341

Thereafter .......................................................... 9,332

Total .............................................................. $ 25,961

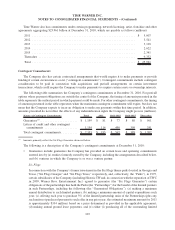

Contingent Commitments

The Company also has certain contractual arrangements that would require it to make payments or provide

funding if certain circumstances occur (“contingent commitments”). Contingent commitments include contingent

consideration to be paid in connection with acquisitions and put/call arrangements on certain investment

transactions, which could require the Company to make payments to acquire certain assets or ownership interests.

The following table summarizes the Company’s contingent commitments at December 31, 2010. For put/call

options where payment obligations are outside the control of the Company, the timing of amounts presented in the

table represents the earliest period in which payment could be made. For other contingent commitments, the timing

of amounts presented in the table represents when the maximum contingent commitment will expire, but does not

mean that the Company expects to incur an obligation to make any payments within that time period. In addition,

amounts presented do not reflect the effects of any indemnification rights the Company might possess (millions).

Nature of Contingent Commitments Total 2011 2012-2013 2014-2015 Thereafter

Guarantees

(a)

....................... $ 1,199 $ 81 $ 77 $ 80 $ 961

Letters of credit and other contingent

commitments .................... 1,154 114 490 309 241

Total contingent commitments .......... $ 2,353 $ 195 $ 567 $ 389 $ 1,202

(a)

Amounts primarily reflect the Six Flags Guarantee discussed below.

The following is a description of the Company’s contingent commitments at December 31, 2010:

• Guarantees include guarantees the Company has provided on certain lease and operating commitments

entered into by (a) entities formerly owned by the Company, including the arrangements described below,

and (b) ventures in which the Company is or was a venture partner.

Six Flags

In connection with the Company’s former investment in the Six Flags theme parks located in Georgia and

Texas (“Six Flags Georgia” and “Six Flags Texas,” respectively, and, collectively, the “Parks”), in 1997,

certain subsidiaries of the Company (including Historic TWand, in connection with the separation of TWC

in 2009, Warner Bros. Entertainment Inc.) agreed to guarantee (the “Six Flags Guarantee”) certain

obligations of the partnerships that hold the Parks (the “Partnerships”) for the benefit of the limited partners

in such Partnerships, including the following (the “Guaranteed Obligations”): (a) making a minimum

annual distribution to such limited partners; (b) making a minimum amount of capital expenditures each

year; (c) offering each year to purchase 5% of the limited partnership units of the Partnerships (plus any

such units not purchased pursuant to such offer in any prior year; the estimated maximum amount for 2011

is approximately $334 million) based on a price determined as provided in the applicable agreement;

(d) making annual ground lease payments; and (e) either (i) purchasing all of the outstanding limited

103

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)