Time Magazine 2010 Annual Report Download - page 71

Download and view the complete annual report

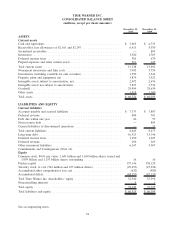

Please find page 71 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.however, as a result of adopting this guidance, because voting control is shared with the other partners in each of the

three entities, the Company determined that it is no longer the primary beneficiary of these entities and, effective

January 1, 2010, accounts for these investments using the equity method. As of December 31, 2010 and

December 31, 2009, the Company’s aggregate investment in these three entities was $597 million and

$362 million, respectively, and was recorded in investments, including available-for-sale securities, in the

consolidated balance sheet.

These investments are intended to enable the Company to more broadly leverage its programming and digital

strategy in the territories served and to capitalize on the growing multi-channel television market in such territories.

The Company provides programming as well as certain services, including distribution, licensing, technological

and administrative support, to HBO Asia, HBO South Asia and HBO LAG. These entities are financed through cash

flows from their operations, and the Company is not obligated to provide them with any additional financial support.

In addition, the assets of these entities are not available to settle the Company’s obligations.

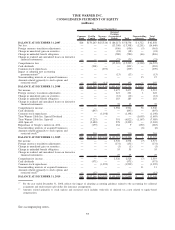

The adoption of this guidance with respect to these entities resulted in an increase (decrease) to revenues,

operating income and net income attributable to Time Warner Inc. shareholders of $(397) million, $(75) million and

$9 million, respectively, for the year ended December 31, 2009 and an increase (decrease) of $(82) million, $(16)

million and $4 million, respectively, for the year ended December 31, 2008. The impact on the consolidated balance

sheet as of December 31, 2009 and consolidated statement of cash flows for the years ended December 31, 2009 and

2008 was not material.

The Company also held variable interests in two wholly owned SPEs through which the activities of its accounts

receivable securitization facilities were conducted. The Company determined it was the primary beneficiary of

these entities because of its ability to direct the key activities of the SPEs that most significantly impact their

economic performance. Accordingly, as a result of adopting this guidance, the Company consolidated these SPEs,

which resulted in an increase to securitized receivables and non-recourse debt of $805 million as of December 31,

2009. In addition, for the year ended December 31, 2008, cash provided by operations increased by $231 million,

with an offsetting decrease to cash used by financing activities. There was no change to cash provided by operations

for the year ended December 31, 2009. The impact on the consolidated statement of operations for the years ended

December 31, 2009 and 2008 was not material. During the first quarter of 2010, the Company repaid the

$805 million that was outstanding under these facilities and terminated the two facilities on March 19, 2010 and

March 24, 2010, respectively.

Disclosures about the Credit Quality of Financing Receivables and the Allowance for Credit Losses

On December 31, 2010, the Company adopted guidance that requires enhanced disclosures regarding the credit

quality of financing receivables (e.g., long-term unbilled accounts receivable) and the allowances for credit losses.

The adoption of this guidance did not affect the Company’s historical consolidated financial statements.

Accounting Guidance Not Yet Effective

Multiple-Deliverable Revenue Arrangements

In October 2009, guidance was issued related to the accounting for multiple-deliverable revenue arrangements,

which amended the existing guidance for separating consideration in multiple-deliverable arrangements and

established a selling price hierarchy for determining the selling price of a deliverable. This guidance became

effective for the Company on January 1, 2011 and is being applied prospectively to multiple-deliverable

arrangements entered into on or after January 1, 2011. The adoption of this guidance is not expected to have a

material impact on the Company’s consolidated financial statements.

59

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)