Time Magazine 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

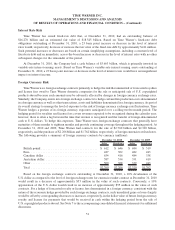

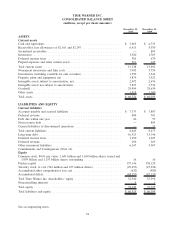

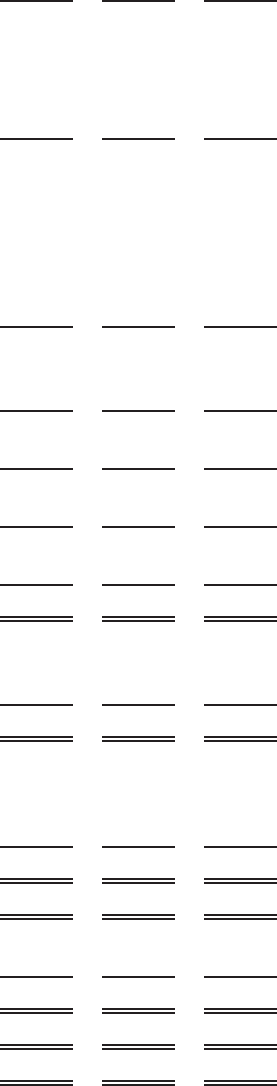

TIME WARNER INC.

CONSOLIDATED STATEMENT OF OPERATIONS

Years Ended December 31,

(millions, except per share amounts)

2010 2009 2008

Revenues:

Subscription ............................................. $ 9,028 $ 8,445 $ 8,300

Advertising .............................................. 5,682 5,161 5,798

Content ................................................ 11,565 11,074 11,450

Other .................................................. 613 708 886

Total revenues ............................................. 26,888 25,388 26,434

Costs of revenues ........................................... (15,023) (14,235) (14,911)

Selling, general and administrative .............................. (6,126) (6,073) (6,678)

Amortization of intangible assets................................ (264) (280) (346)

Restructuring costs .......................................... (97) (212) (327)

Asset impairments .......................................... (20) (85) (7,213)

Gain (loss) on operating assets ................................. 70 (33) (3)

Operating income (loss) ...................................... 5,428 4,470 (3,044)

Interest expense, net ......................................... (1,178) (1,166) (1,360)

Other loss, net ............................................. (331) (67) 7

Income (loss) from continuing operations before income taxes .......... 3,919 3,237 (4,397)

Income tax provision ........................................ (1,348) (1,153) (693)

Income (loss) from continuing operations ......................... 2,571 2,084 (5,090)

Discontinued operations, net of tax .............................. — 428 (9,559)

Net income (loss) ........................................... 2,571 2,512 (14,649)

Less Net (income) loss attributable to noncontrolling interests .......... 7 (35) 1,251

Net income (loss) attributable to Time Warner Inc. shareholders ........ $ 2,578 $ 2,477 $(13,398)

Amounts attributable to Time Warner Inc. shareholders:

Income (loss) from continuing operations ......................... $ 2,578 $ 2,088 $ (5,090)

Discontinued operations, net of tax .............................. — 389 (8,308)

Net income (loss) ........................................... $ 2,578 $ 2,477 $(13,398)

Per share information attributable to Time Warner Inc. common

shareholders:

Basic income (loss) per common share from continuing operations ...... $ 2.27 $ 1.76 $ (4.27)

Discontinued operations ...................................... — 0.32 (6.95)

Basic net income (loss) per common share . . . ..................... $ 2.27 $ 2.08 $ (11.22)

Average basic common shares outstanding......................... 1,128.4 1,184.0 1,194.2

Diluted income (loss) per common share from continuing operations ..... $ 2.25 $ 1.75 $ (4.27)

Discontinued operations ...................................... — 0.32 (6.95)

Diluted net income (loss) per common share . . ..................... $ 2.25 $ 2.07 $ (11.22)

Average diluted common shares outstanding . . ..................... 1,145.3 1,195.1 1,194.2

Cash dividends declared per share of common stock ................. $ 0.850 $ 0.750 $ 0.750

See accompanying notes.

55