Time Magazine 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

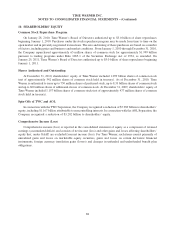

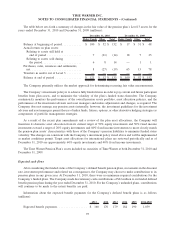

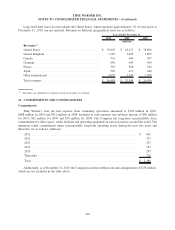

For the year ended December 31, 2010, the Company granted 6 million RSUs at a weighted-average grant date

fair value per RSU of $27.21. For the year ended December 31, 2009, the Company granted 5 million RSUs at a

weighted-average grant date fair value per RSU of $22.34. For the year ended December 31, 2008, the Company

granted 4 million RSUs at a weighted-average grant date fair value per RSU of $44.49.

For the year ended December 31, 2010, the Company granted 0.2 million target PSUs at a weighted-average

grant date fair value per PSU of $30.65. For the year ended December 31, 2009, the Company granted 0.2 million

target PSUs at a weighted-average grant date fair value per PSU of $23.67. For the year ended December 31, 2008,

the Company granted 0.4 million target PSUs at a weighted-average grant date fair value per PSU of $52.59.

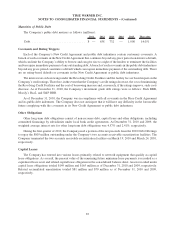

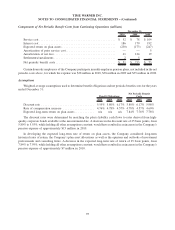

Equity-Based Compensation Expense

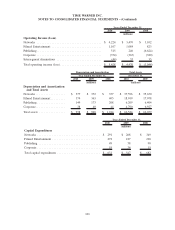

Compensation expense recognized for equity-based compensation plans is as follows (millions):

2010 2009 2008

Years Ended December 31,

Stock options .......................................... $ 70 $ 74 $ 96

Restricted stock units and performance stock units .............. 129 101 96

Total impact on Operating Income .......................... $ 199 $ 175 $ 192

Tax benefit recognized ................................... $ 76 $ 67 $ 73

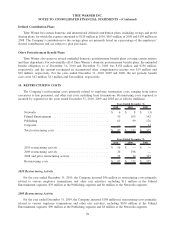

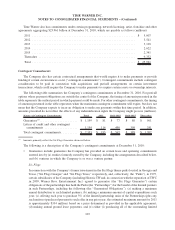

13. BENEFIT PLANS

Retirement Plan Amendments

In March 2010, the Company’s Board of Directors approved amendments to its domestic defined benefit

pension plans. Pursuant to the amendments, (i) effective June 30, 2010, benefits provided under the plans stopped

accruing for additional years of service and the plans were closed to new hires and employees with less than one

year of service and (ii) after December 31, 2013, pay increases will no longer be taken into consideration when

determining a participating employee’s benefits under the plans.

Effective July 1, 2010, the Company increased its matching contributions for eligible participants in the

Company’s domestic defined contribution plan (“Time Warner Savings Plan”). Effective January 1, 2011, the

Company has implemented a supplemental savings plan that provides for similar Company matching for eligible

participant deferrals above the Internal Revenue Service compensation limits that apply to the Time Warner Savings

Plan up to $500,000 of eligible compensation.

In December 2010, amendments to the U.K. defined benefit pension plans were approved. Pursuant to the

amendments, beginning in April 2011, benefits provided under the plans will stop accruing for additional years of

service. Pay increases will continue to be taken into consideration when determining a participating employee’s

benefits under the plans. In addition, matching contributions under a defined contribution plan will be provided to

eligible U.K. employees.

93

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)