Time Magazine 2010 Annual Report Download - page 34

Download and view the complete annual report

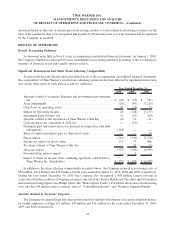

Please find page 34 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Filmed Entertainment segment’s theatrical product revenues principally are generated domestically and

internationally through rentals from theatrical exhibition and subsequently through licensing fees received for the

distribution of films on television networks and pay television programming services. Television product revenues

principally are generated domestically and internationally from the licensing of the Filmed Entertainment

segment’s programs on television networks and pay television programming services. The Filmed

Entertainment segment also generates revenues for both its theatrical and television product through home

video distribution on DVD and Blu-ray Discs and in various digital formats. The Filmed Entertainment

segment also generates revenues through the distribution of interactive videogames.

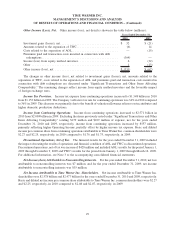

Warner Bros. continues to be an industry leader in the television content business. At the beginning of the

2010-2011 broadcast season, Warner Bros. produced more than 30 scripted primetime series, with at least two series

for each of the five broadcast networks (including Two and a Half Men,The Mentalist,The Big Bang Theory,

Mike & Molly,Gossip Girl, Fringe, The Middle and Chuck) and original series for several cable networks (including

The Closer,Rizzoli & Isles and Pretty Little Liars). Internationally, Warner Bros. is forming a group of local

television production companies in major territories with a focus on non-scripted programs and formats that can be

sold internationally and adapted for sale in the U.S. Warner Bros. is also creating locally produced versions of

programs owned by the studio and is developing original local television programming. As part of its international

expansion efforts, during the fourth quarter of 2010, Warner Bros. acquired a controlling interest in Shed Media plc

(“Shed Media”), a leading television production company in the U.K.

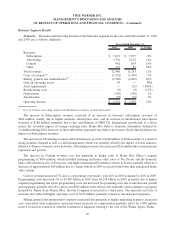

The distribution of DVDs has been one of the largest drivers of the segment’s revenues and profits over the last

several years. The industry and the Company have experienced a decline in DVD sales in recent years as a result of

several factors, including the general economic downturn in the U.S. and many regions around the world, increasing

competition for consumer discretionary time and spending, piracy, and the maturation of the standard definition

DVD format. The decline in home video revenues has also been affected by consumers shifting to subscription

rental services and discount rental kiosks, which generate significantly less revenue per transaction for the

Company than DVD sales. Partially offsetting the softening consumer demand for standard definition DVDs and the

shift to subscription services and kiosks are growing sales of high definition Blu-ray Discs and increased sales

through electronic delivery (particularly video-on-demand), which have higher gross margins than standard

definition DVDs.

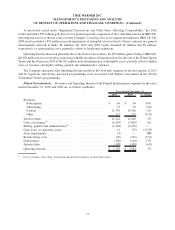

Publishing. Time Warner’s Publishing segment consists principally of magazine publishing and related

websites as well as marketing services and direct-marketing businesses that are all primarily conducted by Time

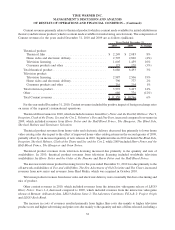

Inc. During the year ended December 31, 2010, the Publishing segment generated revenues of $3.675 billion (14%

of the Company’s overall revenues) and $515 million in Operating Income.

As of December 31, 2010, Time Inc. published 22 magazines in the U.S., including People,Sports Illustrated

and Time, and over 70 magazines outside the U.S. The Publishing segment generates revenues primarily from the

sale of print advertising, magazine subscriptions and newsstand sales. Advertising sales at the Publishing segment,

particularly print advertising sales, were significantly adversely affected by the economic environment during 2009.

In contrast, during 2010, the Publishing segment’s Advertising revenues stabilized driven by increases in domestic

print advertising pages sold, partially offset by lower average advertising rates per page, and increases in digital

advertising. For the year ended December 31, 2010, digital Advertising revenues were 13% of Time Inc.’s total

Advertising revenues.

In July 2010, Time Inc. and Turner announced the formation of a strategic digital partnership between Turner

Sports and Sports Illustrated. The partnership combines Sports Illustrated’s and Golf’s content with Turner’s digital

media and sales expertise. Under the agreement, beginning in the fourth quarter of 2010, Turner began managing the

SI.com and Golf.com websites, including selling all advertising for the websites. Accordingly, effective with the

change, Turner receives all advertising revenues generated from the websites and Time Inc. receives a license fee

from Turner and reimbursement for certain website editorial and other costs.

22

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)