Time Magazine 2010 Annual Report Download - page 116

Download and view the complete annual report

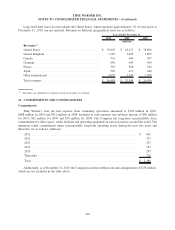

Please find page 116 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.partnership units through the exercise of a call option upon the earlier of the occurrence of certain specified

events and the end of the term of each of the Partnerships in 2027 (Six Flags Georgia) and 2028 (Six Flags

Texas) (the “End of Term Purchase”) or (ii) causing each of the Partnerships to have no indebtedness and to

meet certain other financial tests as of the end of the term of the Partnerships. The aggregate undiscounted

estimated future cash flow requirements covered by the Six Flags Guarantee over the remaining term

(through 2028) of the agreements are approximately $1.1 billion (for a net present value of approximately

$410 million). To date, no payments have been made by the Company pursuant to the Six Flags Guarantee.

In connection with its purchase of the controlling interest in the Parks, Six Flags Entertainment

Corporation (formerly known as Six Flags, Inc. and Premier Parks Inc.) (“Six Flags”), agreed,

pursuant to a subordinated indemnity agreement (the “Subordinated Indemnity Agreement”), to

guarantee the performance of the Guaranteed Obligations when due and to indemnify Historic TW,

among others, in the event that the Guaranteed Obligations are not performed and the Six Flags Guarantee

is called upon. In the event of a default of Six Flags’ indemnification obligations, Historic TW has the right

to acquire control of the managing partner of the Parks. Six Flags’ obligations to Historic TW are further

secured by its interest in all limited partnership units that are held by Six Flags.

On June 13, 2009, Six Flags and certain of its subsidiaries filed petitions for reorganization under

Chapter 11 of the United States Bankruptcy Code in the Bankruptcy Court in Delaware. On April 30, 2010,

Six Flags’ plan of reorganization, which significantly reduced its debt, became effective and it emerged

from bankruptcy. The Partnerships holding the Parks were not included in the debtors’ reorganization

proceedings. Six Flags assumed the Subordinated Indemnity Agreement in the plan of reorganization. In

connection with the plan of reorganization, on April 30, 2010, a Time Warner subsidiary (TW-SF LLC), as

lender, entered into a 5-year $150 million multiple draw term facility with certain affiliates of the

Partnerships, as borrowers, which can be used only to fund such affiliates’ annual obligations to purchase

certain limited partnership units of the Partnerships. Any loan made under the facility will mature 5 years

from its respective funding date. No loan was made under the facility in 2010. On December 3, 2010, the

facility was amended in connection with Six Flags’ refinancing of its first lien credit facility and

termination of its second lien term credit facility. TW-SF LLC agreed to waive the early termination

of the facility as a result of the refinancing and agreed to amend the facility to provide for, among other

things, the payment of a commitment fee to TW-SF LLC, an increase in the amount of permitted Six Flags

first lien debt and the ability of certain of Six Flags’ subsidiaries, and of Six Flags, to make additional

restricted payments to Six Flags and its shareholders, respectively. The facility will expire on April 30,

2015, unless it terminates earlier upon election by the borrowers or due to the acceleration or certain

refinancings of Six Flags’ secured credit facility.

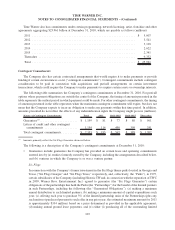

Because the Six Flags Guarantee existed prior to December 31, 2002 and no modifications to the

arrangements have been made since the date the guarantee came into existence, the Company is required to

continue to account for the Guaranteed Obligations as a contingent liability. Based on its evaluation of the

current facts and circumstances surrounding the Guaranteed Obligations and the Subordinated Indemnity

Agreement, the Company is unable to predict the loss, if any, that may be incurred under these Guaranteed

Obligations and no liability for the arrangements has been recognized at December 31, 2010. Because of

the specific circumstances surrounding the arrangements and the fact that no active or observable market

exists for this type of financial guarantee, the Company is unable to determine a current fair value for the

Guaranteed Obligations and related Subordinated Indemnity Agreement.

AOL Revolving Facility and Credit Support Agreement

On December 9, 2009, AOL entered into a $250 million 364-day senior secured revolving credit facility

(the “AOL Revolving Facility”) in connection with the separation of AOL, and Time Warner guaranteed

AOL’s obligations under the AOL Revolving Facility. On September 30, 2010, AOL terminated the AOL

Revolving Facility, which also terminated Time Warner’s guarantee obligations. Time Warner also agreed

104

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)