Time Magazine 2010 Annual Report Download - page 38

Download and view the complete annual report

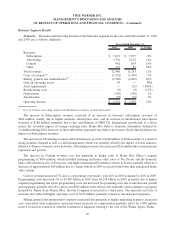

Please find page 38 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Impairments

During the year ended December 31, 2010, the Company recorded noncash impairments of $9 million at the

Filmed Entertainment segment related to the termination of a games licensing relationship and $11 million at the

Publishing segment related to certain intangible assets.

During the year ended December 31, 2009, the Company recorded noncash impairments of $52 million at the

Networks segment related to Turner’s interest in a general entertainment network in India and $33 million at the

Publishing segment related to certain fixed assets in connection with the Publishing segment’s restructuring

activities.

During the year ended December 31, 2008, the Company recorded noncash impairments related to goodwill

and identifiable intangible assets of $7.139 billion at the Publishing segment. The Company also recorded noncash

impairments of $18 million at the Networks segment related to GameTap, an online video game business, and

$30 million at the Publishing segment related to a sub-lease with a tenant that filed for bankruptcy in September

2008, $21 million at the Publishing segment related to Southern Living At Home and $5 million at the Publishing

segment related to certain other asset write-offs.

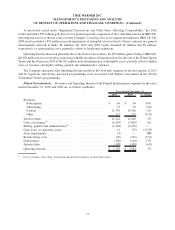

Gain (Loss) on Operating Assets

For the year ended December 31, 2010, the Company recognized a $59 million gain at the Networks segment

upon the acquisition of its controlling interest in HBO CE, reflecting the recognition of the excess of the fair value

over the Company’s carrying costs of its original investment in HBO CE. For the year ended December 31, 2010, the

Company also recorded noncash income of $11 million at the Filmed Entertainment segment related to a fair value

adjustment on certain contingent consideration arrangements relating to acquisitions.

For the year ended December 31, 2009, the Company recognized a $33 million loss at the Filmed Entertainment

segment on the sale of Warner Bros.’ Italian cinema assets.

For the year ended December 31, 2008, the Company recorded a $3 million loss at the Networks segment on the

sale of GameTap.

Investment Gains (Losses), Net

For the year ended December 31, 2010, the Company recognized net investment gains of $32 million, including

$13 million of miscellaneous investment gains, net, and noncash income of $19 million related to fair value

adjustments on certain options to redeem securities.

For the year ended December 31, 2009, the Company recognized net investment losses of $21 million,

including a $23 million impairment of the Company’s investment in Miditech Pvt. Limited, a programming

production company in India, and $43 million of other miscellaneous investment losses, net, partially offset by a

$28 million gain on the sale of the Company’s investment in TiVo Inc. and a $17 million gain on the sale of the

Company’s investment in Eidos plc. (“Eidos”).

For the year ended December 31, 2008, the Company recognized net investment losses of $60 million,

including a $38 million impairment of the Company’s investment in Eidos, $12 million of other miscellaneous

investment losses, net and $10 million of losses resulting from market fluctuations in equity derivative instruments.

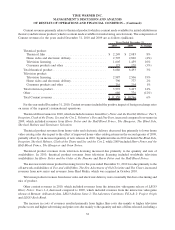

Amounts Related to the Separation of TWC

For the year ended December 31, 2010, the Company recognized $6 million of other loss related to the

expiration, exercise and net change in the estimated fair value of Time Warner equity awards held by Time Warner

Cable Inc. (“TWC”) employees.

26

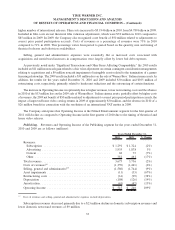

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)