Time Magazine 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

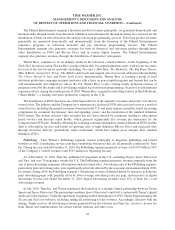

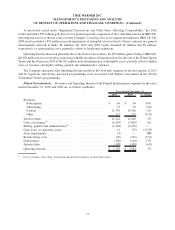

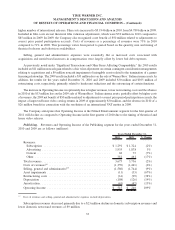

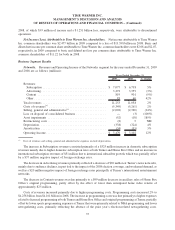

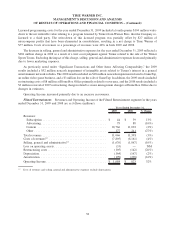

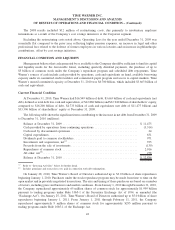

Content revenues primarily relate to theatrical product (which is content made available for initial exhibition in

theaters) and television product (which is content made available for initial airing on television). The components of

Content revenues for the years ended December 31, 2010 and 2009 are as follows (millions):

2010 2009 % Change

Years Ended December 31,

Theatrical product:

Theatrical film .................................... $ 2,249 $ 2,085 8%

Home video and electronic delivery ..................... 2,707 2,820 (4%)

Television licensing................................. 1,605 1,459 10%

Consumer products and other ......................... 125 129 (3%)

Total theatrical product ................................ 6,686 6,493 3%

Television product:

Television licensing................................. 2,987 2,506 19%

Home video and electronic delivery ..................... 790 777 2%

Consumer products and other ......................... 216 214 1%

Total television product................................ 3,993 3,497 14%

Other ............................................. 680 776 (12%)

Total Content revenues ................................ $ 11,359 $ 10,766 6%

For the year ended December 31, 2010, Content revenues included the positive impact of foreign exchange rates

on many of the segment’s international operations.

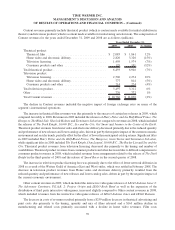

Theatrical film revenues in 2010, which included revenues from Harry Potter and the Deathly Hallows: Part I,

Inception,Clash of the Titans,Sex and the City 2,Valentine’s Day and Due Date, increased compared to revenues in

2009, which included revenues from Harry Potter and the Half-Blood Prince,The Hangover,The Blind Side,

Sherlock Holmes and Terminator Salvation.

Theatrical product revenues from home video and electronic delivery decreased due primarily to lower home

video catalog sales due in part to the effect of improved home video catalog returns in the second quarter of 2009,

partially offset by an increased quantity of new releases in 2010. Significant titles in 2010 included The Blind Side,

Inception, Sherlock Holmes,Clash of the Titans and Sex and the City 2, while 2009 included Harry Potter and the

Half-Blood Prince,The Hangover and Gran Torino.

Theatrical product revenues from television licensing increased due primarily to the quantity and mix of

availabilities. In 2010, theatrical product revenues from television licensing included worldwide television

availabilities for Harry Potter and the Order of the Phoenix and Harry Potter and the Half-Blood Prince.

The increase in television product licensing fees for the year ended December 31, 2010 was due primarily to the

off-network availabilities of Two and a Half Men, The New Adventures of Old Christine and The Closer, increased

revenues from new series and revenues from Shed Media, which was acquired in October 2010.

Television product revenues from home video and electronic delivery were essentially flat due to the timing and

mix of product.

Other content revenues in 2010, which included revenues from the interactive videogame release of LEGO

Harry Potter: Years 1-4, decreased compared to 2009, which included revenues from the interactive videogame

release of Batman: Arkham Asylum,LEGO Indiana Jones 2: The Adventure Continues, F.E.A.R. 2: Project Origin

and LEGO Rock Band.

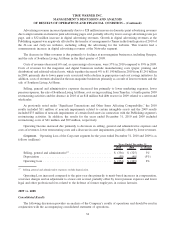

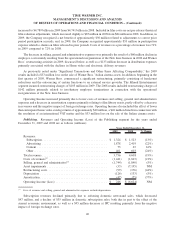

The increase in costs of revenues resulted primarily from higher film costs due mainly to higher television

product costs and higher advertising and print costs due mainly to the quantity and mix of films released, including a

32

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)