Time Magazine 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

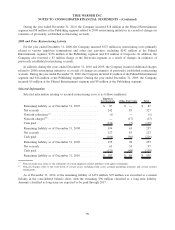

Defined Contribution Plans

Time Warner has certain domestic and international defined contribution plans, including savings and profit

sharing plans, for which the expense amounted to $129 million in 2010, $103 million in 2009 and $105 million in

2008. The Company’s contributions to the savings plans are primarily based on a percentage of the employees’

elected contributions and are subject to plan provisions.

Other Postretirement Benefit Plans

Time Warner also sponsors several unfunded domestic postretirement benefit plans covering certain retirees

and their dependents. For substantially all of Time Warner’s domestic postretirement benefit plans, the unfunded

benefit obligation as of December 31, 2010 and December 31, 2009 was $158 million and $156 million,

respectively, and the amount recognized in accumulated other comprehensive income was $19 million and

$25 million, respectively. For the years ended December 31, 2010, 2009 and 2008, the net periodic benefit

costs were $12 million, $13 million and $14 million, respectively.

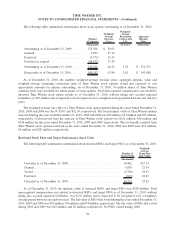

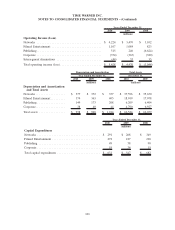

14. RESTRUCTURING COSTS

The Company’s restructuring costs primarily related to employee termination costs, ranging from senior

executives to line personnel, and other exit costs, including lease terminations. Restructuring costs expensed as

incurred by segment for the years ended December 31, 2010, 2009 and 2008 are as follows (millions):

2010 2009 2008

Years Ended December 31,

Networks ........................................... $ 6 $ 8 $ (3)

Filmed Entertainment .................................. 30 105 142

Publishing .......................................... 61 99 176

Corporate ........................................... — — 12

Total restructuring costs ................................ $ 97 $ 212 $ 327

2010 2009 2008

Years Ended December 31,

2010 restructuring activity............................... $ 56 $ — $ —

2009 restructuring activity............................... 26 198 —

2008 and prior restructuring activity ....................... 15 14 327

Restructuring costs .................................... $ 97 $ 212 $ 327

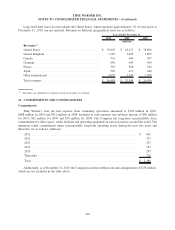

2010 Restructuring Activity

For the year ended December 31, 2010, the Company incurred $56 million in restructuring costs primarily

related to various employee terminations and other exit activities, including $11 million at the Filmed

Entertainment segment, $39 million at the Publishing segment and $6 million at the Networks segment.

2009 Restructuring Activity

For the year ended December 31, 2009, the Company incurred $198 million in restructuring costs primarily

related to various employee terminations and other exit activities, including $100 million at the Filmed

Entertainment segment, $90 million at the Publishing segment and $8 million at the Networks segment.

98

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)