Time Magazine 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

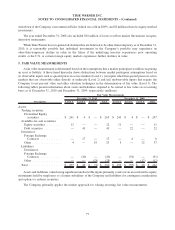

In 2010, the Company recorded noncash impairments of intangible assets of $9 million related to the

termination of a games licensing relationship at the Filmed Entertainment segment and $11 million related to

certain other intangibles at the Publishing segment. In 2009, the Company recorded a $52 million noncash

impairment of intangible assets at the Networks segment related to Turner’s interest in a general entertainment

network in India.

The impairments noted above did not result in non-compliance with respect to any debt covenants.

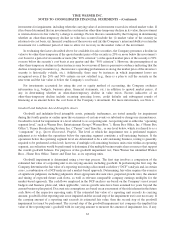

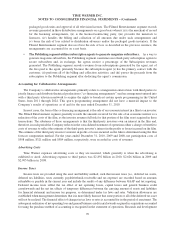

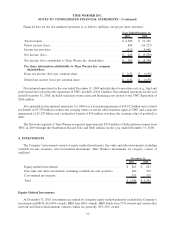

The following summary of changes in the Company’s goodwill related to continuing operations during the

years ended December 31, 2010 and 2009, by reportable segment, is as follows (millions):

December 31,

2008

Acquisitions,

Dispositions

and

Adjustments

Translation

Adjustments

December 31,

2009

Acquisitions,

Dispositions

and

Adjustments

Translation

Adjustments

December 31,

2010

Networks

Gross goodwill . . . . . . . . . . . . . . $ 34,305 $ 9 $ 5 $ 34,319 $ 192 $ (2) $ 34,509

Impairments . . . . . . . . . . . . . . . . (13,277) — — (13,277) — — (13,277)

Net goodwill . . . . . . . . . . . . . . . . 21,028 9 5 21,042 192 (2) 21,232

Filmed Entertainment

Gross goodwill . . . . . . . . . . . . . . 9,533 (19) 3 9,517 197 (5) 9,709

Impairments . . . . . . . . . . . . . . . . (4,091) — — (4,091) — — (4,091)

Net goodwill . . . . . . . . . . . . . . . . 5,442 (19) 3 5,426 197 (5) 5,618

Publishing

Gross goodwill . . . . . . . . . . . . . . 18,428 (8) 39 18,459 2 (29) 18,432

Impairments . . . . . . . . . . . . . . . . (15,288) — — (15,288) — — (15,288)

Net goodwill . . . . . . . . . . . . . . . . 3,140 (8) 39 3,171 2 (29) 3,144

Time Warner

Gross goodwill . . . . . . . . . . . . . . 62,266 (18) 47 62,295 391 (36) 62,650

Impairments . . . . . . . . . . . . . . . . (32,656) — — (32,656) — — (32,656)

Net goodwill . . . . . . . . . . . . . . . . $ 29,610 $ (18) $ 47 $ 29,639 $ 391 $ (36) $ 29,994

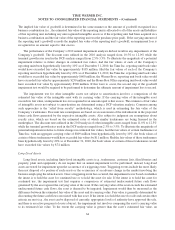

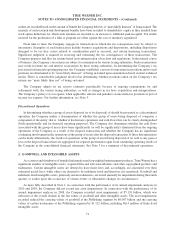

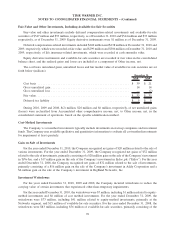

The Company’s intangible assets and related accumulated amortization consisted of the following (millions):

Gross

Accumulated

Amortization

(a)

Net Gross

Accumulated

Amortization

(a)

Net

December 31, 2010 December 31, 2009

Intangible assets subject to amortization:

Film Library . . . . . . . . . . . . . . . . . . . . . . . . $ 3,534 $ (2,036) $ 1,498 $ 3,635 $ (1,871) $ 1,764

Brands, tradenames and other

intangible assets . . . . . . . . . . . . . . . . . . . . . . 2,000 (1,006) 994 1,834 (922) 912

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,534 $ (3,042) $ 2,492 $ 5,469 $ (2,793) $ 2,676

Intangible assets not subject to amortization:

Brands, tradenames and other intangible

assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,084 $ (257) $ 7,827 $ 7,991 $ (257) $ 7,734

(a)

The Film Library is amortized using a film forecast methodology. Amortization of Brands, trademarks and other intangible assets subject to

amortization is provided generally on a straight-line basis over their respective useful lives. The weighted-average useful life for such

intangibles is 18 years. Each reporting period, the Company considers whether events or circumstances warrant revising the estimates of the

useful lives of its finite-lived intangible assets.

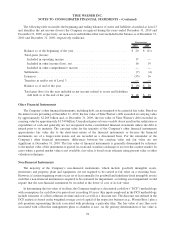

The Company recorded amortization expense of $264 million in 2010 compared to $280 million in 2009 and

$346 million in 2008. Based on the amount of intangible assets subject to amortization at December 31, 2010, the

72

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)