Time Magazine 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

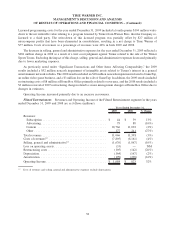

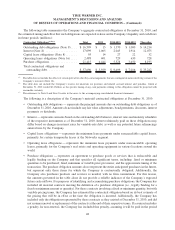

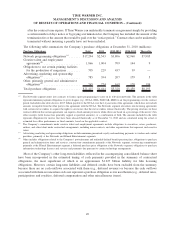

The following table summarizes the Company’s aggregate contractual obligations at December 31, 2010, and

the estimated timing and effect that such obligations are expected to have on the Company’s liquidity and cash flows

in future periods (millions):

Contractual Obligations

(a)(b)(c)

Total 2011 2012-2013 2014-2015 Thereafter

Outstanding debt obligations (Note 8) .... $ 16,599 $ 15 $ 1,370 $ 1,000 $ 14,214

Interest (Note 8) ................... 17,099 1,065 2,045 1,914 12,075

Capital lease obligations (Note 8) ....... 95 14 27 22 32

Operating lease obligations (Note 16) .... 2,488 401 729 630 728

Purchase obligations. . ............... 21,415 4,444 5,328 3,450 8,193

Total contractual obligations and

outstanding debt . . . ............... $ 57,696 $ 5,939 $ 9,499 $ 7,016 $ 35,242

(a)

The table does not include the effects of certain put/call or other buy-out arrangements that are contingent in nature involving certain of the

Company’s investees (Note 16).

(b)

The table does not include the Company’s reserve for uncertain tax positions and related accrued interest and penalties, which at

December 31, 2010 totaled $2.4 billion, as the specific timing of any cash payments relating to this obligation cannot be projected with

reasonable certainty.

(c)

The references to Note 8 and Note 16 refer to the notes to the accompanying consolidated financial statements.

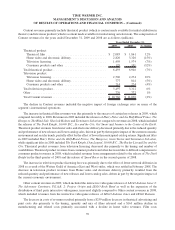

The following is a description of the Company’s material contractual obligations at December 31, 2010:

• Outstanding debt obligations — represents the principal amounts due on outstanding debt obligations as of

December 31, 2010. Amounts do not include any fair value adjustments, bond premiums, discounts, interest

payments or dividends.

• Interest — represents amounts based on the outstanding debt balances, interest rates and maturity schedules

of the respective instruments as of December 31, 2010. Interest ultimately paid on these obligations may

differ based on changes in interest rates for variable-rate debt, as well as any potential future refinancings

entered into by the Company.

• Capital lease obligations — represents the minimum lease payments under noncancelable capital leases,

primarily for certain transponder leases at the Networks segment.

• Operating lease obligations — represents the minimum lease payments under noncancelable operating

leases, primarily for the Company’s real estate and operating equipment in various locations around the

world.

• Purchase obligations — represents an agreement to purchase goods or services that is enforceable and

legally binding on the Company and that specifies all significant terms, including: fixed or minimum

quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. The purchase obligation amounts do not represent the entire anticipated purchases in the future,

but represent only those items for which the Company is contractually obligated. Additionally, the

Company also purchases products and services as needed, with no firm commitment. For this reason,

the amounts presented in the table alone do not provide a reliable indicator of the Company’s expected

future cash outflows. For purposes of identifying and accumulating purchase obligations, the Company has

included all material contracts meeting the definition of a purchase obligation (i.e., legally binding for a

fixed or minimum amount or quantity). For those contracts involving a fixed or minimum quantity, but with

variable pricing terms, the Company has estimated the contractual obligation based on its best estimate of

the pricing that will be in effect at the time the obligation is incurred. Additionally, the Company has

included only the obligations represented by those contracts as they existed at December 31, 2010, and did

not assume renewal or replacement of the contracts at the end of their respective terms. If a contract includes

a penalty for non-renewal, the Company has included that penalty, assuming it will be paid in the period

48

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)