Time Magazine 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year ended December 31, 2010, the Company incurred $18 million at the Filmed Entertainment

segment and $8 million at the Publishing segment related to 2009 restructuring initiatives as a result of changes in

estimates of previously established restructuring accruals.

2008 and Prior Restructuring Activity

For the year ended December 31, 2008, the Company incurred $327 million in restructuring costs primarily

related to various employee terminations and other exit activities, including $142 million at the Filmed

Entertainment segment, $176 million at the Publishing segment and $12 million at Corporate. In addition, the

Company also reversed a $3 million charge at the Networks segment as a result of changes in estimates of

previously established restructuring accruals.

In addition, during the years ended December 31, 2010 and 2009, the Company incurred additional charges

related to 2008 restructuring initiatives as a result of changes in estimates of previously established restructuring

accruals. During the year ended December 31, 2010, the Company incurred $1 million at the Filmed Entertainment

segment and $14 million at the Publishing segment. During the year ended December 31, 2009, the Company

incurred $5 million at the Filmed Entertainment segment and $9 million at the Publishing segment.

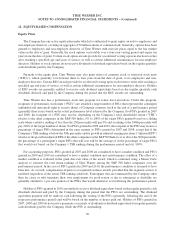

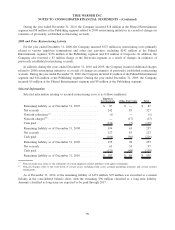

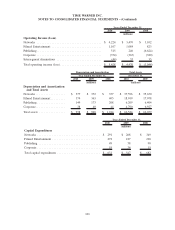

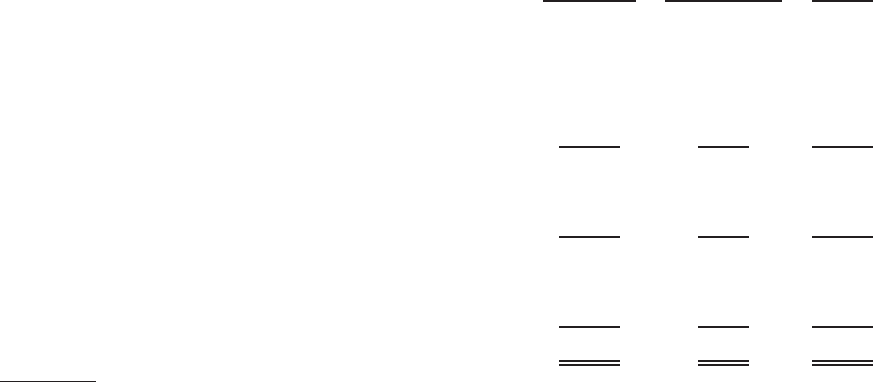

Selected Information

Selected information relating to accrued restructuring costs is as follows (millions):

Employee

Terminations Other Exit Costs Total

Remaining liability as of December 31, 2007 ........... $ 87 $ — $ 87

Net accruals ................................... 242 85 327

Noncash reductions

(a)

............................ (1) — (1)

Noncash charges

(b)

.............................. — (17) (17)

Cash paid ..................................... (134) (5) (139)

Remaining liability as of December 31, 2008 ........... 194 63 257

Net accruals ................................... 127 85 212

Cash paid ..................................... (166) (50) (216)

Remaining liability as of December 31, 2009 ........... 155 98 253

Net accruals ................................... 63 34 97

Cash paid ..................................... (111) (48) (159)

Remaining liability as of December 31, 2010 ........... $ 107 $ 84 $ 191

(a)

Noncash reductions relate to the settlement of certain employee-related liabilities with equity instruments.

(b)

Noncash charges relate to the write-down of certain assets, including fixed assets, prepaid marketing materials and certain contract

terminations.

As of December 31, 2010, of the remaining liability of $191 million, $95 million was classified as a current

liability in the consolidated balance sheet, with the remaining $96 million classified as a long-term liability.

Amounts classified as long-term are expected to be paid through 2017.

99

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)