Time Magazine 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative Instruments

The Company uses derivative instruments principally to manage the risk associated with movements in foreign

currency exchange rates and recognizes all derivative instruments on the balance sheet at fair value. Changes in fair

value of derivative instruments that qualify for hedge accounting will either be offset against the change in fair value

of the hedged assets, liabilities or firm commitments through earnings or recognized in shareholders’ equity as a

component of Accumulated other comprehensive income, net, until the hedged item is recognized in earnings,

depending on whether the derivative instrument is being used to hedge changes in fair value or cash flows. The

ineffective portion of a derivative instrument’s change in fair value is immediately recognized in earnings. For those

derivative instruments that do not qualify for hedge accounting, changes in fair value are recognized immediately in

earnings. See Note 7 for additional information regarding derivative instruments held by the Company and risk

management strategies.

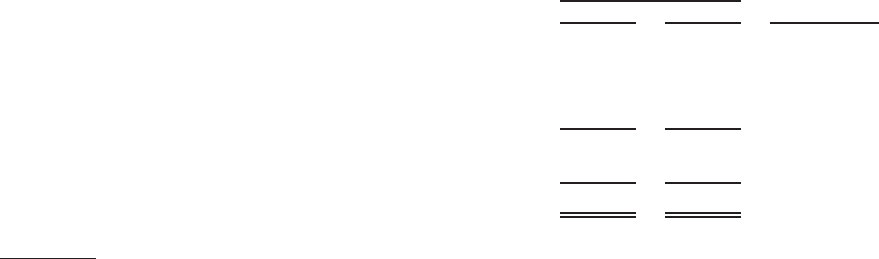

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Additions to property, plant and equipment generally include

material, labor and overhead. Time Warner also capitalizes certain costs associated with coding, software

configuration, upgrades and enhancements incurred for the development of internal use software. Depreciation

is recorded on a straight-line basis over estimated useful lives. Upon the occurrence of certain events or

circumstances, Time Warner evaluates the depreciation periods of property, plant and equipment to determine

whether a revision to its estimates of useful lives is warranted. Property, plant and equipment, including capital

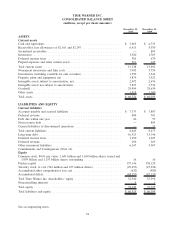

leases, consist of (millions):

2010 2009

Estimated

Useful Lives

December 31,

Land

(a)

......................................... $ 499 $ 476

Buildings ....................................... 2,610 2,512 7 to 30 years

Capitalized software costs ........................... 1,597 1,445 3 to 7 years

Furniture, fixtures and other equipment ................. 3,337 3,221 3 to 10 years

8,043 7,654

Less accumulated depreciation ....................... (4,169) (3,732)

Total .......................................... $ 3,874 $ 3,922

(a)

Land is not depreciated.

Intangible Assets

As a creator and distributor of branded content and copyrighted entertainment products, Time Warner has a

significant number of intangible assets, including acquired film and television libraries and other copyrighted

products and trademarks. Time Warner does not recognize the fair value of internally generated intangible assets.

Costs incurred to create and produce copyrighted products, such as feature films and television series, generally are

either expensed as incurred or capitalized. Intangible assets acquired in business combinations are recorded at the

acquisition date fair value in the Company’s consolidated balance sheet. For more information, see Note 2.

Asset Impairments

Investments

The Company’s investments consist of (i) fair-value investments, including available-for-sale securities and

deferred compensation-related investments, (ii) investments accounted for using the cost method of accounting and

(iii) investments accounted for using the equity method of accounting. The Company regularly reviews its

62

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)