The Hartford 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

Annually, the Company completes evaluations of the reinsurance recoverable asset associated with older, long-term casualty liabilities

reported in the Property & Casualty Other Operations reporting segment, and the allowance for uncollectible reinsurance reported in the

Property & Casualty Commercial reporting segment. For a discussion regarding the results of these evaluations, see Property and

Casualty Insurance Product Reserves, Net of Reinsurance within the Critical Accounting Estimates section of the MD&A.

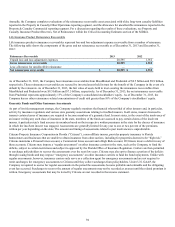

Life Insurance Product Reinsurance Recoverable

Life insurance product reinsurance recoverables represent loss and loss adjustment expense recoverable from a number of reinsurers.

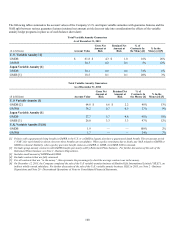

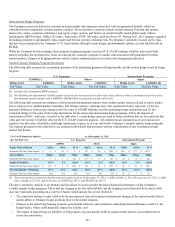

The following table shows the components of the gross and net reinsurance recoverable as of December 31, 2013 and December 31,

2012:

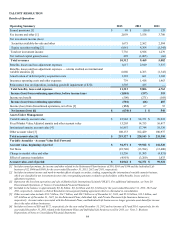

Reinsurance Recoverable 2013 2012

Unpaid loss and loss adjustment expenses 20,595 1,912

Gross reinsurance recoverable 20,595 1,912

Less: allowance for uncollectible reinsurance — —

Net reinsurance recoverable $ 20,595 $ 1,912

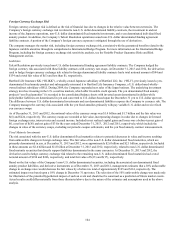

As of December 31, 2013, the Company has reinsurance recoverables from MassMutual and Prudential of $9.5 billion and $9.9 billion,

respectively. These reinsurance recoverables are secured by invested assets held in trust for the benefit of the Company in the event of a

default by the reinsurers. As of December 31, 2013, the fair value of assets held in trust securing the reinsurance recoverables from

MassMutual and Prudential were $9.5 billion and $7.5 billion, respectively. As of December 31, 2013, the net reinsurance recoverable

from Prudential represents approximately 13% of the Company's consolidated stockholders' equity. As of December 31, 2013, the

Company has no other reinsurance-related concentrations of credit risk greater than 10% of the Company’s stockholders’ equity.

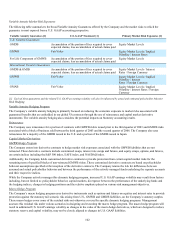

Guaranty Funds and Other Insurance Assessments

As part of its risk management strategy, the Company regularly monitors the financial wherewithal of other insurers and, in particular,

activity by insurance regulators and various state guaranty associations relating to troubled insurers. In all states, insurers licensed to

transact certain classes of insurance are required to become members of a guaranty fund. In most states, in the event of the insolvency of

an insurer writing any such class of insurance in the state, members of the funds are assessed to pay certain claims of the insolvent

insurer. A particular state's fund assesses its members based on their respective written premiums in the state for the classes of insurance

in which the insolvent insurer was engaged. Assessments are generally limited for any year to one or two percent of the premiums

written per year depending on the state. The amount and timing of assessments related to past insolvencies is unpredictable.

Citizens Property Insurance Corporation in Florida (“Citizens”), a non-affiliate insurer, provides property insurance to Florida

homeowners and businesses that are unable to obtain insurance from other carriers, including for properties deemed to be “high risk.”

Citizens maintains a Personal Lines account, a Commercial Lines account and a High Risk account. If Citizens incurs a deficit in any of

these accounts, Citizens may impose a “regular assessment” on other insurance carriers in the state, such as the Company, to fund the

deficits, subject to certain restrictions and subject to approval by the Florida Office of Insurance Regulation. Carriers are then permitted

to surcharge policyholders to recover the assessments over the next few years. Citizens may also opt to finance a portion of the deficits

through issuing bonds and may impose “emergency assessments” on other insurance carriers to fund the bond repayments. Unlike with

regular assessments, however, insurance carriers only serve as a collection agent for emergency assessments and are not required to

remit surcharges for emergency assessments to Citizens until they collect surcharges from policyholders. Under U.S. GAAP, the

Company is required to accrue for regular assessments in the period the assessments become probable and estimable and the obligating

event has occurred. Surcharges to recover the amount of regular assessments may not be recorded as an asset until the related premium is

written. Emergency assessments that may be levied by Citizens are not recorded in the income statement.