The Hartford 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

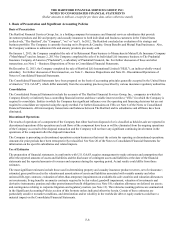

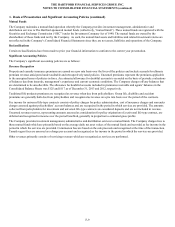

1. Basis of Presentation and Significant Accounting Policies (continued)

F-12

For mortgage loans that are deemed impaired, a valuation allowance is established for the difference between the carrying amount and

the Company’s share of either (a) the present value of the expected future cash flows discounted at the loan’s effective interest rate,

(b) the loan’s observable market price or, most frequently, (c) the fair value of the collateral. A valuation allowance has been established

for either individual loans or as a projected loss contingency for loans with an LTV ratio of 90% or greater and consideration of other

credit quality factors, including DSCR. Changes in valuation allowances are recorded in net realized capital gains and losses. Interest

income on impaired loans is accrued to the extent it is deemed collectible and the loans continue to perform under the original or

restructured terms. Interest income ceases to accrue for loans when it is probable that the Company will not receive interest and principal

payments according to the contractual terms of the loan agreement. Loans may resume accrual status when it is determined that

sufficient collateral exists to satisfy the full amount of the loan and interest payments, as well as when it is probable cash will be

received in the foreseeable future. Interest income on defaulted loans is recognized when received.

Net Realized Capital Gains and Losses

Net realized capital gains and losses from investment sales are reported as a component of revenues and are determined on a specific

identification basis, as well as changes in value associated with fixed maturities for which the fair value option was elected. Net realized

capital gains and losses also result from fair value changes in derivatives contracts (both free-standing and embedded) that do not

qualify, or are not designated, as a hedge for accounting purposes, ineffectiveness on derivatives that qualify for hedge accounting

treatment, and the change in value of derivatives in certain fair-value hedge relationships and their associated hedged asset. Impairments

and mortgage loan valuation allowances are recognized as net realized capital losses in accordance with the Company’s impairment and

mortgage loan valuation allowance policies previously discussed above. Foreign currency transaction remeasurements are also included

in net realized capital gains and losses.

Net Investment Income

Interest income from fixed maturities and mortgage loans is recognized when earned on the constant effective yield method based on

estimated timing of cash flows. The amortization of premium and accretion of discount for fixed maturities also takes into consideration

call and maturity dates that produce the lowest yield. For securitized financial assets subject to prepayment risk, yields are recalculated

and adjusted periodically to reflect historical and/or estimated future repayments using the retrospective method; however, if these

investments are impaired, any yield adjustments are made using the prospective method. Prepayment fees on fixed maturities and

mortgage loans are recorded in net investment income when earned. For equity securities, available-for-sale, dividends will be

recognized as investment income on the ex-divided date. Limited partnerships and other alternative investments primarily use the equity

method of accounting to recognize the Company’s share of earnings; however, the Company also uses investment fund accounting

applied to a wholly-owned fund of funds. For impaired debt securities, the Company accretes the new cost basis to the estimated future

cash flows over the expected remaining life of the security by prospectively adjusting the security’s yield, if necessary. The Company’s

non-income producing investments were not material for the years ended December 31, 2013, 2012 and 2011.

Net investment income on equity securities, trading, includes dividend income and the changes in market value of the securities

associated with the variable annuity products previously sold in Japan. The returns on these policyholder-directed investments inure to

the benefit of the variable annuity policyholders but the underlying funds do not meet the criteria for separate account reporting.

Accordingly, these assets are reflected in the Company’s general account and the returns credited to the policyholders are reflected in

interest credited, a component of benefits, losses and loss adjustment expenses.