The Hartford 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

KEY PERFORMANCE MEASURES AND RATIOS

The Company considers several measures and ratios to be the key performance indicators for its businesses. The following discussions

include the more significant ratios and measures of profitability for the years ended December 31, 2013, 2012 and 2011. Management

believes that these ratios and measures are useful in understanding the underlying trends in The Hartford’s businesses. However, these

key performance indicators should only be used in conjunction with, and not in lieu of, the results presented in the segment discussions

that follow in this MD&A. These ratios and measures may not be comparable to other performance measures used by the Company’s

competitors.

Definitions of Non-GAAP and other measures and ratios

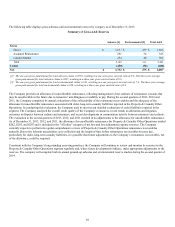

Account Value

Account value includes policyholders’ balances for investment contracts and reserves for future policy benefits for insurance contracts.

Account value is a measure used by the Company because a significant portion of the Company’s fee income is based upon the level of

account value. These revenues increase or decrease with a rise or fall in the amount of account value whether caused by changes in the

market or through net flows.

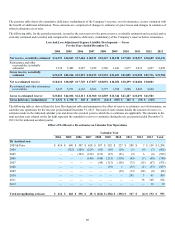

After-tax Margin, excluding buyouts and realized gains (losses)

After-tax margin, excluding buyouts and realized gains (losses), is a non-GAAP financial measure that the Company uses to evaluate,

and believes is an important measure of, the Group Benefits segment’s operating performance. After-tax margin is the most directly

comparable U.S. GAAP measure. The Company believes that the measure after-tax margin, excluding buyouts and realized gains

(losses), provides investors with a valuable measure of the performance of Group Benefits because it reveals trends in the business that

may be obscured by the effect of buyouts and realized gains (losses). After-tax margin, excluding buyouts and realized gains (losses),

should not be considered as a substitute for after-tax margin and does not reflect the overall profitability of Group Benefits. Therefore,

the Company believes it is important for investors to evaluate both after-tax margin, excluding buyouts and realized gains (losses), and

after-tax margin when reviewing performance. After-tax margin, excluding buyouts and realized gains (losses) is calculated by dividing

core earnings excluding buyouts and realized gains (losses) by total core revenues excluding buyouts and realized gains (losses). A

reconciliation of after-tax margin to after-tax margin, core earnings excluding buyouts and realized gains (losses) for the year ended

December 31, 2013, 2012 and 2011 is set forth in the After-tax Margin section within MD&A - Group Benefits.

Assets Under Management

Assets under management (“AUM”) include account values and mutual fund assets. AUM is a measure used by the Company because a

significant portion of the Company’s revenues are based upon asset values. These revenues increase or decrease with a rise or fall in the

amount of account value whether caused by changes in the market or through net flows.

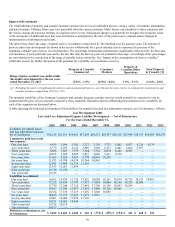

Catastrophe ratio

The catastrophe ratio (a component of the loss and loss adjustment expense ratio) represents the ratio of catastrophe losses incurred in

the current calendar year (net of reinsurance) to earned premiums and includes catastrophe losses incurred for both the current and prior

accident years. A catastrophe is an event that causes $25 or more in industry insured property losses and affects a significant number of

property and casualty policyholders and insurers. The catastrophe ratio includes the effect of catastrophe losses, but does not include the

effect of reinstatement premiums.

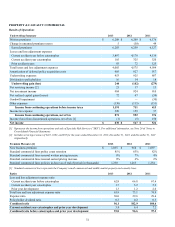

Combined ratio

The combined ratio is the sum of the loss and loss adjustment expense ratio, the expense ratio and the policyholder dividend ratio. This

ratio is a relative measurement that describes the related cost of losses and expenses for every $100 of earned premiums. A combined

ratio below 100 demonstrates underwriting profit; a combined ratio above 100 demonstrates underwriting losses.

Combined ratio before catastrophes and prior accident year development

The combined ratio before catastrophes and prior accident year development, a non-GAAP measure, represents the combined ratio for

the current accident year, excluding the impact of catastrophes. Combined ratio is the most directly comparable U.S. GAAP measure. A

reconciliation of combined ratio to combined ratio before prior accident year reserve development for the years ended December 31,

2013, 2012 and 2011 is set forth in MD&A - Property & Casualty Commercial and Consumer Markets.