The Hartford 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.104

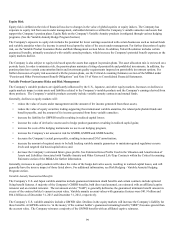

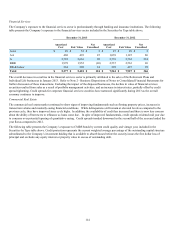

Foreign Currency Exchange Risk

Foreign currency exchange risk is defined as the risk of financial loss due to changes in the relative value between currencies. The

Company’s foreign currency exchange risk is related to non-U.S. dollar denominated liability contracts, the investment in and net

income of the Japanese operations, non-U.S. dollar denominated fixed maturity investments, and a yen denominated individual fixed

annuity product. In addition, the Company’s Talcott Resolution operations issued non-U.S. dollar denominated funding agreement

liability contracts. A portion of the Company’s foreign currency exposure is mitigated through the use of derivatives.

The company manages the market risk, including foreign currency exchange risk, associated with the guaranteed benefits related to the

Japanese variable annuities through its comprehensive International Hedge Program. For more information on the International Hedge

Program, including the foreign currency exchange risk sensitivity analysis, see the Variable Product Guarantee Risks and Risk

Management section.

Liabilities

Talcott Resolution previously issued non-U.S. dollar denominated funding agreement liability contracts. The Company hedged the

foreign currency risk associated with these liability contracts with currency rate swaps. At December 31, 2013 and 2012, the derivatives

used to hedge foreign currency exchange risk related to foreign denominated liability contracts had a total notional amount of $94 and

$134 and a total fair value of $(1) and less than $1, respectively.

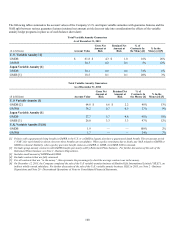

Hartford Life Insurance KK (“HLIKK”), a wholly-owned Japanese subsidiary of Hartford Life, Inc. (“HLI”), previously issued a yen-

denominated fixed annuity product and subsequently reinsured it to Hartford Life Insurance Company, a U.S. dollar based wholly-

owned indirect subsidiary of HLI. During 2009, the Company suspended new sales of the Japan business. The underlying investment

strategy involves investing in the U.S. securities markets, which offer favorable credit spreads. The yen denominated fixed annuity

product (“yen fixed annuities”) is recorded in the consolidated balance sheets with invested assets denominated in dollars while

policyholder liabilities are denominated in yen and converted to U.S. dollars based upon the December 31 yen to U.S. dollar spot rate.

The difference between U.S. dollar denominated investments and yen denominated liabilities exposes the Company to currency risk. The

Company manages the currency risk associated with the yen fixed annuities primarily with pay variable U.S. dollar and receive fixed

yen currency swaps.

As of December 31, 2013 and 2012, the notional value of the currency swaps was $1.4 billion and $1.7 billion and the fair value was

$(6) and $224, respectively. The currency swaps are recorded at fair value, incorporating changes in value due to changes in forward

foreign exchange rates, interest rates and accrued income. Included in net realized capital gains and losses was a before-tax net gain of

$6, a net loss of $(36) and net gain of $3 for the years ended December 31, 2013, 2012 and 2011, respectively, which include the

changes in value of the currency swaps, excluding net periodic coupon settlements, and the yen fixed annuity contract remeasurement.

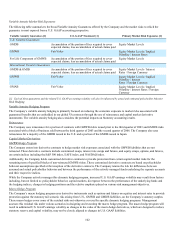

Fixed Maturity Investments

The risk associated with the non-U.S. dollar denominated fixed maturities relates to potential decreases in value and income resulting

from unfavorable changes in foreign exchange rates. The fair value of the non-U.S. dollar denominated fixed maturities, which are

primarily denominated in yen, at December 31, 2013 and 2012, were approximately $2.6 billion and $2.1 billion, respectively. Included

in these amounts are $2.4 billion and $1.8 billion at December 31, 2013 and 2012, respectively, related to non-U.S. dollar denominated

fixed maturity securities that directly support liabilities denominated in the same currencies. At December 31, 2013 and 2012, the

derivatives used to hedge currency exchange risk related to the remaining non-U.S. dollar denominated fixed maturities had a total

notional amount of $194 and $246, respectively, and total fair value of $(13) and $(17), respectively.

Based on the fair values of the Company’s non-U.S. dollar denominated securities, including the associated yen denominated fixed

annuity product liabilities, and derivative instruments as of December 31, 2013 and 2012, management estimates that a 10% unfavorable

change in exchange rates would decrease the fair values by a before-tax total of approximately $165 and $114, respectively. The

estimated impact was based upon a 10% change in December 31 spot rates. The selection of the 10% unfavorable change was made only

for illustration of the potential hypothetical impact of such an event and should not be construed as a prediction of future market events.

Actual results could differ materially from those illustrated above due to the nature of the estimates and assumptions used in the above

analysis.