The Hartford 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

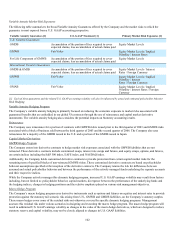

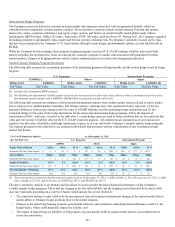

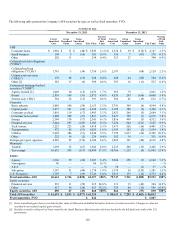

Variable Annuity Market Risk Exposures

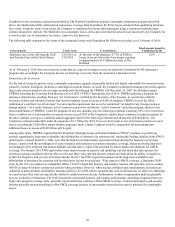

The following table summarizes the broad Variable Annuity Guarantees offered by the Company and the market risks to which the

guarantee is most exposed from a U.S. GAAP accounting perspective.

Variable Annuity Guarantees [1] U.S. GAAP Treatment [1] Primary Market Risk Exposures [1]

U.S. Variable Guarantees

GMDB Accumulation of the portion of fees required to cover

expected claims, less accumulation of actual claims paid Equity Market Levels

GMWB Fair Value Equity Market Levels / Implied

Volatility / Interest Rates

For Life Component of GMWB Accumulation of the portion of fees required to cover

expected claims, less accumulation of actual claims paid Equity Market Levels

International Variable Guarantees

GMDB & GMIB Accumulation of the portion of fees required to cover

expected claims, less accumulation of actual claims paid Equity Market Levels / Interest

Rates / Foreign Currency

GMWB Fair Value Equity Market Levels / Implied

Volatility / Interest

Rates / Foreign Currency

GMAB Fair Value Equity Market Levels / Implied

Volatility / Interest Rates / Foreign

Currency

[1] Each of these guarantees and the related U.S. GAAP accounting volatility will also be influenced by actual and estimated policyholder behavior.

Risk Hedging

Variable Annuity Hedging Program

The Company’s variable annuity hedging is primarily focused on reducing the economic exposure to market risks associated with

guaranteed benefits that are embedded in our global VA contracts through the use of reinsurance and capital market derivative

instruments. The variable annuity hedging also considers the potential impacts on Statutory accounting results.

Reinsurance

The Company uses reinsurance for a portion of contracts with GMWB riders issued prior to the third quarter of 2003 and GMWB risks

associated with a block of business sold between the third quarter of 2003 and the second quarter of 2006. The Company also uses

reinsurance for a majority of the GMDB issued in the U.S. and a portion of the GMDB issued in Japan.

Capital Market Derivatives

GMWB Hedge Program

The Company enters into derivative contracts to hedge market risk exposures associated with the GMWB liabilities that are not

reinsured. These derivative contracts include customized swaps, interest rate swaps and futures, and equity swaps, options, and futures,

on certain indices including the S&P 500 index, EAFE index, and NASDAQ index.

Additionally, the Company holds customized derivative contracts to provide protection from certain capital market risks for the

remaining term of specified blocks of non-reinsured GMWB riders. These customized derivative contracts are based on policyholder

behavior assumptions specified at the inception of the derivative contracts. The Company retains the risk for differences between

assumed and actual policyholder behavior and between the performance of the actively managed funds underlying the separate accounts

and their respective indices.

While the Company actively manages this dynamic hedging program, increased U.S. GAAP earnings volatility may result from factors

including, but not limited to: policyholder behavior, capital markets, divergence between the performance of the underlying funds and

the hedging indices, changes in hedging positions and the relative emphasis placed on various risk management objectives.

Macro Hedge Program

The Company’s macro hedging program uses derivative instruments such as options and futures on equities and interest rates to provide

protection against the statutory tail scenario risk arising from U.S., GMWB and GMDB liabilities, on the Company’s statutory surplus.

These macro hedges cover some of the residual risks not otherwise covered by specific dynamic hedging programs. Management

assesses this residual risk under various scenarios in designing and executing the macro hedge program. The macro hedge program will

result in additional U.S. GAAP earnings volatility as changes in the value of the macro hedge derivatives, which are designed to reduce

statutory reserve and capital volatility, may not be closely aligned to changes in U.S. GAAP liabilities.