The Hartford 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

Future impairments may develop as the result of changes in intent to sell specific securities or if actual results underperform current

modeling assumptions, which may be the result of, but are not limited to, macroeconomic factors and security-specific performance

below current expectations. Ultimate loss formation will be a function of macroeconomic factors and idiosyncratic security-specific

performance.

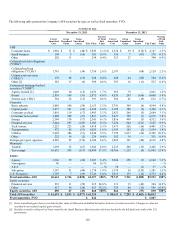

Year ended December 31, 2012

For the year ended December 31, 2012, impairments recognized in earnings were comprised of intent-to-sell impairments of $238,

which included $177 related to the sale of the Retirement Plans and Individual Life businesses. Also included were impairments on

equity securities of $63 largely comprised of downgraded preferred equity securities of financial institutions. The Company's credit

impairments totaled $48, primarily concentrated in structured securities associated with residential and commercial real estate, as well as

ABS small business.

Year ended December 31, 2011

For the year ended December 31, 2011, impairments recognized in earnings were comprised of credit impairments of $125, primarily

concentrated on structured securities associated with commercial real estate, as well as direct private investments. Also included were

impairments on debt securities for which the Company intended to sell of $32, mainly comprised of corporate bonds, certain ABS

aircraft bonds and CMBS, as market pricing improved, as well as impairments on equity securities of $17 primarily related to preferred

stock associated with direct private investments.

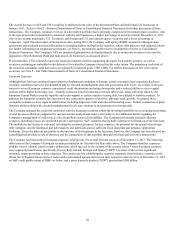

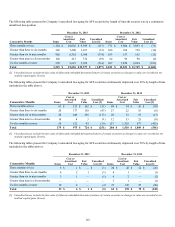

Valuation Allowances on Mortgage Loans

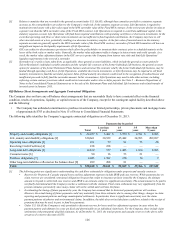

The following table presents (additions)/reversals to valuation allowances on mortgage loans.

For the years ended December 31,

2013 2012 2011

Credit-related concerns $ (2) $ 14 $ 27

Held for sale

Agricultural loans — — (3)

B-note participations — — —

Mezzanine loans — — —

Total $ (2) $ 14 $ 24

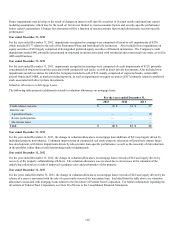

Year ended December 31, 2013

For the year ended December 31, 2013, the change in valuation allowances on mortgage loan additions of $(2) was largely driven by

individual property performance. Continued improvement in commercial real estate property valuations will positively impact future

loss development, with future impairments driven by idiosyncratic loan-specific performance, as well as the necessity of risk reduction

in the portfolio, rather than overall deteriorating market fundamentals.

Year ended December 31, 2012

For the year ended December 31, 2012, the change in valuation allowances on mortgage loan reversals of $14 was largely driven by

recovery of the property collateralizing a B-Note. The valuation allowance was reversed due to an increase in the valuation of the

underlying collateral as a result of improved occupancy rates and performance of the property.

Year ended December 31, 2011

For the years ended December 31, 2011, the change in valuation allowances on mortgage loan reversals of $24 was largely driven by the

release of a reserve associated with the sale of a previously reserved for mezzanine loan. Excluded from the table above are valuation

allowances associated with mortgage loans related to the divestiture of Federal Trust Corporation. For further information regarding the

divestiture of Federal Trust Corporation, see Note 20 of Notes to the Consolidated Financial Statements.