The Hartford 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

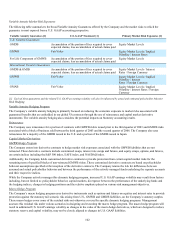

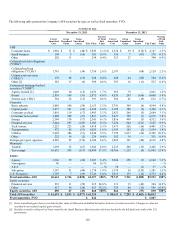

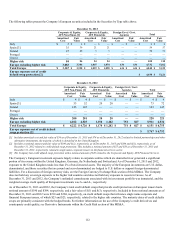

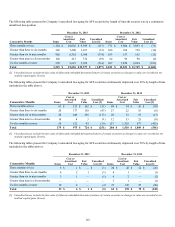

The overall decrease in AFS and FVO securities is attributed to the sales of the Retirement Plans and Individual Life businesses in

January 2013. Refer to Note 2 - Business Dispositions of Notes to Consolidated Financial Statements for further discussion of these

transactions. The Company continues to invest in a diversified portfolio that is primarily comprised of investment grade securities. Due

to the type of securities transferred in connection with the sold businesses, a higher percentage of securities held at December 31, 2013

were in tax-exempt municipals, U.S. Treasuries, and foreign and U.S. government agency securities and a lower percentage in

corporates. Apart from the impact of the business sales, during 2013, the Company sold agency RMBS associated with repurchase

agreements and modestly increased allocations to emerging market and high yield securities, which offer attractive risk-adjusted returns.

For further information on repurchase agreements, see Note 6 - Investments and Derivative Instruments of Notes to Consolidated

Financial Statements. The Company's AFS net unrealized gain position declined primarily due to an increase in interest rates and the

disposition of the Retirement Plans and Individual Life businesses, as discussed above.

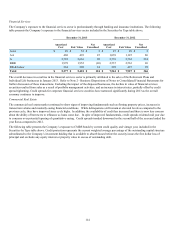

Fixed maturities, FVO, primarily represents Japan government securities supporting the Japan fixed annuity product, as well as

securities containing an embedded credit derivative for which the Company elected the fair value option. The underlying credit risk of

the securities containing credit derivatives are primarily investment grade CRE CDOs. For further discussion on fair value option

securities, see Note 5 - Fair Value Measurements of Notes to Consolidated Financial Statements.

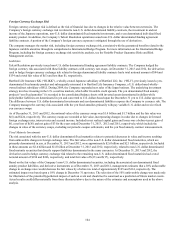

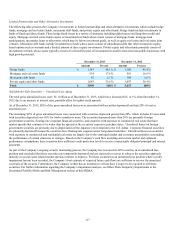

European Exposure

Although there has been continued improvement in fundamental conditions in Europe, certain economies have experienced adverse

economic conditions that were precipitated in part by elevated unemployment rates and government debt levels. As a result, in the past

issuers in several European countries experienced credit deterioration and rating downgrades and a reduced ability to access capital

markets and/or higher borrowing costs. Austerity measures aimed at reducing sovereign debt levels, along with steps taken by the

European Central Bank to provide liquidity and credit support to certain countries issuing debt, have helped to stabilize markets. In

addition, the European economy has experienced two consecutive quarters of positive, although weak, growth. In general, these

economies continue to show signs of stabilization, including improved credit and reduced borrowing costs. Further contraction of gross

domestic product along with elevated unemployment levels may continue to put pressure on sovereign debt.

The Company manages the credit risk associated with the European securities within the investment portfolio on an on-going basis using

several processes which are supported by macroeconomic analysis and issuer credit analysis. For additional details regarding the

Company’s management of credit risk, see the Credit Risk section of this MD&A. The Company periodically considers alternate

scenarios, including a base-case and both a positive and negative “tail” scenarios that includes a partial or full break-up of the Eurozone.

The outlook for key factors is evaluated, including the economic prospects for key countries, the potential for the spread of sovereign

debt contagion, and the likelihood that policymakers and politicians pursue sufficient fiscal discipline and introduce appropriate

backstops. Given the inherent uncertainty in the outcome of developments in the Eurozone, however, the Company has been focused on

controlling both absolute levels of exposure and the composition of that exposure through both bond and derivative transactions.

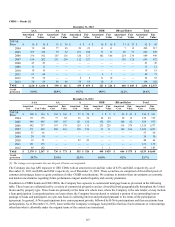

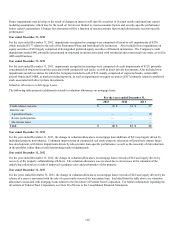

The Company has limited direct European exposure, totaling only 5% of total invested assets as of December 31, 2013. The following

tables present the Company’s European securities included in the Securities by Type table above. The Company identifies exposures

with the issuers’ ultimate parent country of domicile, which may not be the country of the security issuer. Certain European countries

were separately listed below, specifically, Greece, Italy, Ireland, Portugal and Spain (“GIIPS”), because of the current significant

economic strains persisting in these countries. The criteria used for identifying the countries separately listed includes countries on the

iTraxx SovX Western Europe Series 6 index with credit default spreads that exceed their respective index level as of December 31, 2013,

an S&P credit quality rating of BBB+ or below, and a gross domestic product ("GDP") greater than $200 billion.