The Hartford 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

Ratings

Ratings impact the Company’s cost of borrowing and its ability to access financing and are an important factor in establishing

competitive position in the insurance and financial services marketplace. There can be no assurance that the Company’s ratings will

continue for any given period of time or that they will not be changed. In the event the Company’s ratings are downgraded, the

Company’s cost of borrowing and ability to access financing, as well as the level of revenues or the persistency of its business may be

adversely impacted.

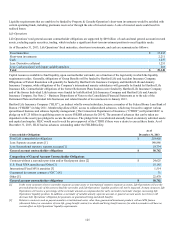

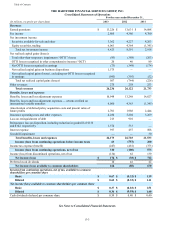

The following table summarizes The Hartford’s significant member companies’ financial ratings from the major independent rating

organizations as of February 25, 2014:

Insurance Financial Strength Ratings: A.M. Best Fitch Standard & Poor's Moody's

Hartford Fire Insurance Company A A+ A A2

Hartford Life Insurance Company A- A- BBB+ A3

Hartford Life and Accident Insurance Company A- A- A- A3

Hartford Life and Annuity Insurance Company A- A- BBB+ Baa2

Other Ratings:

The Hartford Financial Services Group, Inc.:

Senior debt bbb+ BBB BBB Baa3

Commercial paper AMB-2 F2 A-2 P-3

These ratings are not a recommendation to buy or hold any of The Hartford’s securities and they may be revised or revoked at any time

at the sole discretion of the rating organization.

The agencies consider many factors in determining the final rating of an insurance company. One consideration is the relative level of

statutory surplus necessary to support the business written. Statutory surplus represents the capital of the insurance company reported in

accordance with accounting practices prescribed by the applicable state insurance department. See Part I, Item 1A. Risk Factors —

“Downgrades in our financial strength or credit ratings, which may make our products less attractive, could increase our cost of capital

and inhibit our ability to refinance our debt, which would have a material adverse effect on our business, financial condition, results of

operations and liquidity.”

Statutory Surplus

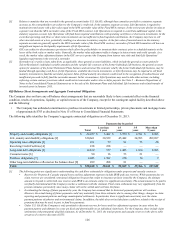

The table below sets forth statutory surplus for the Company’s insurance companies as of December 31, 2013 and 2012:

2013 2012

U.S. life insurance subsidiaries, includes domestic captive insurance subsidiaries $ 6,639 $ 6,410

Property and casualty insurance subsidiaries 8,022 7,645

Total $ 14,661 $ 14,055

Statutory capital and surplus for the U.S. life insurance subsidiaries, including domestic captive insurance subsidiaries, increased by

$229, primarily due to net income from non-variable annuity business of $2 billion including statutory gains from the sales of the

Retirement Plans and Individual Life businesses, change in affiliated subsidiaries carrying values of $361, change in other invested

assets carrying values of $250, net deferred gain on inforce reinsurance of $77, partially offset by decreases in other surplus changes of

$30, letter of credit decreases of $269, deferred income tax of $311, variable annuity surplus impacts of approximately $349, and net

returns of capital of $1.5 billion.

Statutory capital and surplus for the property and casualty insurance subsidiaries increased by $377, primarily due to statutory net

income, after tax, of $1,067, unrealized gains of $100, and an decrease in statutory admitted deferred tax assets of $63, capital

contributions of $73, partially offset by dividends to the HFSG Holding Company of $800. Both net income and dividends are net of

interest payments and dividends, respectively, on an intercompany note between Hartford Holdings, Inc. and Hartford Fire Insurance

Company.

The Company also holds regulatory capital and surplus for its operations in Japan. Under the accounting practices and procedures

governed by Japanese regulatory authorities, the Company’s statutory capital and surplus was $1.2 billion and $1.1 billion as of

December 31, 2013 and 2012, respectively.