The Hartford 2013 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

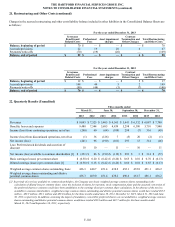

21. Restructuring and Other Costs (continued)

F-102

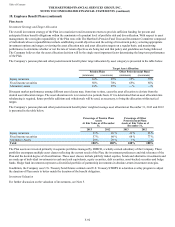

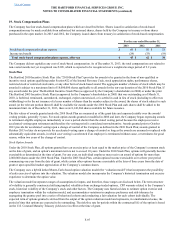

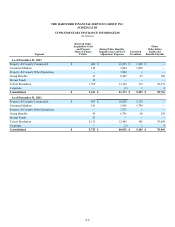

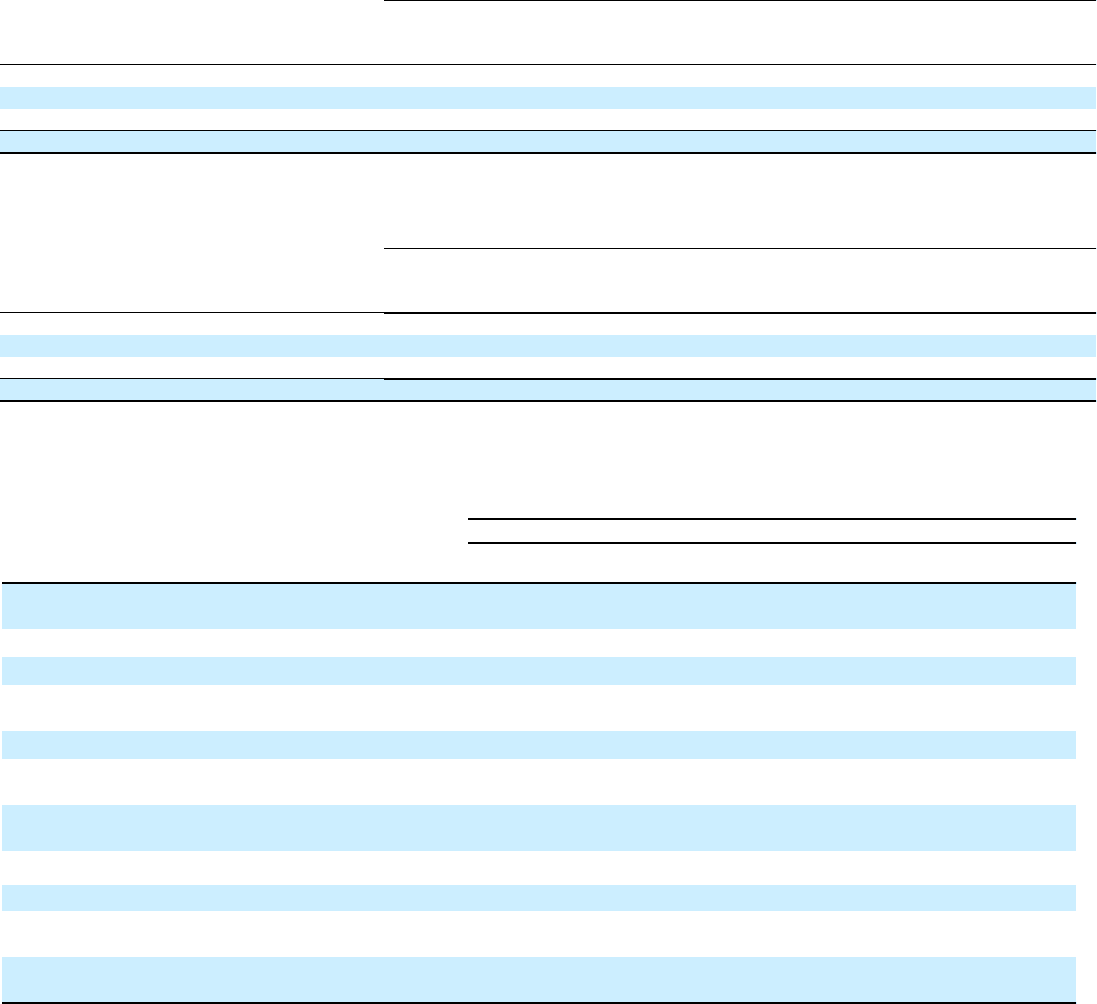

Changes in the accrued restructuring and other costs liability balance included in other liabilities in the Consolidated Balance Sheets are

as follows:

For the year ended December 31, 2013

Severance

Benefits and

Related Costs Professional

Fees Asset impairment

charges

Contract

Termination and

Other Charges Total Restructuring

and Other Costs

Balance, beginning of period $ 70 $ — $ — $ — $ 70

Accruals/provisions 22 19 20 6 67

Payments/write-offs (70) (19) (20) — (109)

Balance, end of period $ 22 $ — $ — $ 6 $ 28

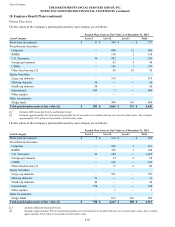

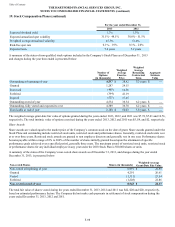

For the year ended December 31, 2012

Severance

Benefits and

Related Costs Professional

Fees Asset impairment

charges

Contract

Termination and

Other Charges Total Restructuring

and Other Costs

Balance, beginning of period $ 12 $ — $ — $ 5 $ 17

Accruals/provisions 148 44 5 2 199

Payments/write-offs (90) (44) (5) (7) (146)

Balance, end of period $ 70 $ — $ — $ — $ 70

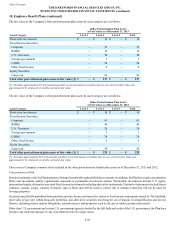

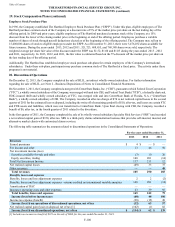

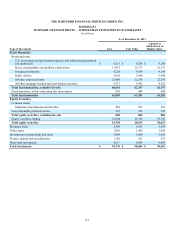

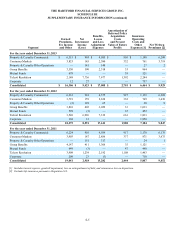

22. Quarterly Results (Unaudited)

Three months ended

March 31, June 30, September 30, December 31,

2013 2012 2013 2012 2013 2012 2013 2012

Revenues $ 9,043 $ 7,525 $ 5,465 $ 4,565 $ 5,641 $ 6,332 $ 6,087 $ 7,700

Benefits, losses and expenses 9,480 7,544 5,685 4,839 5,298 6,380 5,710 7,940

Income (loss) from continuing operations, net of tax (240) 60 (64)(108) 298 (7) 316 (45)

Income (loss) from discontinued operations, net of tax (1) 36 (126) 7 (5) 20 (2) (1)

Net income (loss) (241) 96 (190)(101) 293 13 314 (46)

Less: Preferred stock dividends and accretion of

discount 1010—11—10—11

Net income (loss) available to common shareholders [1] $ (251) $ 86 $ (190) $ (112) $ 293 $ 3 $ 314 $ (57)

Basic earnings (losses) per common share $ (0.58) $ 0.20 $ (0.42) $ (0.26) $ 0.65 $ 0.01 $ 0.70 $ (0.13)

Diluted earnings (losses) per common share [1] $ (0.58) $ 0.18 $ (0.42) $ (0.26) $ 0.60 $ 0.01 $ 0.65 $ (0.13)

Weighted average common shares outstanding, basic 436.3 440.7 451.4 438.2 452.1 435.8 451.1 436.2

Weighted average shares outstanding and dilutive

potential common shares 436.3 469.0 451.4 438.2 490.6 461.7 486.1 436.2

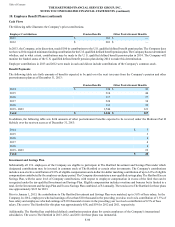

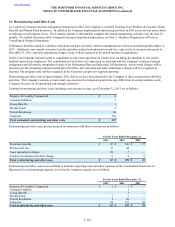

[1] In periods of a net loss available to common shareholders, the Company uses basic weighted average common shares outstanding in the

calculation of diluted loss per common share, since the inclusion of shares for warrants, stock compensation plans and the assumed conversion of

the preferred shares to common would have been antidilutive to the earnings (loss) per common share calculation. In the absence of the net loss

available to common shareholders, weighted average common shares outstanding and dilutive potential common shares would have totaled 485.8

million , 488.9 million, 493.1 million and 489.0 million for the three months ended June 30, 2012, December 31, 2012, March 31, 2013 and June

30, 2013, respectively. In addition, assuming the impact of mandatory convertible preferred shares was not antidilutive, weighted average common

shares outstanding and dilutive potential common shares would have totaled 489.9 million and 482.7 million for the three months ended

March 31, 2012 and September 30, 2012, respectively.