The Hartford 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-8

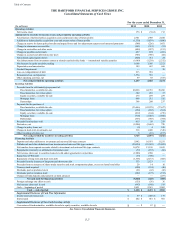

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollar amounts in millions, except for per share data, unless otherwise stated)

1. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Hartford Financial Services Group, Inc. is a holding company for insurance and financial services subsidiaries that provide

investment products and life and property and casualty insurance to both individual and business customers in the United States

(collectively, “The Hartford”, the “Company”, “we” or “our”). In 2012, The Hartford concluded an evaluation of its strategy and

business portfolio. The Company is currently focusing on its Property & Casualty, Group Benefits and Mutual Fund businesses. Also,

the Company continues to administer life and annuity products previously sold.

On January 1, 2013, the Company completed the sale of its Retirement Plans business to Massachusetts Mutual Life Insurance Company

("MassMutual") and on January 2, 2013 the Company completed the sale of its Individual Life insurance business to The Prudential

Insurance Company of America ("Prudential"), a subsidiary of Prudential Financial, Inc. For further discussion of these and other

transactions, see Note 2 - Business Dispositions of Notes to Consolidated Financial Statements.

On December 12, 2013, the Company completed the sale of Hartford Life International Limited ("HLIL"), an indirect wholly-owned

subsidiary. For further discussion of this transaction, see Note 2 - Business Dispositions and Note 20 - Discontinued Operations of

Notes to Consolidated Financial Statements.

The Consolidated Financial Statements have been prepared on the basis of accounting principles generally accepted in the United States

of America (“U.S. GAAP”), which differ materially from the accounting practices prescribed by various insurance regulatory authorities.

Consolidation

The Consolidated Financial Statements include the accounts of The Hartford Financial Services Group, Inc., companies in which the

Company directly or indirectly has a controlling financial interest and those variable interest entities (“VIEs”) in which the Company is

required to consolidate. Entities in which the Company has significant influence over the operating and financing decisions but are not

required to consolidate are reported using the equity method. For further discussions on VIEs see Note 6 of the Notes to Consolidated

Financial Statements. All intercompany transactions and balances between The Hartford and its subsidiaries and affiliates have been

eliminated.

Discontinued Operations

The results of operations of a component of the Company that either has been disposed of or is classified as held-for-sale are reported in

discontinued operations if the operations and cash flows of the component have been or will be eliminated from the ongoing operations

of the Company as a result of the disposal transaction and the Company will not have any significant continuing involvement in the

operations of the component after the disposal transaction.

The Company is presenting as discontinued operations certain businesses that meet the criteria for reporting as discontinued operations.

Amounts for prior periods have been retrospectively reclassified. See Note 20 of the Notes to Consolidated Financial Statements for

information on the specific subsidiaries and related impacts.

Use of Estimates

The preparation of financial statements, in conformity with U.S. GAAP, requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

The most significant estimates include those used in determining property and casualty insurance product reserves, net of reinsurance;

estimated gross profits used in the valuation and amortization of assets and liabilities associated with variable annuity and other

universal life-type contracts; evaluation of other-than-temporary impairments on available-for-sale securities and valuation allowances

on investments; living benefits on annuity contracts required to be fair valued; goodwill impairment; valuation of investments and

derivative instruments; pension and other postretirement benefit obligations (see Note 18); valuation allowance on deferred tax assets;

and contingencies relating to corporate litigation and regulatory matters (see Note 13). The related accounting policies are summarized

in the Significant Accounting Policies section of this footnote unless indicated otherwise herein. Certain of these estimates are

particularly sensitive to market conditions, and deterioration and/or volatility in the worldwide debt or equity markets could have a

material impact on the Consolidated Financial Statements.