The Hartford 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

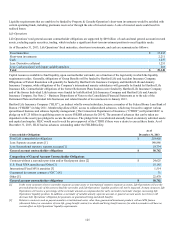

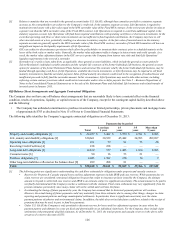

Other-Than-Temporary Impairments

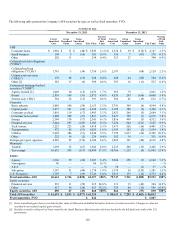

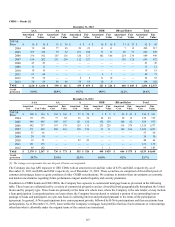

The following table presents the Company’s impairments recognized in earnings by security type excluding intent-to-sell impairment

relating to the sales of Retirement Plans and Individual Life businesses.

For the years ended December 31,

2013 2012 [1] 2011

ABS $ 9 $ 29 $ 27

CRE CDOs 2 10 41

CMBS

Bonds 17 24 16

IOs 4 3 5

Corporate 20 28 50

Equity 15 65 17

RMBS Non-agency — — —

RMBS Alt-A — 1 1

RMBS sub-prime 6 12 15

Other — — 2

Total $ 73 $ 172 $ 174

[1] Excludes $177 of intent-to-sell impairments related to the sales of the Retirement Plans and Individual Life businesses.

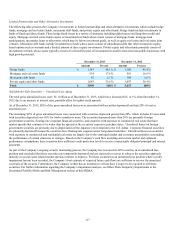

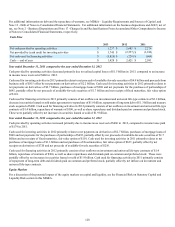

Year ended December 31, 2013

For the year ended December 31, 2013, impairments recognized in earnings were comprised of credit impairments of $32, securities that

the Company intends to sell of $26 and impairments on equity securities of $15.

Credit impairments were primarily concentrated in corporate and fixed-rate CMBS bonds. The corporate bonds were impaired due to

two issuers that have experienced financial difficulty and either defaulted or are expected to default on contractually obligated principal

and interest payments. The structured securities were impaired primarily due to actual performance or property-specific deterioration of

the underlying collateral. The Company calculated these impairments utilizing both a top down modeling approach and a security-

specific collateral review. The top down modeling approach used discounted cash flow models that considered losses under current and

expected future economic conditions. Assumptions used over the period included current macroeconomic factors, such as the

unemployment rate, as well as sector specific factors such as property values, delinquency levels, servicer behavior, and severity rates.

The macroeconomic assumptions considered by the Company did not materially change during 2013 and, as such, the credit

impairments recognized for the year ended December 31, 2013 were primarily driven by actual or expected collateral deterioration,

largely as a result of the Company’s security-specific collateral review.

The security-specific collateral review is performed to estimate potential future losses. This review incorporates assumptions about

expected future collateral cash flows, including projected default rates and severities. The results of the security-specific collateral

review allowed the Company to estimate the expected timing of a security’s first loss, if any, and the probability and severity of potential

ultimate losses. The Company then discounted these anticipated future cash flows at the security’s book yield prior to impairment.

Intent-to-sell impairments were primarily related to structured securities with exposure to commercial and residential real estate and

corporate securities, as a result of the Company's desire to reduce exposure to certain higher risk securities that are currently trading at

relatively attractive valuations. Impairments on equity securities were comprised of securities that have been in an unrealized loss

position and the Company no longer believes the securities will recover within the foreseeable future.

In addition to the credit impairments recognized in earnings, the Company recognized non-credit impairments in other comprehensive

income of $20 for the year ended December 31, 2013, predominantly concentrated in CMBS and corporate securities. These non-credit

impairments represent the difference between fair value and the Company’s best estimate of expected future cash flows discounted at the

security’s effective yield prior to impairment, rather than at current market implied credit spreads. These non-credit impairments

primarily represent increases in market liquidity premiums and credit spread widening that occurred after the securities were purchased,

as well as a discount for variable-rate coupons which are paying less than at purchase date. In general, larger liquidity premiums and

wider credit spreads are the result of deterioration of the underlying collateral performance of the securities, as well as the risk premium

required to reflect future uncertainty in the real estate market.