The Hartford 2013 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-64

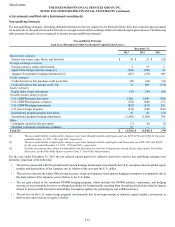

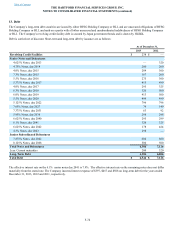

Derivative Collateral Arrangements

The Company enters into various collateral arrangements in connection with its derivative instruments, which require both the pledging

and accepting of collateral. As of December 31, 2013 and 2012, the Company pledged securities collateral associated with derivative

instruments with a fair value of $1.3 billion and $0.6 billion, respectively, which have been included in fixed maturities on the Consolidated

Balance Sheets. The counterparties have the right to sell or re-pledge these securities. The Company also pledged cash collateral associated

with derivative instruments with a fair value of $347 and $208, respectively, as of December 31, 2013 and 2012 which have been included

in short-term investments on the Consolidated Balance Sheets.

As of December 31, 2013 and 2012, the Company accepted cash collateral associated with derivative instruments with a fair value of

$180 and $701, respectively, which was invested and recorded in the Consolidated Balance Sheets in fixed maturities and short-term

investments with corresponding amounts recorded in other liabilities. The Company also accepted securities collateral as of

December 31, 2013 and 2012 of $243 and $653, respectively, of which the Company has the ability to sell or repledge $191 and $525,

respectively. As of December 31, 2013 and 2012, the fair value of repledged securities totaled $39 and $0, respectively, and the

Company did not sell any securities. In addition, as of December 31, 2013 and 2012, non-cash collateral accepted was held in separate

custodial accounts and was not included in the Company’s Consolidated Balance Sheets.

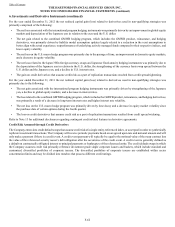

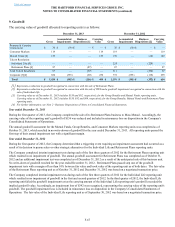

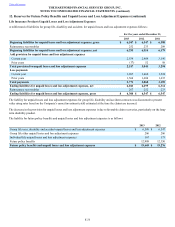

7. Reinsurance

The Company cedes insurance to affiliated and unaffiliated insurers to enable the Company to manage capital and risk exposure. Such

arrangements do not relieve the Company of its primary liability to policyholders. Failure of reinsurers to honor their obligations could

result in losses to the Company. The Company's procedures include careful initial selection of its reinsurers, structuring agreements to

provide collateral funds where necessary, and regularly monitoring the financial condition and ratings of its reinsurers. The Company

entered into two reinsurance transactions in connection with the sales of its Retirement Plans and Individual Life businesses in January

2013. For further discussion of these transactions, see Note 2 - Business Dispositions of Notes to Consolidated Financial Statements.

Reinsurance Recoverables

Reinsurance recoverables include balances due from reinsurance companies for paid and unpaid losses and loss adjustment expenses and

are presented net of an allowance for uncollectible reinsurance. Reinsurance recoverables include an estimate of the amount of gross

losses and loss adjustment expense reserves that may be ceded under the terms of the reinsurance agreements, including incurred but not

reported unpaid losses. The Company’s estimate of losses and loss adjustment expense reserves ceded to reinsurers is based on

assumptions that are consistent with those used in establishing the gross reserves for business ceded to the reinsurance contracts. The

Company calculates its ceded reinsurance projection based on the terms of any applicable facultative and treaty reinsurance, including an

estimate of how incurred but not reported losses will ultimately be ceded by reinsurance agreements. Accordingly, the Company’s

estimate of reinsurance recoverables is subject to similar risks and uncertainties as the estimate of the gross reserve for unpaid losses and

loss adjustment expenses.

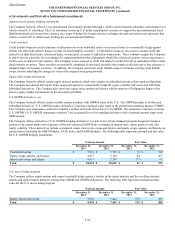

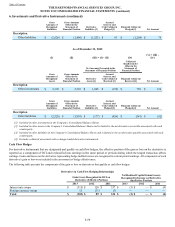

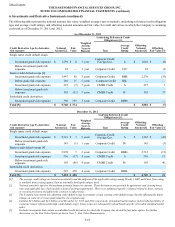

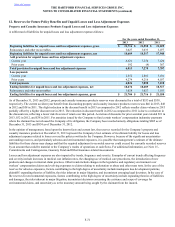

The Company's reinsurance recoverables are summarized as follows:

As of December 31,

2013 2012

Property and Casualty Insurance Products:

Paid loss and loss adjustment expenses $ 138 $ 170

Unpaid loss and loss adjustment expenses 2,841 2,852

Gross reinsurance recoverable 2,979 3,022

Allowance for uncollectible reinsurance (244) (268)

Net reinsurance recoverables $ 2,735 $ 2,754

Life Insurance Products:

Future policy benefits and unpaid loss and loss adjustment expenses:

Sold businesses (MassMutual and Prudential) $ 19,374 $ —

Other reinsurers 1,221 1,912

Net reinsurance recoverables $ 20,595 $ 1,912

Reinsurance recoverables, net $ 23,330 $ 4,666

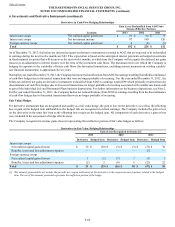

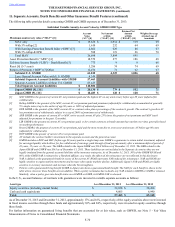

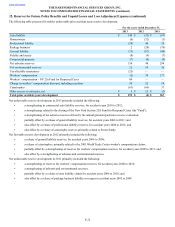

As of December 31, 2013, the Company has reinsurance recoverables, net from MassMutual and Prudential of $9.5 billion and $9.9

billion, respectively. These reinsurance recoverables are secured by invested assets held in trust for the benefit of the Company in the

event of a default by the reinsurers. As of December 31, 2013, the fair value of assets held in trust securing the reinsurance recoverables

from MassMutual and Prudential were $9.5 billion and $7.5 billion, respectively. As of December 31, 2013, the reinsurance

recoverables, net from Prudential represent approximately 13% of the Company's consolidated stockholders' equity. As of December 31,

2013, the Company has no other reinsurance-related concentrations of credit risk greater than 10% of the Company’s consolidated

stockholders’ equity.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Investments and Derivative Instruments (continued)