The Hartford 2013 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-84

Equity Repurchase Program

On January 31, 2013, the Board of Directors authorized a capital management plan which provides for a $500 equity repurchase

program to be completed by December 31, 2014. On June 26, 2013 the Board of Directors approved a $750 increase in the Company's

authorized equity repurchase program, bringing the total authorization to $1.25 billion, with $617 remaining as of December 31, 2013.

In January 2014, the Board of Directors approved an increase in the Company's authorized equity repurchase program by an amount

that, when combined with the amount remaining under the existing authorization, provides the Company with the ability to repurchase

$2 billion, in equity during the period commencing on January 1, 2014 and ending on December 31, 2015.

During the year ended December 31, 2013, the Company repurchased 19.2 million common shares, for $600, and 1.6 million warrants,

for $33, through this program.

The Company repurchased 7.7 million common shares, for $262, from January 1, 2014 to February 25, 2014.

During the year ended December 31, 2012, the Company completed a $500 equity repurchase program authorized on July 27, 2011 by

the Board of Directors that permitted for purchases of common stock, as well as warrants and other derivative securities. In addition to

repurchases that occurred in 2011, the repurchases in 2012 included 8.0 million common shares for $149, and the repurchase of all

outstanding Series B and Series C warrants held by Allianz for $300.

Statutory Results

The domestic insurance subsidiaries of The Hartford prepare their statutory financial statements in conformity with statutory accounting

practices prescribed or permitted by the applicable state insurance department which vary materially from U.S. GAAP. Prescribed

statutory accounting practices include publications of the National Association of Insurance Commissioners (“NAIC”), as well as state

laws, regulations and general administrative rules. The differences between statutory financial statements and financial statements

prepared in accordance with U.S. GAAP vary between domestic and foreign jurisdictions. The principal differences are that statutory

financial statements do not reflect deferred policy acquisition costs and limit deferred income taxes, life benefit reserves predominately

use interest rate and mortality assumptions prescribed by the NAIC, bonds are generally carried at amortized cost and reinsurance assets

and liabilities are presented net of reinsurance.

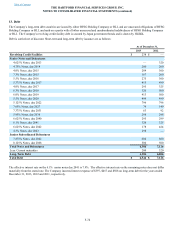

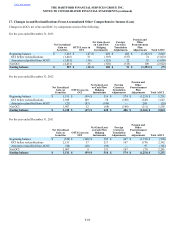

The statutory net income (loss) and statutory capital and surplus were as follows:

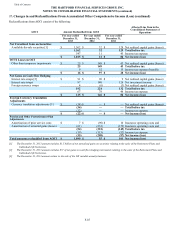

For the years ended December 31,

Statutory Net Income (Loss) 2013 2012 2011

U.S. life insurance subsidiaries, includes domestic captive insurance subsidiaries $ 2,144 $ 592 $ (1,272)

Property and casualty insurance subsidiaries 1,217 883 514

Total $ 3,361 $ 1,475 $ (758)

As of December 31,

Statutory Capital and Surplus 2013 2012

U.S. life insurance subsidiaries, includes domestic captive insurance subsidiaries $ 6,639 $ 6,410

Property and casualty insurance subsidiaries 8,022 7,645

Total $ 14,661 $ 14,055

The Company also holds regulatory capital and surplus for its operations in Japan. Under the accounting practices and procedures

governed by Japanese regulatory authorities, the Company’s statutory capital and surplus was $1.2 billion and $1.1 billion, as of

December 31, 2013 and 2012, respectively.

Table of Contents THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

16. Equity (continued)